top of page

Housing Finance: Exposure at Default in Residential 1-4s

And as we predicted several months ago, Fannie Mae and Freddie Mac are at the bottom of the list now instead of the top, reflecting the fact that release from conservatorship has been shelved in favor of the GSEs buying back their own debt. Using the balance sheets of the GSEs to buy MBS basically makes them instruments of public policy, but this does not preclude President Trump from directing an equity offering after the midterm elections.

-

Jan 219 min read

The Powell FOMC & the Housing Trap

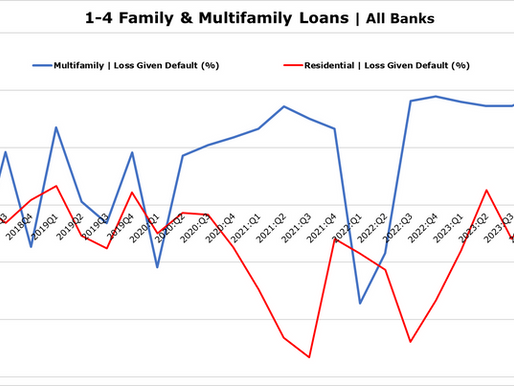

The accumulation of delinquent loans in the mortgage complex since COVID has gotten to the point where residential loan defaults have no place to go but up. Higher delinquency levels will enable investors to pay less for mortgage loans in the secondary markets, adding to cash losses per loan that are already several points vs the loan balance. It's not about "gain on sale" but rather cash received.

-

Oct 19, 20256 min read

Ray Dalio is Wrong About the Treasury Bond Market

When Ray Dalio says to be afraid of the bond market, he is asking a question that belongs in the mid-1970s, when the dollar still competed with other currencies and US interest rates were actually affected by interest rates in other nations. But today, with many of the other industrial nations led by Japan, China and the EU literally drowning in public debt, the US is still the leader of the parade.

-

Jun 5, 20256 min read

Memo to Bill Pulte and Scott Turner: How to Make Housing More Affordable

A more efficient mortgage backed securities market benefits everyone by lowering mortgage rates and making home ownership more affordable.

-

Mar 25, 20256 min read

Housing Finance Outlook | Q2 2025

There is an old rule on Wall Street that industry sectors like airlines and auto manufacturers are trades rather than investments...

-

Mar 16, 202511 min read

Silicon Valley and the Large Bank Dead Pool

When you see a bank with more than 10% of total assets in MBS, that's a big red flag in our book.

-

Mar 9, 20257 min read

Credit Teeters as President Trump Roars

When President Donald Trump says that interest rates are too high, he may not fully understand just how right he is about the cost of credit

-

Jan 27, 20256 min read

Capital Confusion at Ginnie Mae & Mortgage Servicing Rights

Ginnie Mae would rather have issuers raise the NPV of the MSR in cash today than take the price risk of holding the whole MSR through time.

-

Jun 26, 20246 min read

TCBI v Ginnie Mae Goes to Trial | Outlook for Commercial & Residential Mortgage Finance

McCargo's actions and the fact that the case has not been dismissed in its entirety is very unhelpful given current market conditions.

-

Apr 21, 20247 min read

Comments on Basel III Endgame

The Basel III proposal reflects a view of financial risks facing US banks that is decades out of date and ignores market risk

-

Jan 3, 20243 min read

Texas Capital Bank v Ginnie Mae

The legal dispute between Ginnie Mae and Texas Capital Bank makes additional defaults by HECM lenders more likely...

-

Oct 9, 20237 min read

Reverse Mortgage Bankruptcy Festers; IRA Housing Outlook

The Biden Administration has no real strategy for addressing the growing stress in the market for government insured mortgages

-

Aug 14, 202310 min read

Interest Rates, MSRs, Mortgage Putbacks & FICO Scores

Persistent talk about a 5.5% 30-year mortgage rate later this year is badly wrong as TBAs flip from 5.5% to 6% coupons for delivery in June

-

May 25, 20238 min read

Atlas Stumbles, Silvergate Wallows; 360 Mortgage v. Fortress (and RITM)

Are nonbank mortgage firms a risk to Ginnie Mae? Or is it really the other way around?

-

Mar 6, 20238 min read

Ginnie Mae - Credit Suisse = ? A Biden MSR Tax? Does BKI + ICE = < 2?

Our view is that the BKI purchase is a horrible deal for ICE shareholders, a value killer of epic proportions

-

Feb 13, 20238 min read

Record Losses for Mortgage Banks Presage Tough Year Ahead

Is 2023 the year of the Return of the Distressed Loan Trade?

-

Nov 19, 20221 min read

Loan Delinquency, EBOs & Ginnie Mae MSRs

It seems obvious that the reported book value metrics coming from many commercial banks, REITs and mortgage banks are a tad inflated...

-

Nov 15, 20226 min read

Short QE, Long Volatility

Until the FOMC raises interest rates to more “normal” levels, we don’t expect actual volatility to decline.

-

Sep 27, 20223 min read

The Bear Case for Ginnie Mae Issuers

The nightmare scenario in the government loan market is that FHA loan delinquency rises to the point where issuers become insolvent

-

Sep 22, 20228 min read

Interview: Scott Olson of Community Home Lenders of America

The banks have left the government market. Now Ginnie Mae seems bound and determined to drive the IMBs out of government lending as well

-

Aug 24, 20226 min read

bottom of page

.png)