top of page

Desperately Seeking Alpha: PennyMac vs Rithm Capital

PFSI trades on a trailing P/E of 14x vs ~ 8x for RITM. PFSI trades around 1.6x book vs 0.9x for RITM. Case closed? We have long believed that RITM should spin off its manager to create a comp for PFSI and then externally manage the RITM REIT. Like PFSI, in this scenario the new RITM manager would need to retain the Ginnie Mae MSRs.

-

Dec 8, 20256 min read

Why Does United Wholesale Mortgage Sell Low Coupon MSRs?

So why would a firm like CrossCountry or UWMC be a buyer of higher coupon MSRs? The short answer is that they believe their ability to retain the borrower by recapturing a prepayment will offset the obvious negative of high prepayments that comes with a lower interest rate environment. These firms, it seems, would rather try to recapture prepayments on higher rate MSRs than own lower coupons and benefit from the stable cash flow from the servicing.

-

Sep 30, 20257 min read

Paramount Acquisition Suggests Big Office Property Losses Ahead

Mayor Eric Adams just dropped out of the New York City mayoral race and a silver spoon sucking Indian socialist from Uganda looks set to become the next Mayor of New York. You could never makes this up. But while a lot of political energy is focused on Zohran Kwame Mamdani's plans for rent stabilized properties, it is commercial real estate that pays the bills in New York City.

-

Sep 29, 20256 min read

Rates Down, Gold Up; RITM Buys PGRE at One Quarter of NAV? Yikes...

Is Michael Nierenberg, CEO of Rithm Capital (RITM), really paying a double digit cap rate for an "Irreplaceable Portfolio of Class A" properties in San Francisco and New York? What does this say about the true market value of all New York commercial properties?

-

Sep 24, 20256 min read

Will the GSEs Be Released Before the Housing Correction?

Q: Do you suppose the folks inside the Trump White House, who spend much of the day watching Newsmax, understand that loan forbearance is about to end for tens of thousands of American households on October 1st?

-

Sep 17, 20256 min read

Housing Stocks Surge On Rate Cut Hype

As and when the home price correction finally arrives ~ 2028, many of the conventional loans written since 2020 are likely to be underwater vs the collateral. The GSEs will be looking for reasons to reject loans. After all, FHFA Director Bill Pulte is in the loan insurance business.

-

Aug 26, 20258 min read

Bayview Acquires Guild Mortgage

Truth is, it’s hard to see the leadership of either RITM or UWMC combining with another entity, but the cost pressures in the industry today are driving radical change.

-

Jun 19, 20254 min read

Interest Rates, Mortgage Lenders & MSRs

While there are a great number of people inside the Fed who ponder the appropriate level of reserves in the system, they don't really know

-

Feb 15, 20246 min read

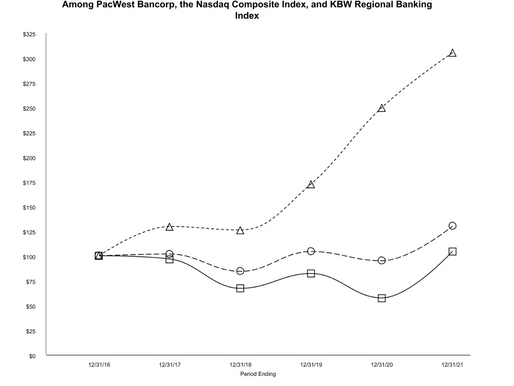

Does PacWest + Banc of California + Warburg Pincus = Value?

The Q2 2023 disclosure for PACW suggests an institution that is bleeding cash and operating in extremis...

-

Sep 18, 20237 min read

RITM Goes Multi Asset; TCBI Shrinks Assets, Grows Returns

TCBI needs to keep efficiency in the 50s if they want to survive the coming drought in mortgage lending.

-

Aug 4, 20236 min read

Is USA still a "AAA" Credit? Really? Update: Rithm Capital

When interest rates eventually fall those late vintage mortgage loans with 6% coupons will evaporate like spring snow in the sunshine

-

May 10, 20238 min read

Atlas Stumbles, Silvergate Wallows; 360 Mortgage v. Fortress (and RITM)

Are nonbank mortgage firms a risk to Ginnie Mae? Or is it really the other way around?

-

Mar 6, 20238 min read

RKT Sinks, UWMC Wobbles, RITM Treads Water & Goldman Doubles Down

GS is a securities dealer first and foremost and has no comparative advantage as a bank.

-

Mar 2, 20236 min read

Mortgage Wrap; PennyMac Financial, Rithm Capital & MSRs

We suspect that the IMBs will be sellers of conventional assets to defend their Ginnie Mae MSRs. Banks may be buyers of conventional assets

-

Feb 9, 20237 min read

Update: Mr. Cooper (COOP)

Despite the outlook for the industry, COOP continues to be one of the better performing names in our mortgage surveillance group.

-

Oct 26, 20224 min read

bottom of page

.png)