New Residential Pivots, Gets "Rithm"

- Jun 22, 2022

- 5 min read

June 22, 2022 | Premium Service | In this issue of The Institutional Risk Analyst, we comment on the announcement last week by New Residential Investment (NRZ) that it is rebranding and, more significant, finally saying goodbye to Softbank affiliate Fortress Investment Group. We have long advocated putting a good bit of distance between NRZ and the notorious Japanese fund, so we view this as a big positive for shareholders.

The big news is that NRZ is saying goodbye to Fortress and is migrating to an internally managed model. NRZ paid Fortress over $100 million annually in management fees. The surprise news, though, is that CEO Michael Nierenberg has decided to bid farewell to residential lending and turn the largest nonbank owner of mortgage servicing rights (MSRs) into a multi-asset manager. More, NRZ has also adopted a new name, Rithm Capital (RITM), which will take affect August 1, 2022.

Source: Google

The company’s stock has fallen sharply since June 7, 2022, suggesting that news of the material announcement made on Friday was in the market at least two weeks before the release. Of note, the announcement comes on the heels of a number of analysts downgrading the stock because of poor visibility on future earnings. While many managers are circling the wagons in the residential market, Nierenberg has decided to harken back to the antecedents of NRZ such as Newcastle and take the firm in a new direction.

When he says that NRZ “will evolve into a more diversified asset manager,” Nierenberg is telling you is that returns in 1-4s are likely to be under pressure or even negative for an extended period. Likewise, NRZ’s leader several times alluded to reducing the $800 million in capital inside the lender and diversifying elsewhere. But with the stock trading at 0.7x book value, buying back stock for a 30% plus return may be one of the best uses of cash at NRZ.

NRZ must pay $400 million to Fortress to end the relationship with the external manager, a final act of squeezing NRZ shareholders after years of extracting very full fees from the externally managed REIT. Of note, when Kevin Barker at Piper Sandler asked Nierenberg how long the negotiations between NRZ and Fortress for the separation had been underway, NRZ’s CEO pled ignorance of the special committee process of each firm’s board. He subsequently told Barker that the process had been ongoing “for months.”

The end of the relationship with Fortress will reportedly save NRZ $60-65 million in fees, net, a fact that highlights the timing of the change as the residential housing market sinks into a period of retrenchment. Nierenberg is always focused on driving returns for shareholders, thus we interpret these changes as being mostly defensive and focused on cost reduction. As we noted in our last comment, expenses are the only thing at the moment.

Why is cost a factor? First, revenues are falling from lending. Second, NRZ has not yet integrated the several lenders within the company, meaning that operating costs will be difficult to manage lower in the near-term. Despite a lot of talk about “operating efficiencies,” NRZ reportedly has yet to begin the long as costly process of combining Caliber, Shellpoint and other lending operations. Achieving operating efficiency gains always seems to be a future project.

Perhaps most surprising was Nierenberg’s assertion that there will be further expansion of the multiple on the firm’s MSR. “We pulled back from lending rather than simply deploy capital for the sake of doing that,” he told one analyst. “We have $630 billion [in UPB of MSR] so we don’t need any more.” Nierenberg confirmed that the current MSR mark is 4.86x annual cash flow and the weighted average coupon (WAC) is 3.68%.

Of note, NRZ has reportedly migrated its financing for GNMA MSRs to Goldman Sachs (GS), an interesting choice given that Goldman has “become the largest warehouse provider for random stuff,” in the words of one prominent analyst. Given that NRZ is explicitly guiding the Street to a higher MSR mark, the move to GS may be counterproductive since Goldman is known for being tough on credit haircuts.

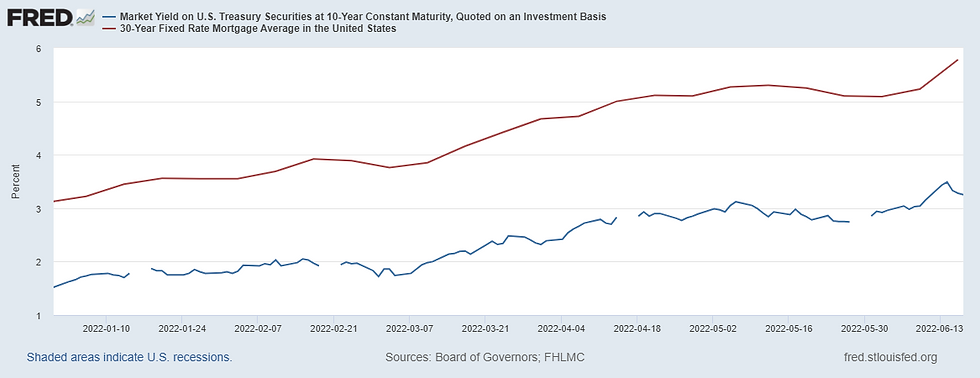

Given that the 10-year Treasury note has been rallying as the month of June ends, it may not be easy to deliver another sharp up valuation in MSR without breaking the bones of some third-party valuation providers. Nierenberg told analysts that book value per share will remain stable, meaning that the upcoming mark of the MSR in Q2 will be big enough to cover the cost of the internalization and a dividend. PiperSandler’s Barker wrote in a note earlier today:

“We are also encouraged to see NRZ disclose book value will remain near $12.50 for the quarter as a large mark-up in the MSR offsets the $0.25 dividend and $0.75/share impact of the internalization. However, we still expect significant headwinds for GAAP earnings going forward due to origination gain on sale pressure. In addition, we see little additional room for the MSR to mark higher and, therefore, see greater downside risk for book value.”

We think that the decision to separate from Fortress is a positive move for the company and for shareholders, and gives the Nierenberg and his team the freedom to manage the company. The move to a multi-asset strategy and the name change are, to us, mostly about repositioning the firm defensively to survive and grow in a world where residential lending is no longer an attractive use of capital. We continue to have concerns about NRZ and other residential lenders with heavy exposure to Ginnie Mae as the US economy heads into a Fed-induced recession.

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments