top of page

Housing Stocks Surge On Rate Cut Hype

As and when the home price correction finally arrives ~ 2028, many of the conventional loans written since 2020 are likely to be underwater vs the collateral. The GSEs will be looking for reasons to reject loans. After all, FHFA Director Bill Pulte is in the loan insurance business.

-

Aug 26, 20258 min read

The Cost to Housing of Donald Trump

Why is Secretary Bessent talking publicly about Powell or the Fed at all? How does this squawking enhance the credibility of the Trump Administration or the U.S. Treasury?

-

Jul 23, 20255 min read

Housing Finance Outlook | Q3 2025

We expect to see continued consolidation in the world of residential mortgage finance in coming months. The sad fact is that many less competitive businesses in mortgage finance have been waiting for the FOMC to ride to the rescue with lower interest rates. If rate cuts do not materialize in 2025, however, then many of these businesses may not survive.

-

May 27, 20259 min read

Housing Finance in the Age of Volatility: GHLD, UWMC, RKT, COOP, JPM

While GHLD provides a lot of good information about their business, the investor disclosure provided by UWMC is a bad joke, especially when you remember that UWMC is the largest nonbank lender in the US. The Q1 2025 press release is just 9 pages in length and lacks some of the most basic financial information available from UWMC’s peers.

-

May 9, 202510 min read

Trump to Fire Jay Powell? No. Bank Earnings? Nada. Bayview for Sale?

President Trump will not try to fire Chairman Powell. Why not? First, because Powell cannot be removed save for malfeasance. Second, because firing Powell would seriously piss off Senate Republicans, killing Trump's hopes for tax legislation this year.

-

Apr 22, 20256 min read

Rocket + Redfin + Mr. Cooper = First in Class

COOP and RKT, plus RDFN, creates an integrated business of realty, lending, servicing and asset management that is impressive

-

Apr 1, 20255 min read

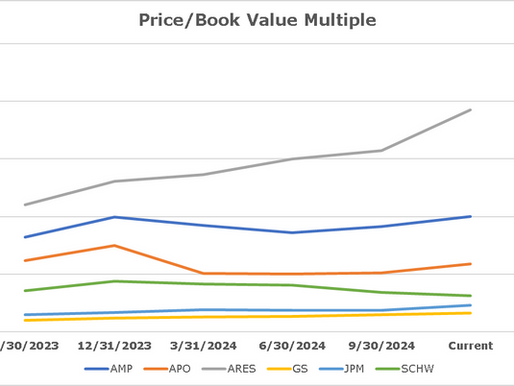

Is Ameriprise Overvalued? Is PennyMac Cheap vs the REITs?

We think it is notable that AMP has underperformed the other members of the group other than SCHW over the past year.

-

Feb 3, 20257 min read

Residential Mortgage Finance 2025

The majority of the actual cash profit generated from residential lending is found in the mortgage servicing rights (MSRs).

-

Jan 20, 202512 min read

Liquidity Preference: SVB Financial Group, WaMu & Reemerging GSEs

Selling the Treasury's control position in the GSEs while dragging the furious shareholders along behind is not an attractive opportunity

-

Dec 12, 20247 min read

Kamikaze GSE Release? Oh Yeah...

Yes, that's right, we are going to downgrade $8 trillion in GSE MBS and hundreds of billions in corporate debt.

-

Dec 10, 202415 min read

Update: Blend Labs Inc.

BLND is generating operating leverage via cost reductions, another way of saying that management is slowly winding up the business.

-

Dec 5, 20244 min read

Update: Block Inc, Nu Holdings & Guild Holdings

Notice that SQ co-founder Jack Dorsey styles himself as "block head" in the corp roster, a silly affectation that does not help the stock

-

Nov 15, 20247 min read

Is Trump Bullish for Interest Rates? Pump & Dump for GSE and Fintech Stocks

You can tell lies and damn lies about the idea of releasing Fannie and Freddie, but the SEC and FINRA cannot and will not say a word.

-

Oct 30, 20246 min read

Housing Finance Outlook; PennyMac, Mr. Cooper & NYCB/Flagstar

NYCB and the unsold rent-stabilized assets left over from the failure of SBNY are two little surprises waiting for the next POTUS.

-

Oct 28, 20249 min read

Citigroup + (Cenlar - Black Knight) = ?

The Citi decision to exit mortgage servicing perhaps made sense in 2017, but today not so much.

-

Oct 9, 20247 min read

Yellen's FSOC: Housing Policy Dreams vs Mortgage Market Reality

Yellen's proposal for a backstop is merely a canard to help Treasury avoid another fiasco next time a Ginnie Mae issuer fails

-

Jul 30, 20246 min read

Update: New York Community Bank & Mr. Cooper

Joe Otting does not seem to understand the value of the Flagstar correspondent lending and mortgage servicing business...

-

Jul 27, 20248 min read

Update: CapitalOne Financial & PennyMac Financial Services

Of note, PFSI has been growing share in wholesale, a direct challenge to UWMC

-

Jul 24, 20245 min read

Joe Biden Goes Subprime; Should Citi Buy NYCB/Flagstar?

Citi is a subprime lender. They should be directly involved in government lending.

-

May 20, 20246 min read

Portfolio Update & Mortgage Survivors

The survivors in mortgage finance optimize operations around purchasing loans from brokers/ correspondents, and direct to consumer (DTC)

-

May 8, 20246 min read

bottom of page

.png)