The Powell FOMC & the Housing Trap

- Oct 19, 2025

- 6 min read

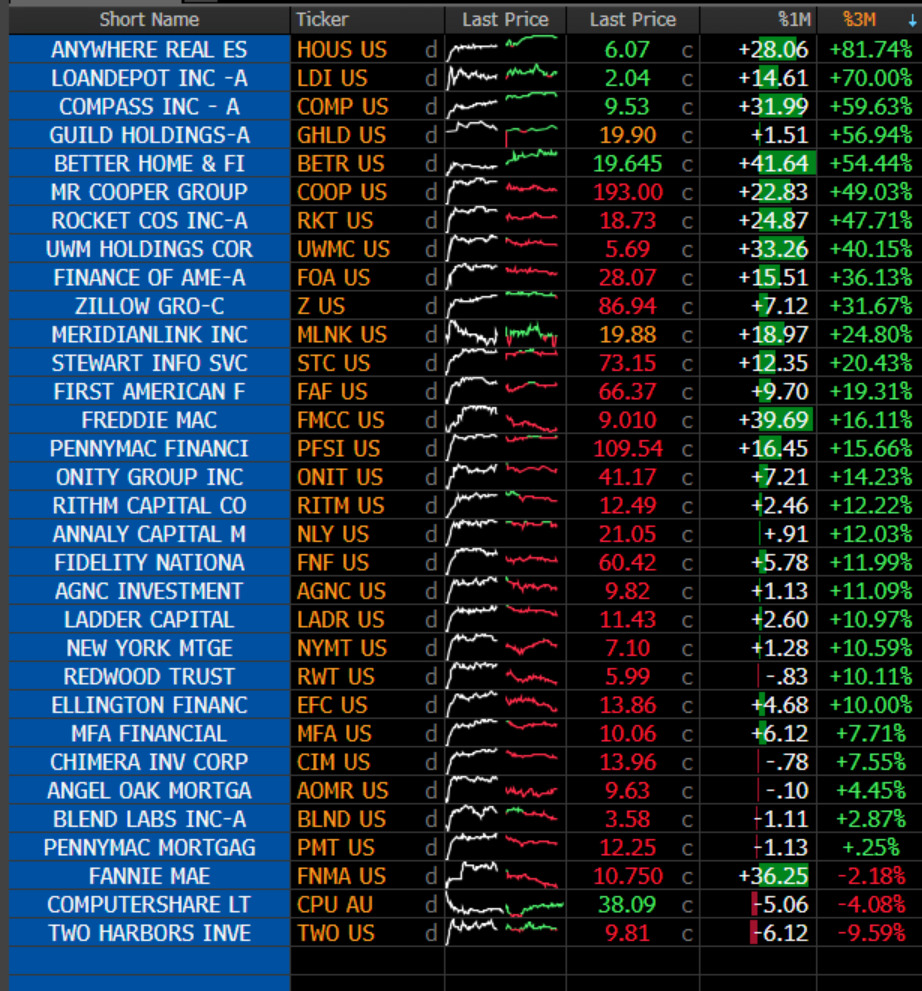

October 20, 2025 | The MBA Annual meeting is being held October 19-22, 2025, at the Fontainebleau in Las Vegas. The MBA Annual Convention and Expo is the largest annual gathering of residential real estate finance professionals. Most mortgage bankers are looking forward to a better year in 2026 with lower interest rates in prospect and a Republican President in the White House. What could be more positive for the housing sector?

The twist in the forward guidance for mortgages, however, is that in in a falling rate environment, credit in residential mortgages may follow the negative trend in other sectors like commercial real estate. Think Tricolor and First Brands.

The accumulation of delinquent loans in the mortgage complex since COVID has gotten to the point where residential loan defaults have no place to go but up. Higher delinquency levels will enable investors to pay less for mortgage loans in the secondary markets, adding to cash losses per loan that are already several points vs the loan balance. It's not about "gain on sale" but rather cash received.

Source: MBA, FDIC

In many respects, the FOMC set a trap for the Trump Administration in housing back in 2020-21, creating a situation where even dramatically lower market interest rates may not change a deterioration in residential credit that is now years overdue. The QE purchases of mortgage securities starting in 2019 after the now famous pivot by Fed Chairman Jerome Powell pushed down the visible cost of credit in 1-4 family mortgages. But the decline in the cost of credit defaults is a mirage caused by high home prices.

In a speech to the National Association of Business Economists, Fed Chairman Powell admitted that the Fed added too much liquidity to the economy after 2020. “With the clarity of hindsight, we could have—and perhaps should have—stopped asset purchases sooner,” said Powell. “Our real-time decisions were intended to serve as insurance against downside risks.”

Unfortunately one of the downside risks of injecting trillions of dollars of unneeded liquidity into the US economy is to push down the visible cost of credit. As Treasury Secretary Scott Bessent noted in an essay for The International Economy:

"The Fed’s adoption of unconventional tools during the 2010s pushed the effective nominal interest rate to as low as -3 percent by May 2014... As a result, the housing market remained overheated even as interest rates rose, with over 70 percent of existing mortgages carrying rates more than three percentage points below the prevailing market rate."

Fed researchers pretend that half of the 50% increase in home prices since 2020 is attributable to a shift to working at home, but does it matter to credit? Not really. The low levels of interest rates maintained by the FOMC starting in 2019 – a year before COVID began – are a more credible explanation for soaring home prices.

The chart below shows loss given default (LGD) for $650 billion multifamily and $3 trillion 1-4 family mortgages owned by banks, showing net loss as a percentage of the loan amount. The chart shows that banks are losing nearly 100% of the loan amount of defaulted multifamily mortgages, but near zero on residential 1-4s.

Source: FDIC

While multifamily credit normalized even before the end of COVID, net losses on prime bank-owned mortgages are still showing zero net defaults, a function of high home prices. Reported delinquency levels in the bottom quartile of the credit stack occupied by FHA loans are around 10%. But if we adjust the FHA default levels for COVID era forbearance and loan modifications, the actual delinquency levels are far higher, in the mid-teens.

Source: Ginnie Mae

According to John Comiskey, who writes great stuff about mortgage finance on Substack, FHA underwater mortgages increased by 30% from May to June 2025. During this period, the percentage of FHA mortgages that were underwater rose from 2.05% to 2.675% of the 8 million FHA loans in the portfolio. This means that the Treasury, which owns the modified loan amount separate from the original mortgage note, faces a total loss as home prices fall.

Comiskey also notes that FHA loans that have had a partial claim in the past have a delinquency rate 5 to 7 times higher than loans without a past partial claim. Keep in mind that the rules for dealing with residential loan delinquency were reset back to pre-COVID rules on October 1st, thus all of those FHA loans that are still in forbearance and have already used up their available loan modifications are now headed for foreclosure.

When mortgage issuers are forced to buy out these delinquent FHA loans from Ginnie Mae MBS, the cash flow stress on the industry will start to build dramatically. Since COVID, government lenders would simply modify delinquent loans before they reached 90-days past due and sell the modified loan into a new Ginnie Mae MBS. The chart below shows early buyouts or "EBOs" from Ginnie Mae pools by banks, again illustrating how QE has artificially suppressed visible levels of delinquency.

Source: FDIC

Just as QE and too much liquidity for too long by the Fed allowed a lot of fraud and criminality to blossom in private equity and credit, and commercial real estate, the same dynamic has hidden a mountain of delinquent residential loans that must now be resolved. Falling short-term interest rates will help issuers by lowering the cost of funds for financing loan buyouts and loss mitigation, but even lower interest rates will not prevent a lot of zombie mortgages avoid resolution.

The good news of sorts is that credit metrics in the conventional and bank markets for 1-4s are still very good, but regulators in Washington know that the government loan market and Ginnie Mae are the true points of vulnerability for the mortgage industry. The table below shows loan repurchase requests for Fannie Mae in the most recent form 10-K.

During the second quarter of 2025, Fannie Mae's single-family loan repurchases saw a 27.7% decrease compared to the first quarter of 2025, from $371.4 million to just $268.5 million, according to Inside Mortgage Finance. This mirrors the decline in bank credit losses on 1-4s. Yet a number of issuers have told The IRA that loan repurchase requests by the GSEs have risen dramatically in the past three months. Of note, the MBA publishes an excellent monthly Loan Monitoring Survey that is must reading for analysts.

As delinquency rises in the Ginnie Mae sector and loan repurchase requests increase in the conventional, bank and jumbo loan sectors, bank and nonbank issuers are going to face growing demands on liquidity. As the cost of resolving troubled loans rises, higher levels of delinquency will push down prices paid for loans sold into the secondary market.

Large banks and nonbank issuers with access to the debt markets will be able to ride out the storm, but the rest of the mortgage industry faces a couple of very tough years ahead. In Washington, it is fashionable to talk about higher "capital" for banks and nonbanks, but today it may be time to focus instead on providing greater liquidity for the residential loan market, particularly the government loan market and Ginnie Mae. If a government lender is defaulted by Ginnie Mae because of inadequate liquidity, that means that the GSEs will face a default as well.

The big question for attendees at the MBA Annual in Las Vegas to ponder: Does the Trump Administration understand the true nature of the risks to the US economy (and the GOP in the midterm election) created by the reckless monetary policies of the Powell FOMC? Instead of looking for ways to boost homebuilding, perhaps the Trump Administration should be filling sandbags in preparation for the coming battle regarding mortgage loan delinquency.

Additional Content

National Mortgage News: Why credit score politics have nothing to do with lending

Bloomberg Surveillance: Banks’ Trio of Alleged Frauds Sparks Fear of Broader Issues

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments