Desperately Seeking Alpha: PennyMac vs Rithm Capital

- Dec 8, 2025

- 6 min read

December 8, 2025 | In this issue of The Institutional Risk Analyst, we feature some reader questions and look at several nonbank financials that may benefit as interest rates fall. Importantly, mortgage spreads (the difference between loan coupons and benchmark Treasury yields) are falling, a significant bull market signal for interest rate sensitive stocks that benefit from higher loan volumes. In our next comment, we'll drill down on several names that will benefit from a falling interest rate environment.

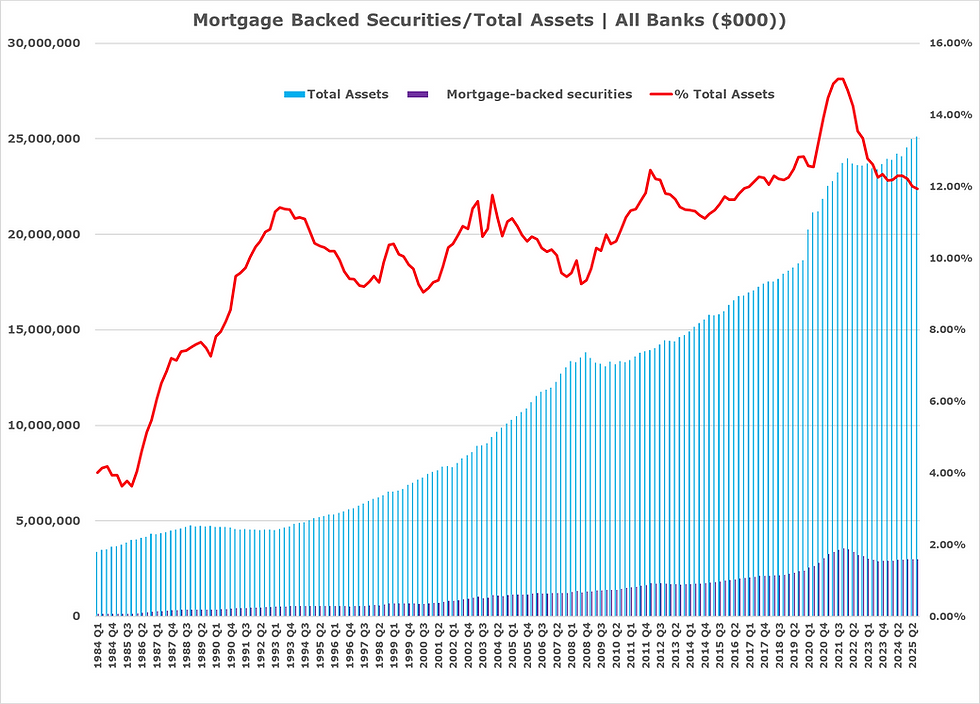

Secondary mortgage spreads have tightened in 2025 due to strong investor demand from money managers and REITs, reduced interest rate volatility (and lower hedging costs), increased liquidity from Fed actions, and a flight to quality favoring lower-coupon MBS, all signaling improved confidence and technical support in the agency mortgage-backed securities (MBS) market despite broader market flux. But US banks are not increasing exposures to 1-4s.

Source: FDIC

As we noted in our new working paper on nonbank mortgage issuers, “Back to the Future in Nonbank Finance: Excess Servicing Strip Transactions 2.0,” banks remain reluctant to increase exposure to mortgage assets going back to before the great financial crisis in 2008. Why? Facing the American consumer is toxic.

