Post-Trumpian Fintech Bounce: How High? How Long?

- May 12, 2025

- 6 min read

Updated: Jul 9, 2025

May 12, 2025 | Premium Service | Most of the finance companies we follow outside of the residential mortgage vertical were down significantly year-to-date, but have bounced strongly in the past month. What is the outlook for nonbank finance and that subset known to some as fintech over the next couple of years? If we assume that there is an accumulating need to purge the system of defaults in areas such as unsecured consumer, credit cards and auto loans, how do finance companies new and old ride out the storm? Does buy-now-pay-later (BNPL) become pay never?

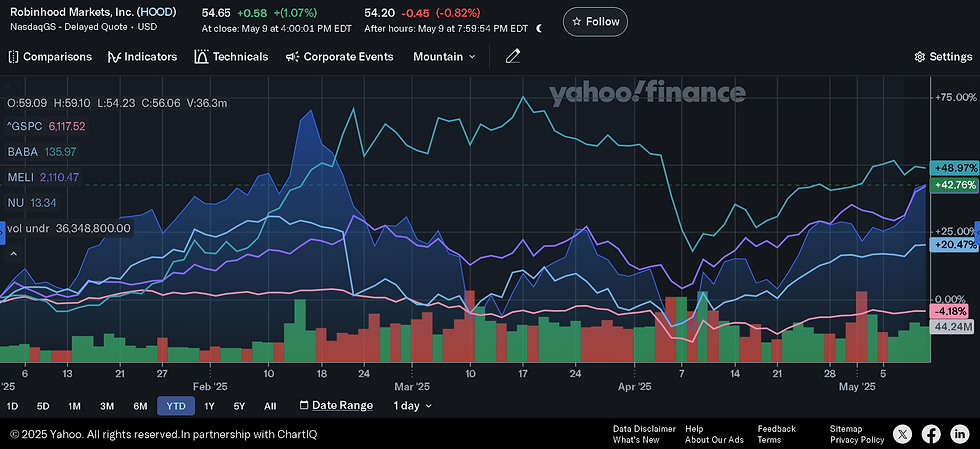

We have included some more established large-cap names in our group as a basis for comparison to the emerging fintech stocks, but no surprise that the newer entrants such as Robinhood Markets (HOOD) and Mercado Libre (MELI) are among the top performers YTD. The large-cap Alibaba (BABA) leads the group overall, both in terms of YTD returns and sheer size. BABA has twice the market cap of Blackstone (BX). At one point last year, HOOD was up several hundred percent, but has given back much of those gains. Yet the leaders of our finance group have outperformed the broad market, as shown in the table below sorted by 1 year returns.

Finance Companies

Source: Bloomberg (05/09/25)

Note that these larger names have rebounded as the media noise from the Trump tariff strategy subsides, but at the bottom of the list we see the consumer lenders, including the BNPL platforms like Upstart Holdings (UPST) and Affirm Holdings (AFRM), along with Lending Club (LC) and Block Inc (XYZ). Fintech firm Klarna halted its planned initial public offering (IPO) earlier this year after the market kerfuffle due to President Donald Trump's sweeping tariff announcements.

We had the pleasure of hearing Dr. Art Laffer speak last week at a the annual dinner sponsored by Nomura (NMR). He assured the audience that the Trump strategy of provoking negotiations with our trade partners is deliberate and carefully calculated to result in changes in America's terms of trade. And as this post is released, the US and China have agreed to reduce tariffs for 90 days. Look for the markets to react accordingly.

In the meantime, however, observed levels of market volatility are likely to remain well-above last year, but that does not mean that some names will not rise. The doom and gloom crowd has once again missed the point that 1) trade deals are likely to be concluded quickly and 2) signs of a recession are building, but very slowly. If the FOMC ever decides to cut ST interest rates, this entire group will likely rally, but the names with more perceived macro and/or consumer risk will underperform.

Source: Bloomberg (05/09/25)

Number four on the list of finance company stocks YTD is NU Holdings (NU), which we own in portfolio. Several Street analysts downgraded the stock at the end of 2024, but the equity remains well-bid and we may add to our position during any weakness. We view both NU and MELI as attractive ways to benefit from LT economic growth in the Americas through increased consumer finance volumes. Notice that all of these fintech names are outperforming the S&P 500 Index.

Source: Yahoo Finance (05/09/25)

Looking at HOOD, crypto currency trading after the November victory by President Trump seems to have driven revenue in Q4 2024, but in Q1 HOOD seemed to lose momentum. Earlier in 2024, for example, crypto revenues fell below $100 million, yet notably option volumes have been steadily marching higher.

News reports suggest that the growth of options trading volume has to do with increasingly sophisticated retail investors, but we think there are probably several other factors at work. Crypto and options trading are the big headlines at HOOD for the moment. The chart below is from the HOOD Q1 2025 presentation.

Perhaps the key factor to watch in the maturation of HOOD is whether growth rates on its core businesses like options and crypto continue to slow. Many of the once hot new names in fintech are now at the bottom of our list. Once upon a time, names such as Block and LC also had big growth rates, more than a dozen analysts writing research and dozens more blogs and web sites pumping these stocks. While HOOD has a lot of mindshare in the fintech world, it is still a tiny stock and is not really a good comp for say Charles Schwab (SCHW). The chart below shows our finance group by market cap, with the top YTD returns starting from the left.

Notice that MELI and NU have larger market capitalizations than does HOOD, big positives for these stocks when facing large global funds. The payments giant Fiserve (FI) is another substantial player in finance and also mortgages that is often overlooked. Fintech turned bank SoFi Technology (SOFI) remains a tiny stock compared to the rest of the finance/fintech group.

The institutional credit managers including BX, Apollo (APO) and Ares Management (ARES) are all sensitive to any sign of a recession, in part because many distressed credit, real estate and other strategies sponsored by these firms are rolling over. As and when a real recession arrives, we expect to hear a lot of complaints from pensions, endowments and other regulated investors about losses in private markets. These losses are coming just as the Trump Administration is cutting federal grants to many of these same institutions.

"Private Equity funds have been unable to sell publicly their long-stuck, often-distressed portfolio companies," notes our colleague Nom de Plumber in New York. "The IPO market will not bid enough to recoup the initial privatization buy-out loans, meaning near-certain capital losses for the General Partners and Limited Partners (typically state and corporate pension funds and non-profit endowments)."

NDP notes that the alternative exit for the PE manager is to sell the portfolio assets at (overstated) book valuations into newly introduced retail Private Equity/Private Credit ETFs, which then start life with the unrecognized losses. APO has sponsored several such deals. "These ETFs permit retail investors to redeem and re-price not daily, but only at delayed intervals, without assured market liquidity or fair pricing," NDP observes. "It is called Holding the Bag."

"The SEC’s decision to publicly voice concerns about State Street Global Advisors’ and Apollo’s private credit exchange-traded fund after it approved the new product has led sources to both question the regulator’s motives and ask what the wider consequences may be," wrote Institutional Investor in March. "The SEC questioned the fund’s liquidity management, valuation practices, and the use of Apollo’s brand in its name, SPDR SSGA Apollo IG Public & Private Credit ETF."

For the larger finance names focused on consumers, the risks are fairly straight forward in terms of the economy and unemployment. If employment softens as a result of the Trump trade war and/or fiscal cuts, then assumptions about defaults will negatively impact share prices. Investors know or suspect that the BNPL models have never been through even a modest recession, one big reason why these lenders and issuers of securities backed by such loans are under selling pressure.

If the Fed eventually eases ST interest rates, the consumer lenders will benefit immediately, but the institutional credit managers such as ARES, APO and BX will remain under scrutiny until the level of distress in markets like private equity, commercial real estate and commercial credit generally improves. A lot of credit strategies are predicated upon the assumption of selling the asset once the balance sheet has been fixed. But these assumptions may be in doubt.

We expect to see a lot of litigation and related noise in coming months arising from private equity and credit strategies, which will not help the valuations of large credit managers. History teaches us that if investor complaints about potential fraud and asset quality become loud enough and managers are forced to repurchase assets, then the alternatives for these firms start to shrink dramatically.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments