top of page

The Wrap: The Flight from AI; PennyMac + Cenlar FSB = Strike Two

Large-cap tech stocks experienced the worst week since November, causing a split market where value-oriented stocks are gaining attention, while tech stocks and crypto tokens are being liquidated. Equity managers are rotating out of tech and into everything else, creating a cosmic imbalance that is difficult for the non-tech equity market to absorb.

-

Feb 137 min read

The Wrap: Pulte Crushes PennyMac; Kevin Warsh's Conflict of Visions

We hear that the PennyMac fiasco was largely caused by Bill Pulte and the Trump Administration. Most people in the markets don't realize that the GSEs had already bought a ton of mortgage-backed securities (MBS) in Q4 of last year. This market manipulation tightened mortgage spreads 15-20bps and increased mortgage prepayment speeds without a corresponding offset from hedges in the Treasury market. This set up PennyMac and other mortgage lenders for a disaster.

-

Feb 56 min read

PennyMac: Hedging Costs & Residential Loan Recapture Crater the Stock

But the key factor that generated investor angst was under-performance in terms of loan recapture, an illustration of the hyper-competitive market in residential mortgages. True retention = Retained fundings divided by total run off. On that basis, we figure that PFSI retained less than 1/3 of mortgages that prepaid in Q4 2025. After touching $160 in late January, PFSI closed yesterday below $95 per share.

-

Feb 24 min read

The Wrap: Gold Surged, Bank Stocks Sagged & FOMC Did Nothing

US banks and nonbanks are entering a period of increased uncertainty in terms of earnings and rising credit costs, yet another reason why financial stocks are retreating. We published a comment on the risks to banks from loans to private equity funds (“Does Private Credit Hurt Bank Stocks?”). Bank credit costs have been so low for so long that they have nowhere to go but up.

-

Jan 305 min read

Housing Finance: Exposure at Default in Residential 1-4s

And as we predicted several months ago, Fannie Mae and Freddie Mac are at the bottom of the list now instead of the top, reflecting the fact that release from conservatorship has been shelved in favor of the GSEs buying back their own debt. Using the balance sheets of the GSEs to buy MBS basically makes them instruments of public policy, but this does not preclude President Trump from directing an equity offering after the midterm elections.

-

Jan 219 min read

JPMorgan, Growing Large Bank Risk & Private Credit

The surprise pre-release of Q4 results led to a significant drop in JPMorgan's stock price and took down the entire sector along with it. But is this the only negative surprise likely to come from JPM? We think not. CNBC’s Jim Cramer said on X yesterday that investors should buy JPM on the dip, but we disagree. In fact, the markets seem to know something about JPM. Maybe this explains why Citigroup (C) has outperformed the House of Morgan all year.

-

Dec 11, 20258 min read

Desperately Seeking Alpha: PennyMac vs Rithm Capital

PFSI trades on a trailing P/E of 14x vs ~ 8x for RITM. PFSI trades around 1.6x book vs 0.9x for RITM. Case closed? We have long believed that RITM should spin off its manager to create a comp for PFSI and then externally manage the RITM REIT. Like PFSI, in this scenario the new RITM manager would need to retain the Ginnie Mae MSRs.

-

Dec 8, 20256 min read

Pulte's GSEs Prepare Capital Increase for Nonbank Mortgage Lenders

Does the Trump White House understand that the professional staff of the GSEs are preparing to roll out yet another capital increase for the residential housing market in 2025? Does Director Pulte understand that the changes are being advanced by the staffs of the GSEs in his name and with his apparent support? We suspect that the answer is no.

-

Nov 23, 20258 min read

Pulte Pulls the Plug on GSE Release? Are LDI and UWMC Underwater?

We expect the shares of the GSEs to lose ground this week given last week’s bizarre announcement by Federal Housing Finance Agency Director Bill Pulte that the GSEs will not be released from conservatorship after all. After pumping the two stocks for months with the prospect of release from conservatorship, Pulte said Friday that the GSEs would stay under federal control for now, reinforcing their conservatorship status while exploring a limited public offering option.

