Update: Mr. Cooper (COOP)

- Oct 26, 2022

- 4 min read

Updated: Oct 29, 2022

October 26, 2022 | Premium Service | As earnings season grinds on, readers of The Institutional Risk Analyst are coming to appreciate just how contorted are Q3 2022 earnings results vs last year. As we told Liz Claman on Fox Business last week, you can just throw the past two years of financial data into the trash from an analytical perspective.

We note in our last comment (“AOCI: The Winter of Quantitative Easing”), that the stress visible in banks and nonbanks is rising. This is due to the huge price volatility injected into markets by the reversal of the Fed’s pro-inflation policies. More, the price risk in committed but undrawn lines from banks is another area that may soon color a number of credit profiles.

In this issue, we look at the results from Mr. Cooper (COOP), one of the earlier filers among publicly traded nonbank lenders and servicers. The story is what you’d expect, with declining lending volumes and a rising mark on the owned mortgage servicing rights (MSR) to 162bp or over 5x annual servicing income. The table below from the COOP Q3 presentation shows the growth in total book value of equity and the decline of deferred tax assets (DTAs) as a portion of capital.

Yet more than half of COOP’s servicing book owned by third parties, a fact that enhances income while reducing operational risk to COOP shareholders. The market for MSRs continues to be supported by interest rate trends.

The new discloser this quarter is where COOP books servicing on “base servicing.” Assuming that is 25 bps per year of gross spread, they are booking at-the-money servicing at over 6x and apparently augmenting GAAP earnings with large amounts of excess servicing, also at rich valuations. Yet valuations may go higher still as the Fed pushes rates higher.

“Servicing assets have experienced significant YTD 2022 price increases across all four sectors and both vintages, with a UPB-weighted increase of 1.17 multiple (or 30.0%),” notes Mike Carnes, MD of the MSR Valuations Group of MIAC. “Within conventional products, pricing increased substantially more for 30-year than for 15-year, in both absolute (1.37 vs. 0.68 multiple), as well as relative (32.5 vs. 19.1%) magnitude.”

Carnes notes that the uptick in MSR valuations comes with the move in 30-year spreads: “This is primarily due to the less negative 15-year option-adjusted durations (OADs) at the start of 2022 vs the substantially more negative 30-year OADs (-13.1 vs. -20.1),” he reports in the Fall 2022 Perspectives.

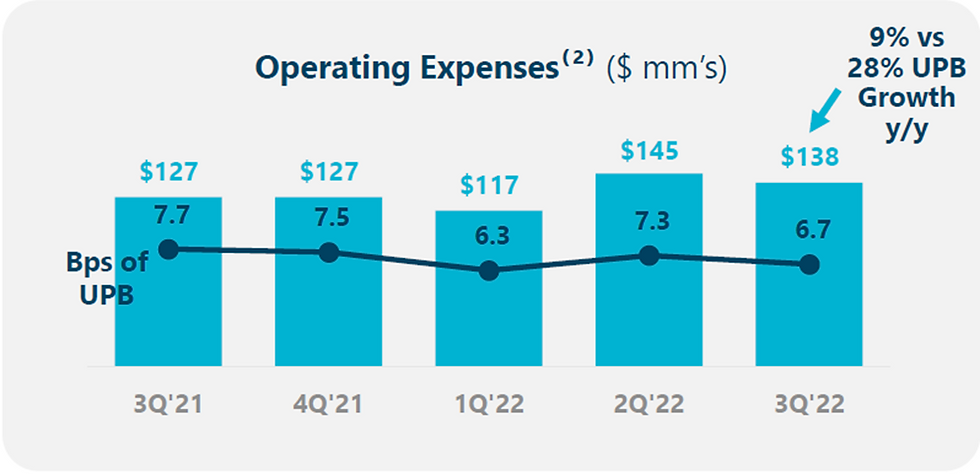

A number of traders have been short the COOP common for months, this on the assumption that the markets would punish this nonbank in the same fashion as smaller seller/servicers. But size matters as does management. The scale of the COOP balance sheet and the discipline shown with respect to operating expenses makes this firm one of the best in class. The table below shows COOP operating expenses.

While there may be some tough quarters in 2023, we expect COOP to continue to lead the mortgage issuers in terms of profitability, even during periods when the whole industry is reporting losses. A big piece of the analysis on COOP, PennyMac (PFSI) and Rithm Capital (RITM) is the value of the MSR. You could argue that all of the owners of MSR are already at peak levels, but that depends upon your view of interest rates next year and, indeed, for the next five years.

If, for example, the FOMC sets an effective floor for interest rates at say 3% for federal funds, then the value of MSRs could easily reach 6x annual cash flows. The peak valuations seen for MSRs in the 1990s, for example, were considerably higher than current levels – 7s and 8s were seen three decades ago. And as we’ve noted previously, many of the loans originated in 2020-2021 would still be points out of the money for refinance. The cash flows will extend, but the refinance options will decline.

While some lenders think that mortgage rates will retrace back down to the 5% range, we disagree. The entire mortgage sector is going to suffer mightily over the next year as lending volumes fall to two-decade lows. We expect COOP to ride out the storm and be ready to capture volumes as and when interest rates decline. The market of 2024 is going to look a lot smaller, with fewer, bigger seller/servicers positioned to harvest refinance events off of giant servicing books. Indeed, industry consolidation will help to grow’s COOP’s book for owned and third-party servicing even higher.

Despite the outlook for the industry, COOP continues to be one of the better performing names in our mortgage surveillance group. Those readers operating in the investment world should anticipate that COOP and other owners of MSR will continue to accrete the value of the asset as interest rates and particularly bond spreads continue to widen. Even if the Fed pauses increases in the Fed funds target rate at year-end, we’d anticipate some further expansion of MBS spreads into 2023. Our surveillance group is below.

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments