top of page

Will Flagstar Survive ZoMa and Rebound? We Like the Leverage...

Is the impending ZoMa administration in NY City Hall any worse than the devastation caused by the 2019 Housing Stability & Tenant Protection Act of 2019? We think that the panicked crowd of New York landlords and developers have greatly exaggerated the impact of ZoMa, who is a slick salesman but has even less substance that the disastrous Mayor Bill de Blasio.

-

Oct 29, 20256 min read

Paramount Acquisition Suggests Big Office Property Losses Ahead

Mayor Eric Adams just dropped out of the New York City mayoral race and a silver spoon sucking Indian socialist from Uganda looks set to become the next Mayor of New York. You could never makes this up. But while a lot of political energy is focused on Zohran Kwame Mamdani's plans for rent stabilized properties, it is commercial real estate that pays the bills in New York City.

-

Sep 29, 20256 min read

Rates Down, Gold Up; RITM Buys PGRE at One Quarter of NAV? Yikes...

Is Michael Nierenberg, CEO of Rithm Capital (RITM), really paying a double digit cap rate for an "Irreplaceable Portfolio of Class A" properties in San Francisco and New York? What does this say about the true market value of all New York commercial properties?

-

Sep 24, 20256 min read

Update: Is GSE Release Really on Hold?

In an earlier issue of The IRA, we noted that one reason that the GSE shares may be suffering is that the Trump Administration is apparently wrestling with how to take Fannie Mae and Freddie Mac out of conservatorship.

-

Jul 29, 20255 min read

Post-Trumpian Fintech Bounce: How High? How Long?

At one point last year, HOOD was up several hundred percent, but has given back much of those gains. Yet the leaders of our finance group have outperformed the broad market.

-

May 12, 20256 min read

WGA Releases Q1 2025 Bank Industry Survey | Higher for Longer May Throttle Deposit Growth

Industry results in 2024 were reasonably good, but the banking industry is still 200 bp below 2019 levels of asset and equity returns

-

Feb 28, 20252 min read

Trumpian Wave Threatens Key Markets

Fed Chairman Jerome Powell now reports up to National Economic Council head Kevin Hassett.

-

Feb 20, 20257 min read

Big Losses in Commercial Real Estate & PE in 2025?

Private equity portfolio companies are about 10 times as likely to go bankrupt as non-PE-owned companies.

-

Jan 13, 20256 min read

Chairman Powell Jumps the Shark

The markets got their rate cut over the past six months and now may have to give some of that back.

-

Oct 7, 20248 min read

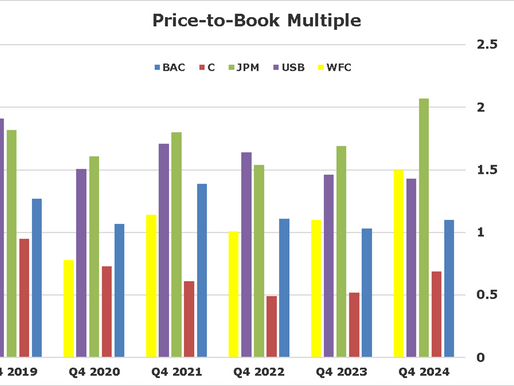

The Bull Case for Large Banks

If you believe that there is no recession coming in 2025, what is the logical response from an informed investment professional?

-

Oct 1, 20246 min read

IRA Bank Book Q3 2024 Industry Survey

The Q3 interest rate rally still leaves the industry with a negative

capital position since the average securities yield is only 3%

-

Sep 16, 20242 min read

New & Old Names in Nonbank Finance

In dollar terms, the moves in 2023 were tiny vs the post March rally in 2020.

-

Aug 21, 20247 min read

Q2 2024 Earnings Setup: JPM, BAC, WFC, C, USB, PNC, TFC

Citigroup leads the pack with a net loss rate of 133 basis points (bp) that is almost five times the average for Peer Group 1 at 27 bp.

-

Jun 23, 20249 min read

Update: BMO + Bank of the West = ?

BMO arguably has the weakest reserve position among the large Canadian banks....

-

Jun 17, 20246 min read

Will Credit Risk Transfer Save the Banks? Are MSRs Overvalued?

How much in synthetic CRT transactions will be done in 2024? Our best guess is many hundreds of billions globally...

-

Jun 12, 20249 min read

Faux Bear Raids on OZK and AX? But More Trouble Ahead for CRE Equity

We remind readers that unrealized losses on securities are still a bigger problem for banks than CRE.

-

Jun 7, 20247 min read

Inside the Private Credit Trade

Direct lenders are the pawnbrokers of the 21st Century for subprime commercial borrowers, usually firms financed via leveraged buyouts.

-

Jun 4, 20246 min read

Inflation & CRE Deflation Too? UMB Financial + Heartland = ?

With a budget deficit projected to be $1.8 trillion in 2024, the odds of the FOMC actually controlling inflation are pretty low.

-

May 28, 20247 min read

Interest Rates, Deficits & Inflation

We think it is reasonable to push expectations of a cut in the target for Fed funds into Q1 2025.

-

May 24, 20246 min read

MBA Aftermath; Profile: Merchants Bancorp (MBIN)

When NYC is forced to recognize reality, it will already be too late to avoid another fiscal crisis.

-

May 22, 20247 min read

bottom of page

.png)