top of page

WGA Releases Precious Metals Top 25

With the sharp move upward in gold and silver prices, and growing concerns about the stability of the dollar and US financial markets, investor interest in precious metals is increasing dramatically. Despite the big price movements seen in 2025, we believe that the appreciation of gold against the fiat currencies and worthless crypto tokens is in the early stages. Remember, bitcoin is a fraud, nothing more.

-

11 hours ago4 min read

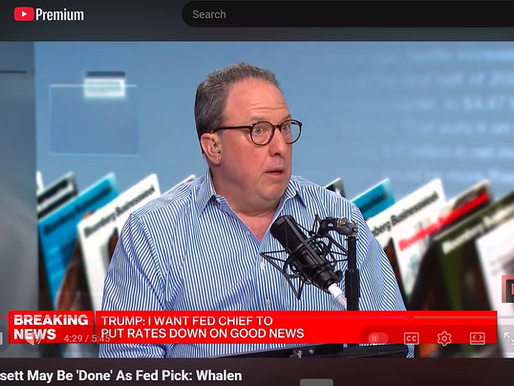

The Martyrdom of Jerome Powell

As we told Bloomberg TV last week, not only has the President's attacks not forced Powell out, but he has made this decidedly mediocre Fed chief a progressive martyr. As a result of Trump’s ill-considered attacks, Powell will likely remain as a Governor through 2028, depriving the President of an opportunity to appoint another governor for a 14-year term. How does this mess serve the agenda of President Trump?

-

Jan 267 min read

The Wrap: Hezbollah in Caracas? AI Flameout? Trump Buys MBS? Really?

Only the Fed under Janet Yellen was dumb enough to buy $3 trillion in MBS, costing the taxpayer hundreds of billions in losses without really affecting mortgage rates. A mere $200 billion from Donald Trump is a rounding error, pure populist political pulp -- another progressive political display that will have zero impact on LT interest rates. In fact, the childish suggestions coming from the White House on housing may continue to push LT interest rates up.

-

Jan 810 min read

Desperately Seeking Alpha: PennyMac vs Rithm Capital

PFSI trades on a trailing P/E of 14x vs ~ 8x for RITM. PFSI trades around 1.6x book vs 0.9x for RITM. Case closed? We have long believed that RITM should spin off its manager to create a comp for PFSI and then externally manage the RITM REIT. Like PFSI, in this scenario the new RITM manager would need to retain the Ginnie Mae MSRs.

-

Dec 8, 20256 min read

The IRA Bank Book Q4 2025: Credit Defaults Fall, Market Risk Grows

We have published the latest edition of The IRA Bank Book for Q4 2025. Entitled "Defaults Fall, Market Risk Grows," the report details how indicators of consumer credit risk are falling even as risk to financial markets from institutional and commercial credit, crypto tokens and market exposures grow. Bank income has reached record levels in Q3 2025, but what happens in Q4 2025 and 2026?

-

Nov 29, 20253 min read

The Wrap: NVDA Slows AI Unwind, But Home Prices Begin Correction

Hedge fund mogul Bill Ackman changed his tune and told investors this week that the government should not hurry to release Fannie Mae and Freddie Mac from government conservatorship. This announcement is essentially window dressing on the part of Ackman after FHFA Director Bill Pulte announced that the GSEs would not be released from conservatorship, dashing the hope of long-suffering shareholders.

-

Nov 21, 20255 min read

The Wrap: Is it November 2018 All Over Again?

As we've noted in the past, owning the share of crypto facilitators such as SOFI or Robinhood Markets (HOOD) is a better trade than owning BTC. We have seen a lot of market participants taking profits and moving to the sidelines, one reason why the markets have not seen an explosion in downside volatility -- yet.

-

Nov 14, 20256 min read

Pulte Pulls the Plug on GSE Release? Are LDI and UWMC Underwater?

We expect the shares of the GSEs to lose ground this week given last week’s bizarre announcement by Federal Housing Finance Agency Director Bill Pulte that the GSEs will not be released from conservatorship after all. After pumping the two stocks for months with the prospect of release from conservatorship, Pulte said Friday that the GSEs would stay under federal control for now, reinforcing their conservatorship status while exploring a limited public offering option.

-

Nov 10, 20259 min read

Should the FOMC End Fed Funds Targeting? Issue CMOs?

As Chairman Powell said in the latest FOMC presser, the SOMA reinvestment plan is intended to get their duration down to that of the Treasury debt outstanding by allowing long duration MBS to be replaced by short-duration T-bills. Could the Fed have continued to shrink the SOMA further as Bowman and others have urged?

-

Nov 5, 20259 min read

Goldman Sachs Sees a Difficult AI Harvest

Below we set up Goldman, Morgan Stanley and the other asset gatherers as we go into Q3 2025 earning this week. As you might expect, GS is ahead of where it was a year ago in terms of non-interest income, earnings overall and equity market value.

-

Oct 7, 20258 min read

Why Does United Wholesale Mortgage Sell Low Coupon MSRs?

So why would a firm like CrossCountry or UWMC be a buyer of higher coupon MSRs? The short answer is that they believe their ability to retain the borrower by recapturing a prepayment will offset the obvious negative of high prepayments that comes with a lower interest rate environment. These firms, it seems, would rather try to recapture prepayments on higher rate MSRs than own lower coupons and benefit from the stable cash flow from the servicing.

-

Sep 30, 20257 min read

Paramount Acquisition Suggests Big Office Property Losses Ahead

Mayor Eric Adams just dropped out of the New York City mayoral race and a silver spoon sucking Indian socialist from Uganda looks set to become the next Mayor of New York. You could never makes this up. But while a lot of political energy is focused on Zohran Kwame Mamdani's plans for rent stabilized properties, it is commercial real estate that pays the bills in New York City.

-

Sep 29, 20256 min read

Trump & Powell Fiddle as Private Credit Burns

If the Powell FOMC crashes the short-term markets, again, because the Board staff mismanages the required level of liquidity, Powell will need to resign same day but the real loser will be the Trump Administration. Neither the public nor members of Congress will understand who caused the latest market upset, but they will be happy to blame Donald Trump and members of his team.

-

Sep 5, 20258 min read

Trump to IPO GSEs? Details to Follow...

The $30 billion target for cash raised in a GSE IPO is pathetic and only confirms our view that the Treasury should repurchase the GSE voting common and issue new preferred to raise hundreds of billions in proceeds. If we keep the US Treasury as the majority common shareholder and finance the capital structure with new senior preferred, the Trump Administration could raise $500 billion easily.

-

Aug 9, 20256 min read

Interest Rates, Crypto Tokens & Mortgage Servicing Rights

The number of very late people running into Bitcoin and other tokens over the past year only makes us realize that there is nothing new in the world of finance. Had Jim Fisk and Jay Gould traded crypto tokens like Bitcoin over the past decade, they'd have gotten out in 2013.

-

Aug 4, 20258 min read

The Cost to Housing of Donald Trump

Why is Secretary Bessent talking publicly about Powell or the Fed at all? How does this squawking enhance the credibility of the Trump Administration or the U.S. Treasury?

-

Jul 23, 20255 min read

Should the Federal Reserve Pay Interest on Bank Reserves?

Paying interest on reserves has nothing to do with whether banks lend and everything to do with enabling the Fed to manage the Treasury market. If you don’t want the Treasury market to remain open, then take away the Fed’s power to pay interest on reserves.

-

Jul 17, 20258 min read

Silver Surges? Waller Wants Lower Reserves & Tighter Policy

The leading candidate to be the next Fed Chairman believes the balance sheet could safely shrink to around $5.8 trillion, with bank reserves potentially decreasing to $2.7 trillion. Waller argues that a shift towards more short-term Treasury bills would make the balance sheet safer and more flexible, and he is absolutely right.

-

Jul 14, 20255 min read

Soaring Fiscal Deficits, Military Parades and Irrelevant Bank Stress Tests

Imagine if the Fed had to tell the public that federal deficits were bad for bank safety and soundness? We haven't had a Fed chairman since Arthur Burns who would speak publicly about the inflationary aspect of federal deficits.

-

Jul 5, 20256 min read

Regulators Retreat on Bank Capital; Trump Wants Fed Funds at 1%. Really?

The Treasury market/bank industry PR lobbyist angle on the Fed's eSLR proposal is a little fake-out for the financial media. This not about buying more Treasury debt but instead buying back more bank stocks. Sabe?

-

Jun 30, 20257 min read

bottom of page

.png)