top of page

Is JPMorgan Chase Insolvent?

The US banking industry has been rendered insolvent by the Federal Open Market Committee

-

Nov 28, 20226 min read

Crypto Crash Signal End of Fintech?

Despite all the hyperbole, the great crypto fraud was a small game, like the party poker that many crypto enthusiasts share in common

-

Nov 25, 20229 min read

Extension Risk Threatens US Banks

There are literally dozens of banks in the US made insolvent by the policy moves of the FOMC over the past year.

-

Nov 17, 20227 min read

Update: Mr. Cooper (COOP)

Despite the outlook for the industry, COOP continues to be one of the better performing names in our mortgage surveillance group.

-

Oct 26, 20224 min read

Will the FOMC Break the Financials?

Will the market risk created by quantitative tightening (QT) tip over a large bank or nonbank financial firm?

-

Oct 17, 20227 min read

Nonbank Lenders: The Dead Pool

With the Fed doubling down on rate increases, the pressure on all manner of nonbank finance companies and fintech platforms is growing.

-

Oct 6, 20226 min read

Large Banks: QT Winners & Losers

A number of readers have asked us to talk about the winners and losers among large banks in the current interest rate environment.

-

Oct 2, 202210 min read

The Bear Case for Ginnie Mae Issuers

The nightmare scenario in the government loan market is that FHA loan delinquency rises to the point where issuers become insolvent

-

Sep 22, 20228 min read

Update: The Bull Case for US Financials

Investors who were buying large caps at 2x book value a year ago are now running away from bank stocks just as fundamentals improve...

-

Sep 8, 20225 min read

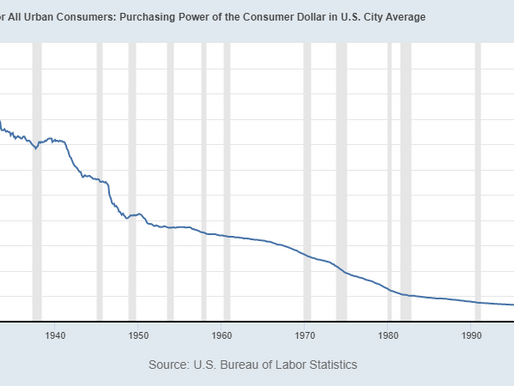

Pink Floyd: Inflation & Asset Prices

The assumption of price volatility on the part of consumers and business managers is at the heart of inflation expectations

-

Sep 6, 20225 min read

Update: Blend Labs & loanDepot Inc.

If the merger of Black Knight and Intercontinental Exchange goes through, the expanded ICE monopoly will simply give POS tools away for free

-

Aug 25, 20226 min read

Interest Rates, FinTechs & MSRs

Interest rates are starting to be very positive, and bank deposit rates are barely moving, so pretense of fintech as bank killer is over

-

Aug 21, 20227 min read

Universal Banks | Morgan Stanley, Goldman Sachs, Charles Schwab, Raymond James & Stifel

Total noncore funding at GS was over $700 billion at the end of Q1 2022 vs $321 billion for MS.

-

Aug 15, 20229 min read

Update: Guild Mortgage & Block Inc.

Since Block has not yet changed its ticker symbol, perhaps Mr. Dorsey will eventually change the company's name back to Square...

-

Aug 7, 20227 min read

Should the FOMC Pause Rate Hikes After July?

The real message to the FOMC is this: hike another 75bp in July and then let the Fed funds target sit for a few meetings...

-

Jul 21, 20225 min read

New Residential Pivots, Gets "Rithm"

NRZ must pay $400 million to Fortress to end the relationship with the external manager, a final act of squeezing NRZ shareholders

-

Jun 22, 20225 min read

Update: US Banks Post-QE

Even as the FOMC raises interest rates, we caution our readers to be prepared for disappointment from banks near term

-

Jun 15, 20225 min read

QE = Supranormal Credit Risk

Given the demand for safe assets, the true risk free rate today is probably less than zero. Ponder that Chairman Powell

-

Jun 12, 20227 min read

Interest Rates and Residential Mortgage REITs

We see an at least equal chance that margins will get squeezed for agency and MSR investors before they expand via higher interest rates

-

Jun 9, 20228 min read

Memo to Gary Gensler: Beware the “Non-Controlling Interest”

As a result of the adoption of "artificial intelligence," the 21st Century investor is mostly a victim in waiting.

-

Jun 6, 20226 min read

bottom of page

.png)