Rising Interest Rates? Really?

- Dec 12, 2022

- 4 min read

Updated: Dec 14, 2022

December 12, 2022 | Premium Service | Craig Torres and Liz Capo McCormick wrote on the Bloomberg over the weekend: “Fed’s Long Hold Message At Odds With Market Bets On Rapid Ease.” So true. But the real issue facing investors and risk managers is that investment managers still choose to believe that the FOMC is in control of policy and the key derivatives, the dollar and equity market prices.

When we look at the actual data, a very different picture of US interest rate trends emerges from the narrative in the financial media. The sharp drop in Treasury yields beyond two years suggests a significant shortage of available investments or duration. Indeed, since 2008, dollar swap spreads have traded below Treasury yields, suggesting a persistent demand for dollars coming from offshore. In fact, the global economy now dictates dollar interest rates.

In basic terms, the difference between America under President Joe Biden in 2022 and Mexico circa 1994 is the continued use of the dollar as the means of exchange in global finance and commerce. But the role of the US as global backstop for the dollar market since 2008 is unprecedented and has accorded America a huge economic and financing advantage over the rest of the world.

But for the special role of the dollar, which is fueled by new securities issuance and related money growth, the Treasury under Secretary Janet Yellen might be fighting a falling dollar with rising inflation. Instead, offshore demand for the dollar keeps LT financing rates below short-term Treasury yields and, most important, makes swap rates negative. Klingler and Sundaresan (2018) summarize the classical view:

“Negative swap spreads are a pricing anomaly and present a challenge to views that have been held prior to the financial crisis that suggested that swap spreads are indicators of market uncertainty, which increase in times of financial distress… Therefore, swap spreads should increase in times of elevated bank credit risk.”

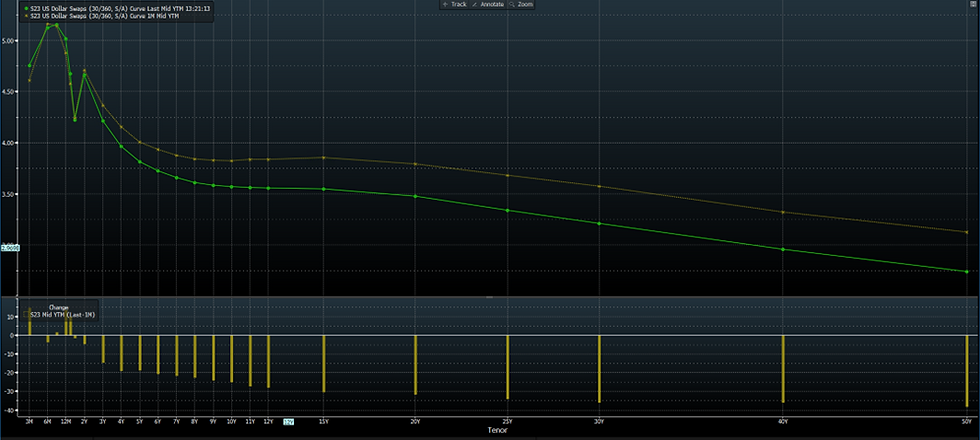

Instead, no matter how much money the US borrows and spends, LT interest rates remain well-below short-term yields. The chart below shows the US dollar swaps curve as of Friday (green line) and a month ago (yellow line). Notice that the change shown below has the negative spread for longer dated dollar swap contracts moving far more than the short-term rates. Should LT US rates ever start to trade above short-term yields, then the US becomes a distressed debtor nation on the following day.

Source: Bloomberg

Klingler and Sundaresan posit that the negative swing in dollar swaps spreads since 2008 has to do with duration-hungry pension funds, an interesting but we think incomplete explanation of this dramatic shift in the terms of finance. Today US interest rates spike above 5% out to about 15 months, then fall dramatically with a brief upward spike at 2 years to about 4.5%, then again fall to 3.5% at ten years and then trend on down to 2.5% for 50-year dollar swaps.

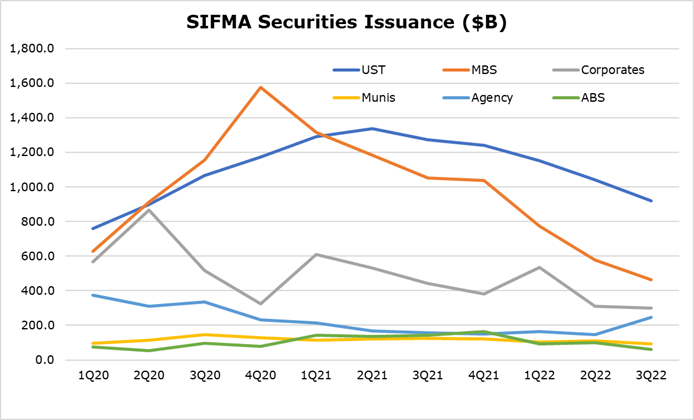

Does this look like a market that wants to go up in yield? No, in fact the credit markets are pushing yields down even as the FOMC talks about maintaining higher short-term rates for longer. Although the banks are net sellers of Treasury paper and MBS, and the Fed portfolio is running off, net demand for duration seems to be growing. The fact that there is no risk premium in dollars out to 50 years is both remarkable and troubling. Things do change.

To us, the key question is not whether the FOMC will try to push fed funds higher but how much lower will the sheer demand for duration pull down longer maturities for bonds and swaps? We think the 10-year Treasury could again touch 3% yield, which implies LT swap rates below 2%. The same market volatility that is retarding new securities issuance could well result in significantly lower bond market yields.

Looking around the financial markets, the supply of existing loans and securities is actually falling rapidly. Consider, for example, the announcement by PennyMac Mortgage Trust (PMT) that it is cutting its dividend and preparing to de-lever its balance sheet. Credit-risk transfer (CRT) deals at PMT and across the industry are headed for redemption, for example, again contributing to a net reduction in available duration. Even the banks and GSEs themselves will likely be de-levering over the rest of the decade.

The false narrative that courses through the financial community says that the FOMC is raising interest rates. The markets are telling us that the rate for LT dollar financing is falling, as illustrated by a 2.5% rate for fixed to floating dollar swaps. The fact of falling issuance of new securities in the US and around the world suggests to us that Treasury yields beyond two years are more likely to fall in the months ahead. Have a great week.

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments