top of page

The Wrap: Pulte Crushes PennyMac; Kevin Warsh's Conflict of Visions

We hear that the PennyMac fiasco was largely caused by Bill Pulte and the Trump Administration. Most people in the markets don't realize that the GSEs had already bought a ton of mortgage-backed securities (MBS) in Q4 of last year. This market manipulation tightened mortgage spreads 15-20bps and increased mortgage prepayment speeds without a corresponding offset from hedges in the Treasury market. This set up PennyMac and other mortgage lenders for a disaster.

-

6 days ago6 min read

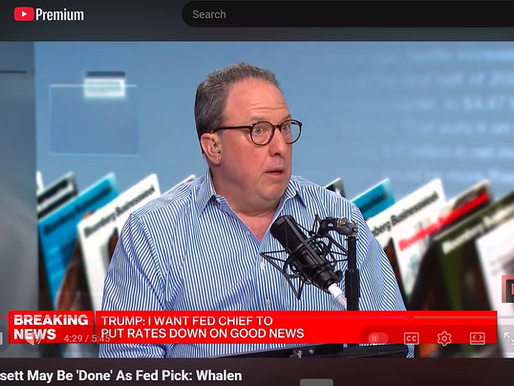

The Martyrdom of Jerome Powell

As we told Bloomberg TV last week, not only has the President's attacks not forced Powell out, but he has made this decidedly mediocre Fed chief a progressive martyr. As a result of Trump’s ill-considered attacks, Powell will likely remain as a Governor through 2028, depriving the President of an opportunity to appoint another governor for a 14-year term. How does this mess serve the agenda of President Trump?

-

Jan 267 min read

The Wrap: Trump Does Nada in Davos Jim Rickards on the Asymmetry of Gold

This week in “The Wrap,” we report in summary fashion about the latest events in Washington and Wall Street this week. The Trump Administration departed from Davos with a variety of “wins,” but there was nothing substantive about housing affordability or really anything else.

-

Jan 236 min read

The Wrap | New Year 2026: Lower Interest Rates, Higher Defaults

When the Fed took net loan loss rates for banks down to ~ 50% of par in 2021 vs 95% after 2008, they enabled some very stupid and foolish behavior by investors and lenders. These behaviors are only partly described by the nominal level of interest rates because, of course, we must account for leverage in calculating the full scope of the prospectives losses. Lend More Upon Default (LMUD) has concealed the scope of the disaster and even pushed down reported loan default rates.

-

Dec 31, 202511 min read

The Wrap: Hassett or Warsh to Fed? Big Beautiful Housing Reform? Coin Crime?

Kevin Hassett's comments on Federal Reserve independence may have undercut his chances for the top Fed job. President Donald Trump has observed in recent days that there are “two Kevins,” Hassett and former Fed governor Kevin Warsh, who we personally support.

-

Dec 19, 20255 min read

The Wrap: Rate Cuts, FSOC Fantasy and CRE Deflation

The Trump FSOC document reads like a Marvel comic book and is entirely laudatory towards crypto fraud, but uses the same idiotic language as former Treasury Secretary Janet Yellen in describing the grave systemic risks posed by residential mortgage servicers. The report states incredibly: "The continued use of U.S. dollar-denominated stablecoins is expected to support the role of the U.S. dollar in the international financial system..."

-

Dec 11, 20256 min read

Should the FOMC End Fed Funds Targeting? Issue CMOs?

As Chairman Powell said in the latest FOMC presser, the SOMA reinvestment plan is intended to get their duration down to that of the Treasury debt outstanding by allowing long duration MBS to be replaced by short-duration T-bills. Could the Fed have continued to shrink the SOMA further as Bowman and others have urged?

-

Nov 5, 20259 min read

Senate Defeats Fed Reserve Folly; Trump Trade Twist Trashes Crypto

Why does the US central bank need to pay interest on bank deposits at the Fed? Because we have $35 trillion in public debt. The interest rate on T-bills, bank reserves deposited at the Fed and reverse repurchase agreements (RRPs) issued by the Fed must be roughly the same.

-

Oct 12, 20256 min read

Interview: Alex Pollock on the Fed and Gold | Part II

My view of Fed “independence," if you talk about absolute independence, it's nonsense. You can't have one piece of the government that becomes an autonomous power running around doing whatever it wants. That's ridiculous. But the Fed should be independent of the President and the Treasury. The reason why this is completely clear was explained by none other than William McChesney Martin: The Treasury is the borrower.

-

Oct 9, 202512 min read

Interview: Alex Pollock on the Fed and Gold | Part I

“A higher money price of gold is best read as a symptom of a weaker currency. It isn't really the gold going up, it's the dollar or fiat currency in general going down.” That seems to me to be right. And then he says, “The value of gold lies in being independent from political discretion. Fiat money is a claim on the future discretion of politicians.” Isn't that good?

-

Oct 3, 202511 min read

Will the GSEs Be Released Before the Housing Correction?

Q: Do you suppose the folks inside the Trump White House, who spend much of the day watching Newsmax, understand that loan forbearance is about to end for tens of thousands of American households on October 1st?

-

Sep 17, 20256 min read

Should the Federal Reserve Pay Interest on Bank Reserves?

Paying interest on reserves has nothing to do with whether banks lend and everything to do with enabling the Fed to manage the Treasury market. If you don’t want the Treasury market to remain open, then take away the Fed’s power to pay interest on reserves.

-

Jul 17, 20258 min read

Silver Surges? Waller Wants Lower Reserves & Tighter Policy

The leading candidate to be the next Fed Chairman believes the balance sheet could safely shrink to around $5.8 trillion, with bank reserves potentially decreasing to $2.7 trillion. Waller argues that a shift towards more short-term Treasury bills would make the balance sheet safer and more flexible, and he is absolutely right.

-

Jul 14, 20255 min read

Soaring Fiscal Deficits, Military Parades and Irrelevant Bank Stress Tests

Imagine if the Fed had to tell the public that federal deficits were bad for bank safety and soundness? We haven't had a Fed chairman since Arthur Burns who would speak publicly about the inflationary aspect of federal deficits.

-

Jul 5, 20256 min read

Will Banks Buy More Treasury Bonds?

The connection between expanding the balance sheet via open market purchases of Treasury debt and bank reserves is one of the starkest illustrations of how federal budget deficits translate directly into inflation.

-

Jun 18, 20253 min read

Ray Dalio is Wrong About the Treasury Bond Market

When Ray Dalio says to be afraid of the bond market, he is asking a question that belongs in the mid-1970s, when the dollar still competed with other currencies and US interest rates were actually affected by interest rates in other nations. But today, with many of the other industrial nations led by Japan, China and the EU literally drowning in public debt, the US is still the leader of the parade.

-

Jun 5, 20256 min read

The First Crypto Currency: The Dollar

When you buy a crypto currency, you buy an option on finding a greater fool, but nothing more, a transaction that would have provoked contempt in Lincoln’s day.

-

May 18, 20258 min read

The Single Fed Mandate & Bank Stocks

The Fed's actions in 2008 and again in March 2020 were largely driven by the sole mandate of the central bank -- to keep the Treasury market opening and functioning.

-

May 14, 20259 min read

Should Treasury Accept Debt for Tax Payments? Bank OZK Update

When President Donald Trump says the Fed should cut interest rates, he is probably right – at least speaking from the perspective of the real estate markets.

-

Apr 28, 20257 min read

Trading Points: Banks, Interest Rates & MSRs

Some of the smaller holders of MSRs may ask themselves if selling right now is not the best strategy over a 36-48 month horizon.

-

Apr 16, 20258 min read

bottom of page

.png)