top of page

Goldman Sachs Sees a Difficult AI Harvest

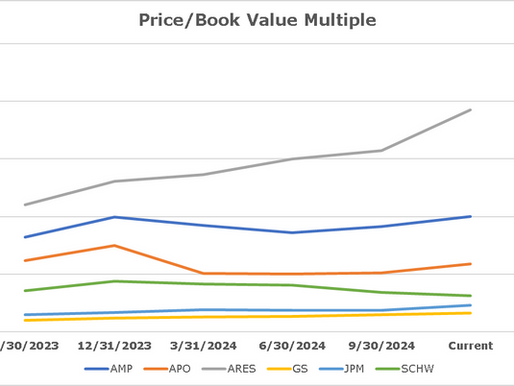

Below we set up Goldman, Morgan Stanley and the other asset gatherers as we go into Q3 2025 earning this week. As you might expect, GS is ahead of where it was a year ago in terms of non-interest income, earnings overall and equity market value.

-

Oct 7, 20258 min read

Crypto Bubble? A Rising Tide Lifts All Coins -- Until It Doesn't

Owners of crypto tokens hold nothing except an option to sell their flutter to a greater fool. The real worry for the future is that another financial debacle — à la FTX — where crypto was revealed to be pure fraud will surprise the markets as burned punters flee their speculations. The fact that crypto prices are increasingly being supported by stock issuance and schemes like perpetual futures contracts (Perps) suggests the end of the game is nigh.

-

Aug 17, 20257 min read

Trading Points: ALLY, CRCL, COIN, HOOD, SCHW & SOFI

Smaller issuers of stable coins will soon be competing with Verizon (VZN) and JPMorgan (JPM), while platforms offering turnkey coin solutions will multiply like Lantern Flies.

-

Jul 20, 20255 min read

Is Goldman's Run Over? Or Do Financials Surge Ever Higher?

We all were more than a little amused to learn that in the most recent bank stress tests the Federal Reserve Board decided to ignore the massive financial and reputation risk in private equity and private credit. With cash bids for private assets plummeting, and sponsors in full flight due to prospective litigation by jilted clients, how do the Fed and other bank regulators retain any credibility? Our friend Nom de Plumber had an appropriate observation...

-

Jul 9, 20258 min read

Do Stablecoins Help or Hurt Crypto?

The intriguing thing about private coin empires is that they are obviously not a positive for existing payment systems, yet neither are they dependent upon crypto. Larger sponsors may be able to create exclusive coin ecosystems without actually touching crypto assets at all. Fiat to AMZN coin, “ZON,” is really all that the sponsor needs.

-

Jun 15, 20258 min read

Profile: The Bank of New York

As of yesterday's close, BK was right behind SoFi Technology (SOFI) leading the bank surveillance group higher. BK closed yesterday at 14x forward earnings and 1.6x book value, roughly the same PE multiple as JPM but at a lower book value multiple.

-

Jun 3, 20255 min read

Post-Trumpian Fintech Bounce: How High? How Long?

At one point last year, HOOD was up several hundred percent, but has given back much of those gains. Yet the leaders of our finance group have outperformed the broad market.

-

May 12, 20256 min read

Bank Stocks Down | WGA Bank Top 100 Index: Q2 2025

TD was up about 6% over the past three months, the only name in our test group with a positive three-month market return, of note.

-

May 4, 20256 min read

Fear & Loathing on Wall Street: GS, MS, AMP, SCHW, RJF, SF

Some of the largest banks by assets have dropped from the top quartile into the bottom half of the distribution for the top 100 banks

-

Apr 8, 20258 min read

HOOD: Is the Bloom off the Rose?

And just why do financial firms like HOOD, SoFi Technologies (SOFI) and Block (XYZ) talk about EBITDA in their investor materials?

-

Feb 13, 20254 min read

Is Ameriprise Overvalued? Is PennyMac Cheap vs the REITs?

We think it is notable that AMP has underperformed the other members of the group other than SCHW over the past year.

-

Feb 3, 20257 min read

WGA Bank Top 100 Index | Q1 2025

GS had not appeared in the top 25 since we began the indices a year ago, while MS had made it three times.

-

Jan 29, 20254 min read

Update: Charles Schwab | SCHW

The SVB duration management from 2020 onward was recklessly negligent by any reasonable standard

-

Jan 22, 20255 min read

Update: Top Bank Asset Managers

As and when GS can exit the loss leading credit card relationship with AAPL, the performance of the business should improve significantly.

-

Dec 30, 20248 min read

Powell Overshoots the Runway; Update: American Express & Charles Schwab

Last year, when a lot of people were predicting the demise of SCHW, we told our readers to calm down.

-

Oct 23, 20247 min read

Should TD Bank Rethink US Retail?

WFC is not even out of dodge yet, but TD has cut off the fingers of one hand in yakuza style and is now headed for years of misery

-

Oct 16, 20246 min read

Universal Banks: Should TD Buy Schwab & Sell Its US Operation?

SCHW needs to take advantage of their strong operating leverage and repair some needless damage done during COVID by inept bank management.

-

Aug 25, 20247 min read

Bank Earnings: JPM, BAC, AX, GS & SCHW

GS saw loss provisions fall slightly in Q2 2024 to $282 million but the number was still $600 million in the first half of the year...

-

Jul 17, 20245 min read

Who Leads the Asset Gatherers? | SCHW, MS, GS, AMP, RJF & SF

The larger banks led the way in January and February, but today the top 25 names in terms of total return include many smaller banks.

-

Jul 3, 20247 min read

The Bull Case for Large Banks

Big banks have big CRE exposures, too. So what drives this marvelous progression up the wall of worry?

-

May 15, 20247 min read

bottom of page

.png)