top of page

Desperately Seeking Alpha: PennyMac vs Rithm Capital

PFSI trades on a trailing P/E of 14x vs ~ 8x for RITM. PFSI trades around 1.6x book vs 0.9x for RITM. Case closed? We have long believed that RITM should spin off its manager to create a comp for PFSI and then externally manage the RITM REIT. Like PFSI, in this scenario the new RITM manager would need to retain the Ginnie Mae MSRs.

-

Dec 8, 20256 min read

Residential Mortgage Finance 2025

The majority of the actual cash profit generated from residential lending is found in the mortgage servicing rights (MSRs).

-

Jan 20, 202512 min read

Update: PennyMac Financial Services

If we are marking balance sheet assets to actual market in the age of deflation, what of the heavily modeled world of servicing assets?

-

Nov 1, 20236 min read

Rising Interest Rates? Really?

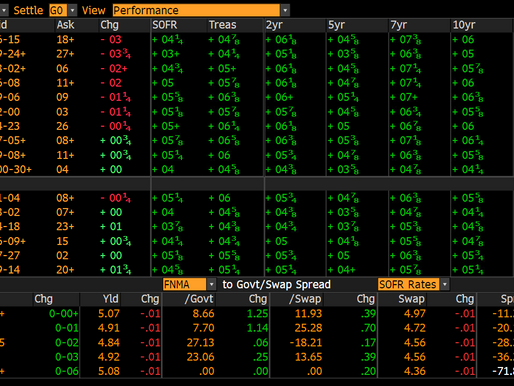

Since 2008, dollar swap spreads have traded below Treasury yields, suggesting a persistent demand for dollars coming from offshore.

-

Dec 12, 20224 min read

Update: New Residential Investment, Fortress & Softbank

The good news is that NRZ is growing and making strides in terms of asset creation and, especially, asset retention.

-

Nov 3, 20217 min read

Nonbank Update: PennyMac Financial Services

There is no actual disclosure from PSFI as to exactly how much of the firm’s default advances are being financed with bondholder funds

-

Nov 23, 20207 min read

bottom of page

.png)