Source: FDIC

Speaking of primary-secondary mortgage spreads, last week during our quarterly call for subscribers to our Premium Service, a reader named Geoff asked about Annaly Capital Management (NLY), a LT holding in our portfolio:

“You went over two key points related to NLY that piqued my interest. Namely how Hassett might not follow thru on his stated rate policy and what, if any, impact banks re-entering the mortgage market might have on mortgage rates and the servicing rights business pursued by NLY. The rate discussion is interesting because there has been a lot of interest in the steepener trade. NLY is in a particularly nice situation due to the limited credit risk and higher MBS yields vs say the 10 yr swap which is more or less scratch on short term funding costs at present. You brought to mind two risks to this trade. One, short term rates aren’t a shoe in to go lower, and two, could bank re-entrance lower mortgage rates, thereby compressing spreads via lower MBS coupons over and above any impact by lower rates in general. NLY's MSR business, however, is something I don’t really understand. It seems like this section of the business is really there to balance the spread business. I read your paper in the link at the end of today’s note and am trying to put the pieces together. Seems like NLY might struggle to compete with the banks in this business going forward as the cost of funds is likely lower for banks. I also wondered about the impact on volumes for originating companies like RKT, LC, PFSI, etc. as it seemed the banks are only interested in providing capital, not originating? Do any of these concerns reduce your inclination to hold any or all of your NLY shares in the portfolio?

We’ve owned NLY on and off for many years and have a lot of respect for their management team. Our basis in the stock is well-below par, so we are quite comfortable owning the position, which we hold primarily for income rather than alpha. The fact that NLY acquires mortgage servicing rights or MSRs, which are negative duration payment intangible assets with cash flow, makes the investment proposition even more attractive for us. MSRs provide a natural hedge for mortgage loans and MBS. But we don't own REITs for alpha.

REITs as a group are pass-through vehicles that are typically owned by income-oriented equity investors and are not generally good market performers in terms of alpha. Compare say the hybrid REIT Rithm Capital (RITM), which owns a taxable lender, and PennyMac Financial Services (PFSI), the external manager of mortgage REIT PennyMac Investment Trust (PMT). RITM purchased several lenders over the years in order to hold Ginnie Mae servicing assets, which are prohibited assets for REITs.

PFSI trades on a trailing P/E of 14x vs ~ 8x for RITM. PFSI trades around 1.6x book vs 0.9x for RITM as of Friday. Case closed? We have long believed that RITM should spin off its manager to create a comp for PFSI and then externally manage the RITM REIT. Like PFSI, in this scenario the new RITM manager would need to retain the Ginnie Mae MSRs. Likewise, we believe that Two Harbors (TWO), another hybrid REIT that owns a lender and creates MSRs with its captive lender, would benefit from spinning off the lender Roundpoint/Matrix, which would then become the external manager of the TWO REIT.

Why Don't Banks Like Mortgages?

No matter how many research notes our friends on the Sell Side right about banks buying more MBS, it's just not happening. As we noted in our paper, banks have not been major buyers of mortgages or servicing assets for decades, although there was an unfortunate increase after COVID leading to the failure of Silicon Valley Bank.

Fact is, the portion of bank loans and assets allocated to 1-4s has been declining for a quarter of a century. Part of this indifference to mortgage exposures by banks may come from the absurd, 250% capital risk weighting for 1-4s in the Basel capital framework. After all, MSRs don’t have any default risk. The Basel Committee has never published an explanation for its punitive risk weighting for MSRs.

But the bigger obstacles to banks increasing their participation in 1-4s and MSRs are low risk-adjusted returns and reputational risk from facing consumers. The combination of idiotic progressive politics and the American trial bar serves as a significant disincentive for banks to lend money to low-income borrowers. Thus when you look at the allocation of bank mortgage and consumer credit assets, the lower 25% in terms of income and credit score are largely ignored by banks. Some 80% of all mortgage originations have FICO scores above 720.

The big factor in the stock prices for many mortgage lenders is how aggressive the management team becomes in terms of capturing volumes and thereby drive higher ST earnings. The volumes may or may not be profitable, but the gain on sale accounting under GAAP manages to conceal the cash reality very nicely. The value of the mortgage-servicing right or MSR at the close of a mortgage loan represents the present value of future cash flows that have yet to be received, one big reason why we like the idea of large institutional investors financing the MSR and backstopping loss mitigation expenses.

In our next comment, we will look at some of the top names in financials in a falling interest rate environment for subscribers to our Premium Service. Don't forget to take advantage of our Winter Sale by using coupon code "IRA2025" for 25% off for the first year of the Premium Service of The Institutional Risk Analyst. Offer ends 12/31/2025!

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments