Should Treasury Accept Debt for Tax Payments? Bank OZK Update

- Apr 28, 2025

- 7 min read

April 28, 2025 | Premium Service | When President Donald Trump says the Fed should cut interest rates, he is probably right – at least speaking from the perspective of the real estate markets. After all, if commercial real estate values are not rising by at least 2% per annum, by definition we have a problem.

The traditional 2% rule in commercial property, of note, states that a property's monthly rental income needs to be at least 2% of the purchase price in order for the owner to make a sustainable profit. But that also assumes that the building is rising in value and thus can be financed.

High interest rates have been driving down valuations for commercial properties for several years. By no coincidence, prices for single-family residential properties are also starting to fall in many markets as relatively high interest rates throttle loan markets. The chart below shows the plummeting volume of new issuance in the government loan market.

Source: Ginnie Mae

Like the world of residential real estate, the cash out refi was also part of the calculus of commercial real estate until about 2021. Now rising cap rates and falling valuations have killed the stairway to heaven of 50 plus years of rising commercial real estate equity valuations. An article in The Real Deal last week talked about new, fully occupied residential buildings in New York City that are going into special servicing because of excessive debt taken out during COVID.

High interest rates are a problem, but so too are low rate securities left over from COVID. Back in 2024, the US Treasury began a program to repurchase low coupon bonds in the open market in order to improve market liquidity. If you are a small dealer or fund paying SOFR +1% for money from your friendly neighborhood bank, you don’t want to own a Treasury note paying 0.125% per annum. More than half of the Treasury note market is more than 10 points under water at todays yields and therefore illiquid, as shown in the chart below.

Source: US Treasury

When the Treasury began the debt buybacks on a small scale, the primary dealers observed that “while buybacks were moderately supportive of liquidity and market-making in specific sectors, it was difficult to ascertain the size of the impact because of recent robust liquidity conditions and the relatively small size of buybacks to date.” Apparently the widely loathed Treasury 20-year bonds were the maturity that gained the most liquidity from the Treasury's tiny repurchase operation.

Last week, one of our more astute readers who works in the offshore gold market suggested that Treasury Secretary Scott Bessent ought to borrow a page from Argentina and encourage private investors to eliminate the overhang of low-coupon Treasury securities in the markets. Investors should be encouraged to purchase discount Treasury securities and tender same in payment of taxes or tariffs at par value, perhaps with little or no ST capital gains taxes depending upon the maturity and coupon rate of the note.

Extinguishing a 20- or 30-year Treasury security issued during COVID now is a big savings for the Treasury. There are $6 trillion in outstanding T-bills, $15 trillion in Treasury notes and $5 trillion in Treasury bonds. There are literally trillions of dollars in Treasury notes with coupons below 1% that could be repurchased. And remember, the Treasury is realizing par value for the debt that is retired early. The chart below shows the distribution of Treasury note coupons from lowest to highest by CUSIP.

Source: US Treasury

US banks took $16 billion in losses on securities last year, but the overhang of low coupon Treasury and agency paper that trades well below par is a continuing problem, and one that affects both residential and commercial borrowers. JPMorgan (JPM) averaged around 3.75% on its MBS in 2024, but the industry average yield on all MBS remains below 3% or roughly 85 cents on the dollar of market value. The chart below shows the distribution by coupons of the $2.7 trillion market for Ginnie Mae MBS

Source: Ginnie Mae

Secretary Bessent has indicated that he might increase repurchase activity in response to the threat of offshore selling of Treasury securities, one of those ridiculous media narratives that just won’t go away. But the better purpose of buybacks is to increase private purchases of low coupon notes and bonds in order to drive down yields and increase market liquidity. If the Treasury gives investors a reason to take the COVID era float off the table permanently, the result will be a significant tightening of pricing – and lower yields – for longer dated Treasury maturities in general.

A Trump Treasury Tax Sale is the perfect response to former Treasury Secretary Janet Yellen’s idiotic redux of “operation twist,” which arguably cost taxpayers billions of dollars. Purchases of LT Treasury debt would be funded with private sector cash! The original operation twist was actually implemented in 1961 by President John F. Kennedy, and delivered very modest results in terms of lowering LT interest rates, but we’ll talk about that another time.

Treasury Secretary Scott Bessent should take a page from US history. In July 1836, President Andrew Jackson issued the Specie Circular, which required that all payments for tariffs and federal lands be made in gold or silver, rather than paper currency. The stated purpose was to curb land speculation and reduce the amount of paper money in circulation, but the result was deflation.

President Trump should authorize the payment of tariffs and taxes using Treasury debt purchased on the open market. The purpose is to reduce the federal debt and restore liquidity to the government bond markets by retiring low-coupon securities issued during COVID.

Bank OZK

A couple of weeks back, we were horrified to see Bank OZK (OZK) foreclose on another loan by developer Sterling Bay in the Lincoln Yards project in Chicago. “Bank OZK wrote down almost $17M on its loan to a subsidiary of Chicago developer Sterling Bay for a section of the land at the Lincoln Yards megadevelopment just months after recording a roughly $21M charge-off on the same loan,” reports BizNow.

The $38 billion asset development lender has since seized control of part of the stalled project, which it is now marketing to to prospective buyers. Yet in Q1 2025 earnings, OZK actually reported lower provisions for loss than in Q4 2024. Provisions for credit losses were $38.4 million in Q1 2025 vs $42 million in Q1 2024. Perhaps of more significance, however, is that fact that the bank has seen yields falling on loans for four consecutive quarters even as loan balances have grown.

Source: Bank OZK

Unlike its larger peers, OZK’s yield on its investment book is well-above 4% and its net interest margin is likewise more than a point above its peers. “If the Fed leaves interest rates unchanged, we believe our net interest margin should improve somewhat in the remaining quarters of 2025 as deposit costs should continue to improve,” notes OZK.

“If the Fed reduces interest rates in 2025, we anticipate our loan yields would decrease faster than our deposit costs, likely resulting in some decrease in our net interest margin, at least until time deposits reprice and/or floor rates are reached on more variable rate loans,” the bank reports. The chart below shows net interest margin for OZK vs its peers.

Source: Bank OZK

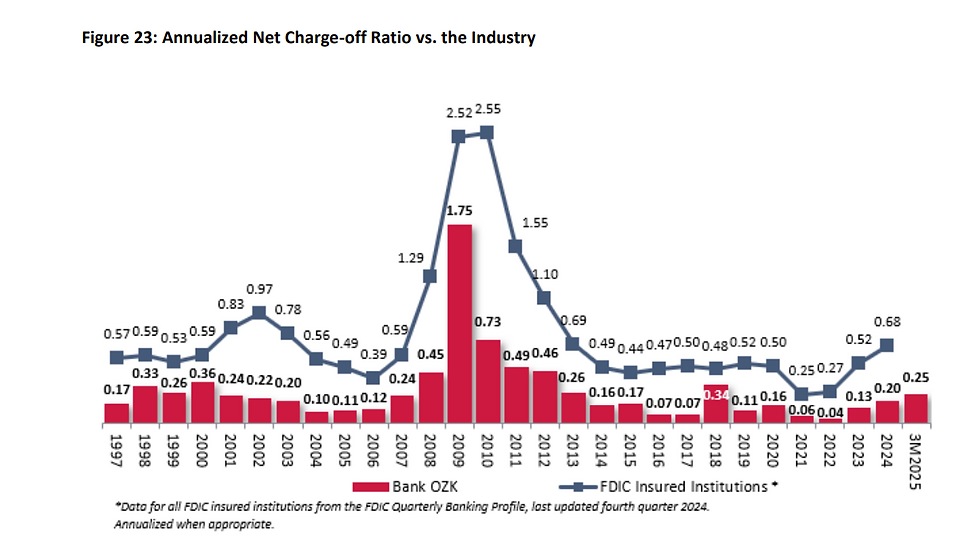

OZK peaked above $50 in February, but then retreated into the high $30s by the start of April 2025. While the bank has one of the best records of managing credit in the industry, the heavy emphasis on real estate exposure is likely to keep OZK under pressure for the balance of the year. The chart below shows the historical net loss rate for OZK vs its peers.

Source: Bank OZK

While OZK's net loss rate has risen since 2022, its heavy focus on real estate lending has not tarnished its track record for below-peer credit losses. Since that time, the bank's stock has fallen from 1.25x book to just 0.9x today. Is the bank a bargain at these levels? While we have long admired the management of OZK, we'll wait to see how long it takes the Federal Open Market Committee to realize that it is late once again in terms of changing interest rates.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments