Housing Finance: Exposure at Default in Residential 1-4s

- Jan 21

- 9 min read

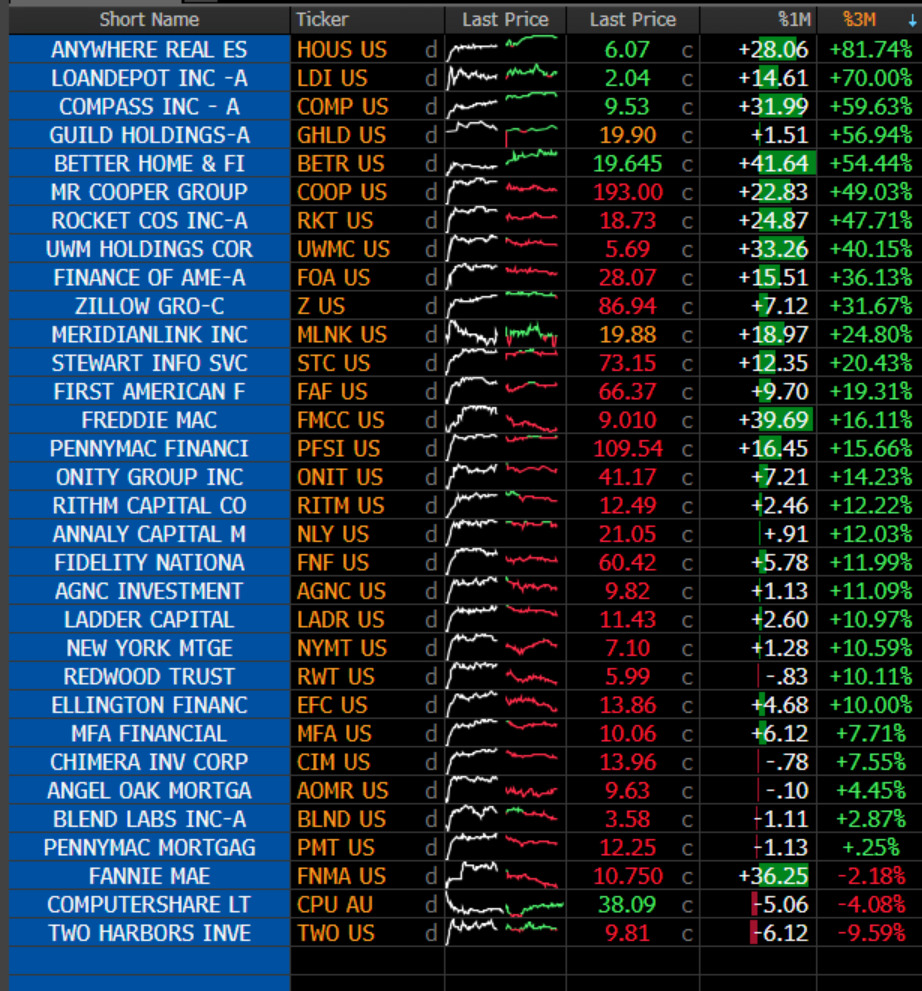

January 21, 2026 | In this issue of The Institutional Risk Analyst, we provide an update on Residential Mortgage Finance for our Premium Service subscribers. There are a lot of things happening in the mortgage world and not all of them good, but the one big positive is that 1-4 family mortgage rates have fallen by a point over the past year. As the FOMC has cut ST interest rates, lenders have lowered coupons, but LT bond yields remain a big question.

The Trump Administration is expected to announce measures to address “affordability” in housing at Davos, but most proposals will be demand-side expedients that do nothing to reduce home prices. The purchase of MBS by Fannie Mae and Freddie Mac are, in theory, supposed to offset the runoff of securities from the Fed's system open market account (SOMA). The more interesting observation to make about the Fed's $2 trillion in MBS holdings is that they are still not really declining very fast despite the drop in mortgage rates more generally

Source: Ginnie Mae/FRBNY

The White House will reportedly take a step toward allowing savers to withdraw from their 401(k)s to make a down payment on a home. Mortgage rates have fallen all year as lenders optimistically lower coupons, but the periodic Treasury refunding operations push LT interest rates back up, hurting secondary market execution. The lender who opportunistically lowers coupons may lose when selling the loan.

The 10-year Treasury note is backing up following a $700 billion Treasury refunding and Japan’s bond market is likewise in retreat. But the more important fact is that the spread between 2 year Treasury notes and the 10 year Treasury is widening because of the policy noise coming from the White House. The spread between Treasury 2s and 10s rightly is considered the most important relationship in bonds.

Eric Hagen at BTIG frames the situation nicely in their latest Mortgage Finance update:

“30-Yr mortgage rates to GSE borrowers are averaging around 6% following the 20 bps of spread tightening in the secondary market since Trump's MBS announcement. Spreads in the Ginnie Mae channel have also started tightening in anticipation of an announcement for a cut to FHA insurance premiums this week at Davos, alongside other potential housing directives to support first-time homebuyers. Prime jumbo rates have expectedly lagged the drop in conventional rates, even though jumbo spreads in the private-label securitization market appear mostly stable…”

Our view on FHA insurance premiums is simple: with 12% visible delinquency, the statutory 2% MIP target is probably not enough, but 11% is too much. Garrett, McAuley asked the right question in their comment this week:

“FHA’s MMI Fund had a capital ratio of 11.47% as of last September 30th, or $188.8 billion. Is this enough to cover losses from the $1.65 trillion in FHA mortgages outstanding? Despite an elevated delinquency ratio on FHA loans, it’s probably way more than is needed.”

You can reduce the MIP now in front of the midterm elections, but in a real home price correction a couple of years from now it needs to be close to the net default rate. FHA serious delinquency rates are a good surrogate and are significantly higher than conventional loans, hovering around 3.5%–4% serious delinquency at year-end. These are loans that are likely to go to resolution.

FHA Defaults Rise

Want to read more?

Subscribe to theinstitutionalriskanalyst.com to keep reading this exclusive post.

.png)