-

Nov 10, 20259 min read

Trading Points: Mortgage Finance With Rising Volumes and Loan Defaults

The latest statements about a possible stock offering for the GSEs seem to be designed to boost the share price in the near-term and do not provide any more information than we had when such statements were made previously. Given the management changes announced yesterday and the other requirements for a successful offering, we have a hard time believing that a GSE stock offering will occur this year. Notice how the shares of Fannie Mae popped for a couple of days this week

-

Oct 23, 20256 min read

Why Does United Wholesale Mortgage Sell Low Coupon MSRs?

So why would a firm like CrossCountry or UWMC be a buyer of higher coupon MSRs? The short answer is that they believe their ability to retain the borrower by recapturing a prepayment will offset the obvious negative of high prepayments that comes with a lower interest rate environment. These firms, it seems, would rather try to recapture prepayments on higher rate MSRs than own lower coupons and benefit from the stable cash flow from the servicing.

-

Sep 30, 20257 min read

Interest Rates, Crypto Tokens & Mortgage Servicing Rights

The number of very late people running into Bitcoin and other tokens over the past year only makes us realize that there is nothing new in the world of finance. Had Jim Fisk and Jay Gould traded crypto tokens like Bitcoin over the past decade, they'd have gotten out in 2013.

-

Aug 4, 20258 min read

Trump to Fire Jay Powell? No. Bank Earnings? Nada. Bayview for Sale?

President Trump will not try to fire Chairman Powell. Why not? First, because Powell cannot be removed save for malfeasance. Second, because firing Powell would seriously piss off Senate Republicans, killing Trump's hopes for tax legislation this year.

-

Apr 22, 20256 min read

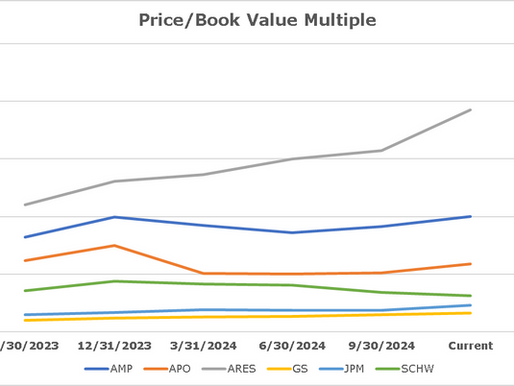

Is Ameriprise Overvalued? Is PennyMac Cheap vs the REITs?

We think it is notable that AMP has underperformed the other members of the group other than SCHW over the past year.

-

Feb 3, 20257 min read

Residential Mortgage Finance 2025

The majority of the actual cash profit generated from residential lending is found in the mortgage servicing rights (MSRs).

-

Jan 20, 202512 min read

Kamikaze GSE Release? Oh Yeah...

Yes, that's right, we are going to downgrade $8 trillion in GSE MBS and hundreds of billions in corporate debt.

-

Dec 10, 202415 min read

Update: Block Inc, Nu Holdings & Guild Holdings

Notice that SQ co-founder Jack Dorsey styles himself as "block head" in the corp roster, a silly affectation that does not help the stock

-

Nov 15, 20247 min read

Fiat Currencies, GSEs & Presidents

Could President elect Donald Trump be facing a maxi market correction before inauguration day?

-

Nov 13, 20246 min read

Is Trump Bullish for Interest Rates? Pump & Dump for GSE and Fintech Stocks

You can tell lies and damn lies about the idea of releasing Fannie and Freddie, but the SEC and FINRA cannot and will not say a word.

-

Oct 30, 20246 min read

Housing Finance Outlook; PennyMac, Mr. Cooper & NYCB/Flagstar

NYCB and the unsold rent-stabilized assets left over from the failure of SBNY are two little surprises waiting for the next POTUS.

-

Oct 28, 20249 min read

bottom of page

.png)