Update: PennyMac Financial Services

- Nov 1, 2023

- 6 min read

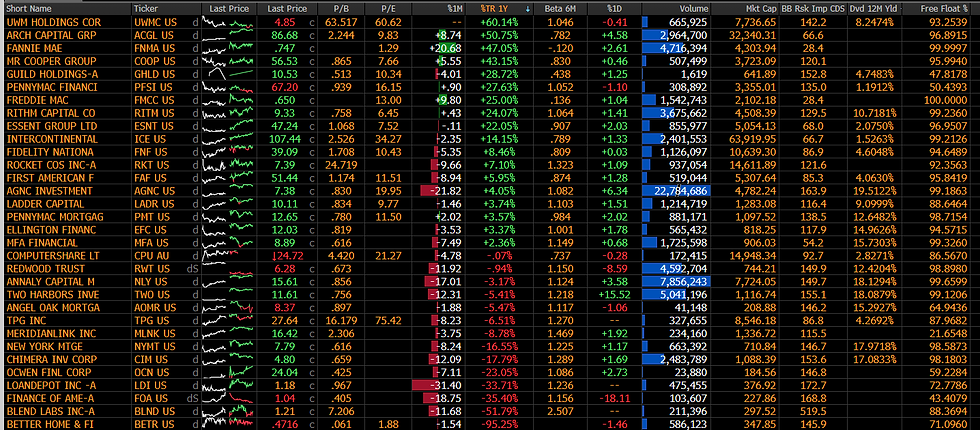

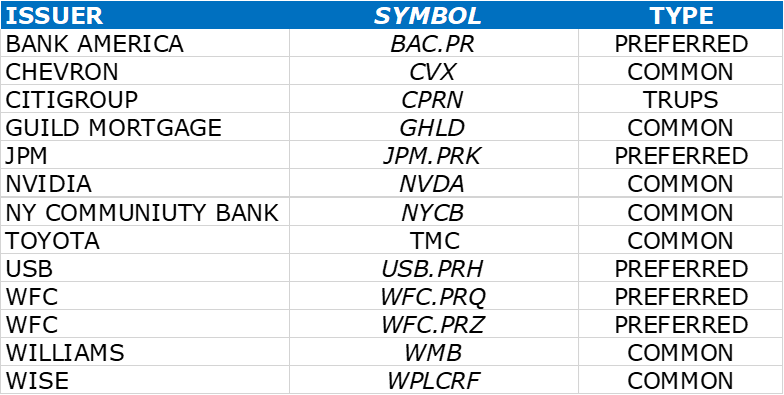

November 1, 2023 | Premium Service | In this edition of the Institutional Risk Analyst, we look in on PennyMac Financial (PFSI) for a sanity check on interest rates and mortgage credit. It is pretty clear that Uncle Jay and the gang on the FOMC have reached the limit of interest rate hikes, but credit in residential mortgages has yet to show any cracks. Net loss rates on bank owned loans are still barely positive after a decade in negative territory. Our latest portfolio also is shown below.

Even as foreclosures mount in the world of commercial real estate and WeWork prepares for bankruptcy, reports the Wall Street Journal, residential assets remain quiet – perhaps too quiet. And then there is the question of valuations for mortgage servicing assets. If we are marking balance sheet assets to actual market in the age of deflation, what of the heavily modeled world of mortgage servicing assets?

PFSI is an important benchmark for fiancials because the firm is the largest aggregator (i.e. buyer) of conventional residential mortgage loans in the US. It is also a large Ginnie Mae issuer and has a top-ten servicing portfolio. PennyMac Mortgage Investment Trust (PMT), is a passive REIT that contains all of the group's conventional exposures from Fannie Mae and Freddie Mac. PFSI holds all of the Ginnie Mae risk, of note, and manages the REIT.

Our mortgage equity surveillance list is shown below sorted by one-year total return. Notice that Mr.Cooper (COOP) and Guild Holdings (GHLD), which we own, have traded places with PFSI as the latter has lost ground in the mortgage equity group. And yes, the laggards Better Home (BETR) and Blend Labs (BLND) are at the very bottom of the list.

Mortage Equity

Source: Bloomberg (10/31/23)

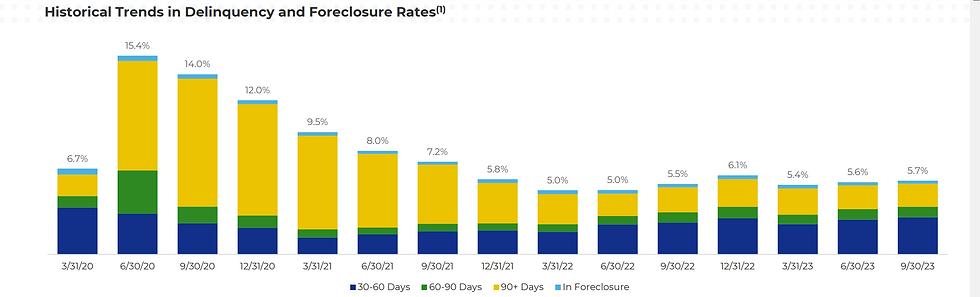

Of interest, despite several dire predictions of imminent collapse since the COVID pandemic, the PennyMac binary of PFSI and PMT is still here. As the chart below from the PFSI earnings suggests, the level of credit losses on the firm’s owned and subserviced portfolios remains quite low despite the high level of mortgage interest rates. We are not surprised to see the equity market value of PFSI fading, however, due to management changes earlier this year.

The PFSI portfolio is showing low levels of credit loss but also relatively high levels of hedging losses on its MSR. Also notable in this regard is that PFSI continues to report that prepayments are covering P&I advances in delinqunt loans.

“Servicing advances outstanding for PFSI’s MSR portfolio decreased to approximately $321 million at September 30, 2023 from $407 million at June 30, 2023,” PFSI reported. “No P&I advances are outstanding, as prepayment activity continues to sufficiently cover remittance obligations.”

PFSI reported $25 million in production profit in Q3 2023, but mortgage bankers are not working for much with the primary-secondary spread (PSS) below 90bp. When mortgage bankers were writing 2% MBS in the middle of 2020, they were working for more than one and a half points of spread. But what are those low coupon loans and servicing assets worth today? That is the question. The TBAs from yesterday's close are shown below. Notice that Fannie Mae 7% MBS for delivery in November are the only premium contract shown on the screen but 7.5%s are also trading.

Source: Bloomberg (10/31/23)

With the “belly” of the Treasury/mortgage yield curve at the top of the scale, execution is difficult in correspondent lending but impossible in retail channels. Most of the major issuers have shuttered retail entirely. Direct to consumer is the most profitable channel for most issuers not willing to compete for brokered loans against United Wholesale Mortgage (UWMC) and Rocket Companies (RKT).

Although the correspondent channel was 80% of the PFSI volume this quarter, it resulted in just over 40% of the revenue. Consumer direct, with a tiny slice of the volume, produced a third of total production revenue. What is the message here? Issuers with strong consumer direct channels will thrive in this difficult environment. Correspondent is a loss leader.

While the results published by PFSI are consistent with GAAP, it is important to state that the presentation of earnings by PFSI deviates significantly from the cash reality. Unlike most issuers, of note, PFSI provides a statement of cash flows with the quarterly and annual reports to the SEC.

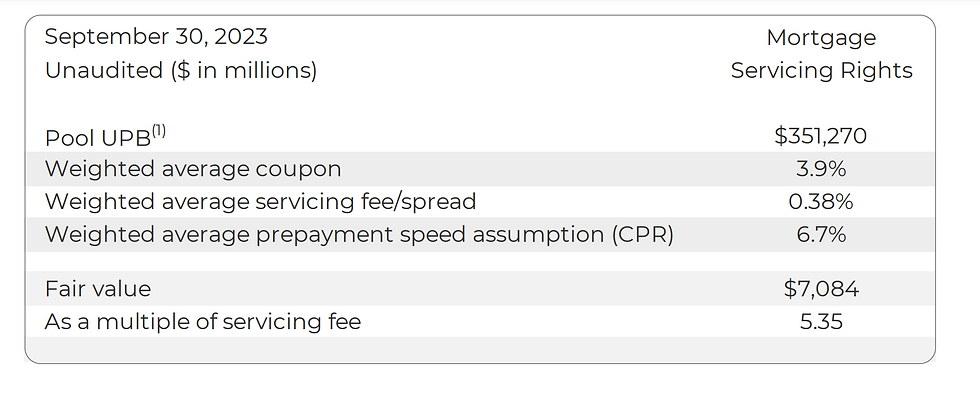

Gain on sale accounting allows firms like PFSI to book the full economic gain on a loan sale up front including the MSR, which is retained and revenue booked even before the cash is received. Also, many of the data points in the earnings release are modeled rather than actuals. So, for example, the value of the MSR shown below is based upon modeled cash flows rather than actuals. Notice that PFSI is modeling their financials assuming a 6.7% prepayment rate, but the weighted average coupon is below 4%.

So long as credit expenses and related operating costs remain low, the low volume situation in the mortgage sector is manageable for PFSI and other lenders with large servicing portfolios. Should default rates rise, however, then the situation could change quickly and funding becomes a vital concern. The fact that so much of the GAAP disclosure of firms like PFSI is modeled vs actuals raises additional concerns. The table below shows the modeled gain on sale of the MSR from the PFSI earnings release.

Notice in the table above that even though volumes are down, and gain-on-sale margins are also compressed, the "receipt" of the MSR -- the non-cash gain on sale -- is larger in Q2 and Q3 2023 than a year ago. And the MSR value, 5.35x annual cash flows, is modeled. The modeled cash flows for the low coupon servicing assets held by PFSI are likely above the actual cash receipts by a significant amount. Richie May noted in an important comment last year:

“As owners of the MSR asset, it is important to look beyond the change in the MSR value and dig deeper into the servicing cash flows that are supporting the estimate of the fair value. Are the cash flows used on the determination of the fair value achievable? Most importantly, how do they compare the actual cash flows earned?”

In other words, if the actual cash flows from low coupon servicing assets are actually falling but the modeled MSR valuation is rising, then we have a valuation problem. The cash flows supporting the MSR fair value estimate may include some assumed factors that may or may not be supported by the actual cash receipts achieved and earned by the MSR owner.

Ironically, the MSRs from those low coupon loans with the gigantic gain-on-sale margins from 2020-2021 may now suffer because of the low coupons. If interest rates remain at present levels, but delinquencies rise, then issuers like PFSI may face a cash squeeze because modeled cash flows are above actual cash receipts. And even with a modest rate decline, volumes and profitability may not improve significantly.

If interest rates fall, however, then issuers like PFSI may face margin calls as the value of the late vintage MSR is dissipated by prepayments, forcing the issuer to replace collateral with new production MSRs. Or to put it another way, is the MSR on those new issue Ginnie Mae MSRs really worth more than 5.35x gross servicing income? Really? Don't you love residential mortgage finance?

In a falling rate environment, the surviving lenders will fight over the few in-the-money loans at shrinking spreads as their MSRs disappear in a hail of prepayments. That is why that 5.35x multiple used by PFSI is arguably conservative or aggressive, depending on your assumptions about interest rates and compared to other issuers. But we still think that those Ginnie Mae 2% and 3% MSRs from 2020 are going to be a good investment over time, even with the compression in cash flows for the lower coupons.

Disclosure

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments