top of page

PennyMac: Hedging Costs & Residential Loan Recapture Crater the Stock

But the key factor that generated investor angst was under-performance in terms of loan recapture, an illustration of the hyper-competitive market in residential mortgages. True retention = Retained fundings divided by total run off. On that basis, we figure that PFSI retained less than 1/3 of mortgages that prepaid in Q4 2025. After touching $160 in late January, PFSI closed yesterday below $95 per share.

-

Feb 24 min read

Housing Finance: Exposure at Default in Residential 1-4s

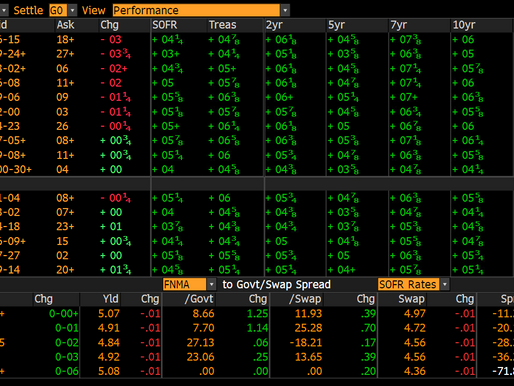

And as we predicted several months ago, Fannie Mae and Freddie Mac are at the bottom of the list now instead of the top, reflecting the fact that release from conservatorship has been shelved in favor of the GSEs buying back their own debt. Using the balance sheets of the GSEs to buy MBS basically makes them instruments of public policy, but this does not preclude President Trump from directing an equity offering after the midterm elections.

-

Jan 219 min read

Flagstar Bank Rebounds, But Hochul & ZoMa Make NYC Multifamily Toxic

“The delinquency rate for commercial mortgages increased in the second quarter of 2025 across most major capital sources,” said Reggie Booker, MBA’s Associate Vice President of Commercial Real Estate Research. “The largest increase was among CMBS loans, driven by rising delinquencies in both multifamily and office properties. Delinquency trends continue to reflect differences in property type, loan structure, geography, and borrower profile.”

-

Dec 14, 20258 min read

JPMorgan, Growing Large Bank Risk & Private Credit

The surprise pre-release of Q4 results led to a significant drop in JPMorgan's stock price and took down the entire sector along with it. But is this the only negative surprise likely to come from JPM? We think not. CNBC’s Jim Cramer said on X yesterday that investors should buy JPM on the dip, but we disagree. In fact, the markets seem to know something about JPM. Maybe this explains why Citigroup (C) has outperformed the House of Morgan all year.

-

Dec 11, 20258 min read

Trading Points: Mortgage Finance With Rising Volumes and Loan Defaults

The latest statements about a possible stock offering for the GSEs seem to be designed to boost the share price in the near-term and do not provide any more information than we had when such statements were made previously. Given the management changes announced yesterday and the other requirements for a successful offering, we have a hard time believing that a GSE stock offering will occur this year. Notice how the shares of Fannie Mae popped for a couple of days this week

-

Oct 23, 20256 min read

Why Does United Wholesale Mortgage Sell Low Coupon MSRs?

So why would a firm like CrossCountry or UWMC be a buyer of higher coupon MSRs? The short answer is that they believe their ability to retain the borrower by recapturing a prepayment will offset the obvious negative of high prepayments that comes with a lower interest rate environment. These firms, it seems, would rather try to recapture prepayments on higher rate MSRs than own lower coupons and benefit from the stable cash flow from the servicing.

-

Sep 30, 20257 min read

Housing Finance Outlook | Q3 2025

We expect to see continued consolidation in the world of residential mortgage finance in coming months. The sad fact is that many less competitive businesses in mortgage finance have been waiting for the FOMC to ride to the rescue with lower interest rates. If rate cuts do not materialize in 2025, however, then many of these businesses may not survive.

-

May 27, 20259 min read

Housing Finance in the Age of Volatility: GHLD, UWMC, RKT, COOP, JPM

While GHLD provides a lot of good information about their business, the investor disclosure provided by UWMC is a bad joke, especially when you remember that UWMC is the largest nonbank lender in the US. The Q1 2025 press release is just 9 pages in length and lacks some of the most basic financial information available from UWMC’s peers.

-

May 9, 202510 min read

Rocket + Redfin + Mr. Cooper = First in Class

COOP and RKT, plus RDFN, creates an integrated business of realty, lending, servicing and asset management that is impressive

-

Apr 1, 20255 min read

Update: Our Top Five Ideas

How will the sudden shift in Fed policy impact financials? Are we headed for a recession?

-

Sep 24, 20246 min read

Recession? Consumer Lenders: AX, AXP, ALLY, Barclays, COF, SOFI, SYF

Axos continues to rebound after the bear raid by Hindenburg Research. AX ranked 18th in the WGA Bank Top Index in Q3 2024 vs 98th for SOFI

-

Sep 2, 202412 min read

Debt Deflation in CRE? PFSI, COOP & RKT

If the run-of-the-mill Republic First interest rate mark is 13.3% of assets that is not just wiping out one bank’s 8% capital but also FDIC

-

May 5, 20249 min read

Update: UWMC & Rocket; Rate Cut Dreams Fade

Industry leaders believe that the FHFA wants the GSEs to offer issuers "repurchase insurance" to the tune of 25bps per loan.

-

Feb 29, 20247 min read

Update: PennyMac Financial Services

If we are marking balance sheet assets to actual market in the age of deflation, what of the heavily modeled world of servicing assets?

-

Nov 1, 20236 min read

Update: Mortgage Lenders, TBA Contango & MSRs

We look for lower prices for legacy MBS and MSRs as new allocations are used up and P&Ls sink deeper into the red...

-

Jun 26, 20238 min read

RKT Sinks, UWMC Wobbles, RITM Treads Water & Goldman Doubles Down

GS is a securities dealer first and foremost and has no comparative advantage as a bank.

-

Mar 2, 20236 min read

The Year That Was: 2022

Many in the Buy Side chorus are looking forward to lower interest rates, but we are concerned that next year could really be about solvency

-

Dec 16, 20226 min read

Record Losses for Mortgage Banks Presage Tough Year Ahead

Is 2023 the year of the Return of the Distressed Loan Trade?

-

Nov 19, 20221 min read

TIAA Sells Everbank; Mortgage Earnings Wrap

The big news this week starts with the poor showing by Rocket Companies (RKT), reporting a loss for Q3 2022 and a big decline in volumes.

-

Nov 4, 20225 min read

No End to Conservatorship for Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac will likely sit in conservatorship indefinitely unless and until Congress acts first.

-

Aug 17, 20226 min read

bottom of page

.png)