top of page

The Wrap: Pulte Crushes PennyMac; Kevin Warsh's Conflict of Visions

We hear that the PennyMac fiasco was largely caused by Bill Pulte and the Trump Administration. Most people in the markets don't realize that the GSEs had already bought a ton of mortgage-backed securities (MBS) in Q4 of last year. This market manipulation tightened mortgage spreads 15-20bps and increased mortgage prepayment speeds without a corresponding offset from hedges in the Treasury market. This set up PennyMac and other mortgage lenders for a disaster.

-

Feb 56 min read

Large Financials Slide in WGA Bank Top 100; Trump on Affordability? Really?

The addition of Kevin Warsh as Fed Chairman does not change the ST calculus on the FOMC in terms of support for further rate cuts. Even as a former Governor, Warsh begins his term as leader of a minority on the Committee, especially if former Chairman Powell remains on the Board. This is why the inability of Trump to blame Powell for the astronomical increase in home prices, as we discuss below, is so remarkable.

-

Feb 18 min read

The Wrap: Gold Surged, Bank Stocks Sagged & FOMC Did Nothing

US banks and nonbanks are entering a period of increased uncertainty in terms of earnings and rising credit costs, yet another reason why financial stocks are retreating. We published a comment on the risks to banks from loans to private equity funds (“Does Private Credit Hurt Bank Stocks?”). Bank credit costs have been so low for so long that they have nowhere to go but up.

-

Jan 305 min read

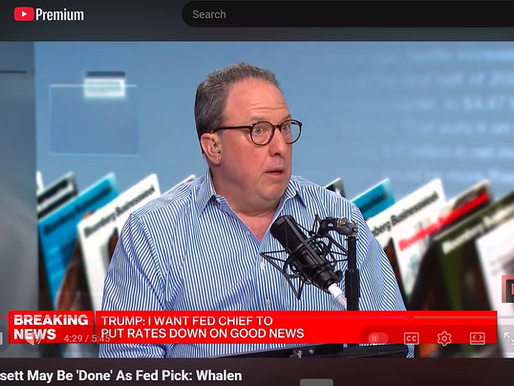

The Martyrdom of Jerome Powell

As we told Bloomberg TV last week, not only has the President's attacks not forced Powell out, but he has made this decidedly mediocre Fed chief a progressive martyr. As a result of Trump’s ill-considered attacks, Powell will likely remain as a Governor through 2028, depriving the President of an opportunity to appoint another governor for a 14-year term. How does this mess serve the agenda of President Trump?

-

Jan 267 min read

The Wrap | New Year 2026: Lower Interest Rates, Higher Defaults

When the Fed took net loan loss rates for banks down to ~ 50% of par in 2021 vs 95% after 2008, they enabled some very stupid and foolish behavior by investors and lenders. These behaviors are only partly described by the nominal level of interest rates because, of course, we must account for leverage in calculating the full scope of the prospectives losses. Lend More Upon Default (LMUD) has concealed the scope of the disaster and even pushed down reported loan default rates.

-

Dec 31, 202511 min read

The Wrap: Hassett or Warsh to Fed? Big Beautiful Housing Reform? Coin Crime?

Kevin Hassett's comments on Federal Reserve independence may have undercut his chances for the top Fed job. President Donald Trump has observed in recent days that there are “two Kevins,” Hassett and former Fed governor Kevin Warsh, who we personally support.

-

Dec 19, 20255 min read

The Powell FOMC & the Housing Trap

The accumulation of delinquent loans in the mortgage complex since COVID has gotten to the point where residential loan defaults have no place to go but up. Higher delinquency levels will enable investors to pay less for mortgage loans in the secondary markets, adding to cash losses per loan that are already several points vs the loan balance. It's not about "gain on sale" but rather cash received.

-

Oct 19, 20256 min read

Should the Federal Reserve Pay Interest on Bank Reserves?

Paying interest on reserves has nothing to do with whether banks lend and everything to do with enabling the Fed to manage the Treasury market. If you don’t want the Treasury market to remain open, then take away the Fed’s power to pay interest on reserves.

-

Jul 17, 20258 min read

Silver Surges? Waller Wants Lower Reserves & Tighter Policy

The leading candidate to be the next Fed Chairman believes the balance sheet could safely shrink to around $5.8 trillion, with bank reserves potentially decreasing to $2.7 trillion. Waller argues that a shift towards more short-term Treasury bills would make the balance sheet safer and more flexible, and he is absolutely right.

-

Jul 14, 20255 min read

Is Goldman's Run Over? Or Do Financials Surge Ever Higher?

We all were more than a little amused to learn that in the most recent bank stress tests the Federal Reserve Board decided to ignore the massive financial and reputation risk in private equity and private credit. With cash bids for private assets plummeting, and sponsors in full flight due to prospective litigation by jilted clients, how do the Fed and other bank regulators retain any credibility? Our friend Nom de Plumber had an appropriate observation...

-

Jul 9, 20258 min read

Asset Allocation: Financials Blow Past the Broad Market

We have little conviction behind our long positions in AXP and the SPX, thus the defensive recommendation in terms of sell orders.

-

Jun 27, 20254 min read

The IRA Bank Book Industry Survey | Q2 2025

“Our operative assumption is that the strong economy and continued high inflation expectations will mitigate against any interest rate cuts in 2025,” Whalen notes. “We expect to see the FOMC end the shrinkage of the central bank’s balance sheet, which should help to increase the very low growth rates for bank deposits.”

-

Jun 1, 20253 min read

The Single Fed Mandate & Bank Stocks

The Fed's actions in 2008 and again in March 2020 were largely driven by the sole mandate of the central bank -- to keep the Treasury market opening and functioning.

-

May 14, 20259 min read

Trump, Powell and the Banks

Even as President Donald Trump demands rate cuts, the Powell FOMC is sharply reducing US economic growth estimates

-

Mar 20, 20256 min read

Silicon Valley and the Large Bank Dead Pool

When you see a bank with more than 10% of total assets in MBS, that's a big red flag in our book.

-

Mar 9, 20257 min read

Trumpian Wave Threatens Key Markets

Fed Chairman Jerome Powell now reports up to National Economic Council head Kevin Hassett.

-

Feb 20, 20257 min read

Powell Fed Dithers on Inflation as the Trump Rally Fizzles

Kevin Hasset is now effectively Powell’s boss on everything other than monetary policy.

-

Feb 18, 20258 min read

QT + Lower Federal Outlays = ?

Banks continue to show a strong preference for late vintage loans over securities, a fact which may cause loan yields to continue falling

-

Feb 11, 20255 min read

The Fed & GSEs: Questions Asked and Unanswered in Washington

In the strange world of Washington, speaking truth in public is a capital crime. Truth is often revealed accidentally.

-

Jan 23, 20257 min read

Four Big Risks Ahead in 2025

Indeed, if President Trump wants to be rid of Jerome Powell he can simply impeach him for violations of the Federal Reserve Act

-

Dec 27, 202411 min read

bottom of page

.png)