Interest Rates, Crypto Tokens & Mortgage Servicing Rights

- Aug 4, 2025

- 8 min read

August 5, 2025 | Last week’s negative jobs numbers caused a small rally in bonds and suggested that President Donald Trump may get his way on interest rates sooner rather than later. The resignation of Governor Adriana Kugler gives President Trump an open slot to appoint a new chair and completely changes the tactical situation vis-a-vis Chairman Jerome Powell.

"Trump alleged without proof that Kugler resigned over a disagreement with Powell on interest rates," reports Jeff Cox of CNBC. "Trump added that he was 'very happy' about having a Fed vacancy to fill."

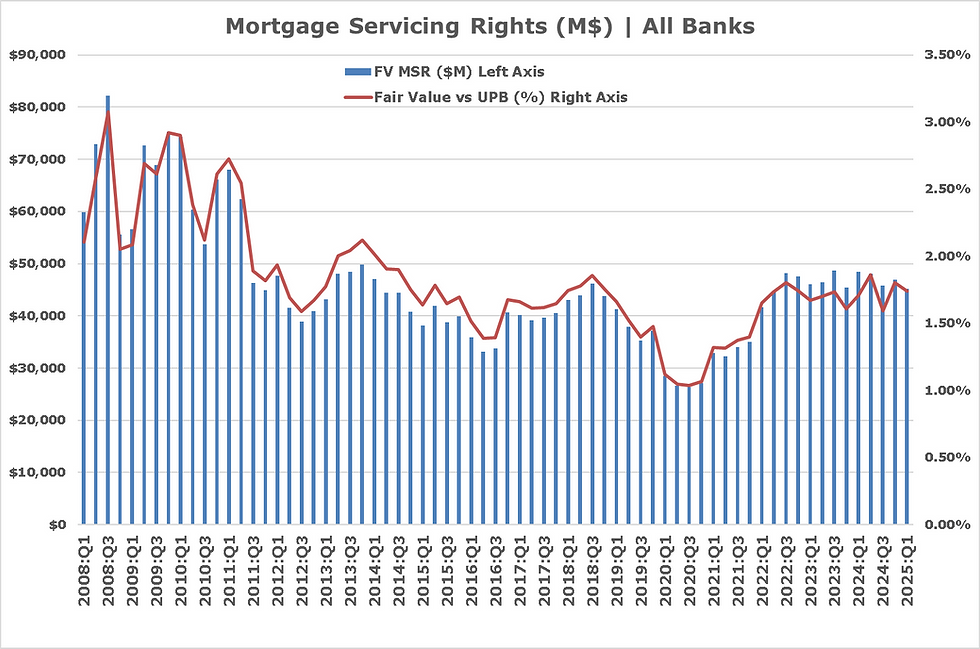

One asset class greatly impacted by actual or perceived changes in interest rates is that naturally occurring negative duration asset, mortgage servicing rights (MSRs). Once upon a time, housing was the chief conveyor belt of monetary policy, but no more with the Treasury adding new debt at $500 billion per quarter.

As the chart below suggests, the payment intangibles known as MSRs owned by banks are currently changing hands at 6x annual cash flow, but a change in short-term interest rates by the FOMC may change that – or not. Notice where MSR multiples were in Q1 2020, almost half of today's bid side. Figure the fair value of the MSR is 2% of the UPB, in case you're wondering. But is a fair deal a good deal?

Source: FDIC/WGA LLC

If the FOMC drops the target for fed funds 50bp in September, as our friend Kathleen Hays suggests in a recent interview, how should PennyMac Financial (PFSI) and Bayview et al manage their considerable portfolios of MSRs? Should operators in the mortgage industry and their Buy Side partners lean into a bond market rally and sell before prepayments decimate asset values? Or should we retain the servicing asset and merely amp up the long duration hedge on $9 trillion or so in unpaid principal balance (UPB) of MSRs owned by nonbanks?

Our guess is the latter scenario, BTW. We think LT interest rates may not follow fed funds lower, especially given yesterday's market action and the looming Treasury cash build. While MSR models may require mark-downs in valuations in Q3, say, after that 50bp rate cut, the actual prepays on these assets may underperform the model, causing mortgage firms to true up their ersatz financials in Q4 and 2026. The average APR for 30-year fixed rate conventionals, Inside Mortgage Finance reports, was 6.8% last week.

“Given that rates have already declined following the softer jobs report, a surprise 50bp cut in September would likely have a more muted impact on the front end of the curve, though it could still drive short-term rates lower—particularly if the market views it as the beginning of a more aggressive easing cycle,” Mike Carnes at MIAC tells The Institutional Risk Analyst. He continues:

“Long-term rates could move in either direction depending on how the cut is interpreted. If it's seen as a preemptive step toward a soft landing, we might see curve steepening. But if it signals deeper concerns about growth, long-end yields could decline further—and my guess is the market would lean toward the latter. From an MSR perspective, much of the value impact may already be unfolding, but a 50bp cut would likely push CPR expectations higher, especially for more recent originations.”

The complicating factor in the analysis of interest rate movements is that the US Treasury is about to increase its borrowings rather considerably to regrow the government's cash position (blue line in chart above, right scale). Treasury is going to put the cash balance in the TGA back to February 2025 levels (red arrow). Notice that during the initial setup of Trump II, Treasury "allowed" its cash balances to drop dramatically, a pretty blatant (and pathetic) attempt at yield curve control that worked not at all.

The dark red line at bottom of the wonderful chart from FRED is reverse repurchase agreement (RRPs), essentially a competitor to and substitute for Treasury bills illegally issued by the Fed. Given that the Fed rationalized the massive expansion of the balance sheet and attendant losses since, engaging in RRPs was an easy leap of faith. The Vatican-like expansion of the Fed's HQ should put to rest any doubt as to the location of the key agency in Washington.

John Comiskey notes on Substack that the Treasury's marketable borrowing will be $1 trillion in Q3 2025, half of which is new financing need. Treasury is adding almost $400 billion to the Treasury General Account at the Fed, which is fully collateralized by US Treasury bonds. Cash at the end of Q3 and Q4 will be over $800 billion held in the TGA at the Fed. And no, the Fed does not pay interest on the TGA, but it does remit the interest earned on the Treasury collateral back to Uncle Sam, net of the Fed's operating expenses and trading losses.

The two charts below come from SIFMA and show fixed income issuance and trading volumes through Q2 2025.

Imagine how these great SIFMA charts will look with Treasury adding $1 trillion in new issuance, and the Fed running off the system open market account a modest (SOMA) $15 billion per quarter. But if we get that 50bp rate cut and the 10-year Treasury does rally say below 4% on 10s, then we get another sudden bull market in all manner of assets, from resi mortgages to high-yield securities to commercial mortgages. Some CRE managers may start to appear solvent again.

A bull market in issuance will be a bear market for MSRs, especially if we see conventional loans fall down below 6% yield. FHA and VA loans, keep in mind, already have yields a half point or more below conventionals. In the event, we can expect a surge of prepayments on existing assets and an equal surge in the creation of new MSRs from that new issuance. Long hedging of MSRs will surge, margin calls will be made and met, and forward sales of TBAs will balance it all out. But more to the point, given the federal budget deficit and the debt, should not we assume that short and long-term interest rates are going to be managed down in a return to financial repression?

For the Fed, the challenge continues to be managing the floor of interest rates in a market where the Treasury is the largest issuer and the majority of new issuance is in short-duration assets. The preference for T-bills on the part of Treasury Secretary Scott Bessent is essentially a given, thus we think that our readers should assume that the markets will see a substantial rally in short-term assets, even beyond the market move already seen. Fact is, at the close on Monday, the 10-year Treasury note was yielding 4.25%, a very modest rally from Friday given that a Treasury refunding looms.

Some observers have indicated that the growth of speculation in crypto assets will somehow benefit the Treasury. No, crypto rides on the carcass of the old world, like some exotic alien parasite out of the 2012 Ridley Scott film "Prometheus." The fact of stable-coin issuance is likely to boost demand for high-quality liquid assets, but many of the nouvelle issuers of coin are not averse to placing customer deposits with offshore banks. Take a look at the public filings of the listed coin enablers and look where they deposit client funds. Of course, it is one big global dollar market when you are pursuing yield.

There are other aspects to the growth in stable coins that may be detrimental to demand for Treasury collateral. Bill Nelson from Bank Policy Institute:

“In late April, the Treasury Borrowing Advisory Council briefed Treasury officials on the state of markets and on two special topics, one of which was how growth in stablecoins would affect the demand for Treasury securities. Unfortunately, the briefing missed half the story. While the TBAC told Treasury that growth in stablecoins would increase the demand for Treasuries, they neglected to account for the reduction in demand for Treasuries caused by the shift out of bank deposits, money funds, and currency. While the TBAC reported that demand would increase by about $900 billion, the offsetting shifts would be considerable, possibly resulting in a net decline in demand of around $100 billion.”

If the FOMC is worried about defending the positive floor for short-term interest rates given the borrowing needs of the Treasury, the proponents of crypto assets are searching for new and innovative ways to support the ceiling on prices for a growing variety of crypto tokens. The fact that prices for crypto assets are being supported by new stock issuance via SPACs and other vehicles should be cause for concern. Cash is raised, worthless tokens are purchased, and the sponsors of the tokens take the cash and the carry on the fiat assets.

Source: Backtest

In the last 13 years, the Bitcoin index (in USD) had a compound annual growth rate of 99.25%, a standard deviation of 150.77%, and a Sharpe ratio of 0.82, Backtest reports That last metric is actually quite mediocre, but the holders of tokens don't care because they act within a self-reinforcing group. The fact that the standard deviation is larger than the annual growth rate is also indicative of a volatile asset with no intrinsic value. But if we focus on the period of quantitative easing, 2020 through 2022, notice that Bitcoin did very poorly in a low rate environment. And that is precisely where we are headed.

Our worry for the future is not that the Treasury market is going to collapse or stocks will implode. Notice that the markets have been largely stable despite a pretty grim set of numbers from the BLS. No, our worry is that another financial debacle a la FTX will surprise the markets and send short-term rates falling as investors run for cover.

The number of very late people including the Trump clan running into Bitcoin and other tokens over the past year only makes us realize that there is nothing new in the world of finance. Had great operators like Jim Fisk and Jay Gould traded crypto tokens like Bitcoin over the past decade, they'd have gotten out in 2014.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments