top of page

Citigroup + (Cenlar - Black Knight) = ?

The Citi decision to exit mortgage servicing perhaps made sense in 2017, but today not so much.

-

Oct 9, 20247 min read

GSE Release Under Trump? Post-Rate Cut Margin Calls??

Why should a private Fannie Mae be a 20% risk weight under Basel III, but PFSI or Mr. Cooper (COOP) are 100%?

-

Sep 22, 20248 min read

Yellen's FSOC: Housing Policy Dreams vs Mortgage Market Reality

Yellen's proposal for a backstop is merely a canard to help Treasury avoid another fiasco next time a Ginnie Mae issuer fails

-

Jul 30, 20246 min read

Update: CapitalOne Financial & PennyMac Financial Services

Of note, PFSI has been growing share in wholesale, a direct challenge to UWMC

-

Jul 25, 20245 min read

Portfolio Update & Mortgage Survivors

The survivors in mortgage finance optimize operations around purchasing loans from brokers/ correspondents, and direct to consumer (DTC)

-

May 8, 20246 min read

Debt Deflation in CRE? PFSI, COOP & RKT

If the run-of-the-mill Republic First interest rate mark is 13.3% of assets that is not just wiping out one bank’s 8% capital but also FDIC

-

May 5, 20249 min read

Update: UWMC & Rocket; Rate Cut Dreams Fade

Industry leaders believe that the FHFA wants the GSEs to offer issuers "repurchase insurance" to the tune of 25bps per loan.

-

Feb 29, 20247 min read

Assume Loss Given Default > 100% | PennyMac & Western Alliance Bank

Q: What do Silicon Valley Bank, First Republic Bank, Signature Bank and New York Community Bank have in common? Auditor, KPMG.

-

Feb 4, 202410 min read

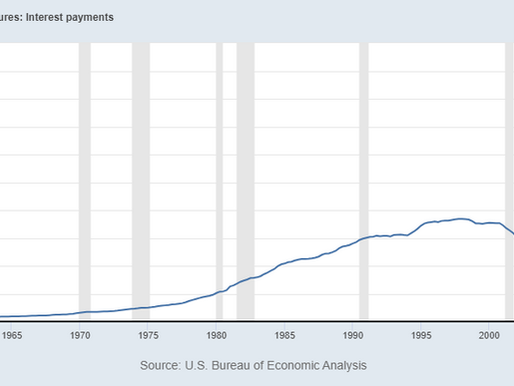

Rates Rally Financials, But Credit Fears Remain

The key term for risk managers and investors in 2024 remains unchanged from this year: Volatility.

-

Dec 15, 20237 min read

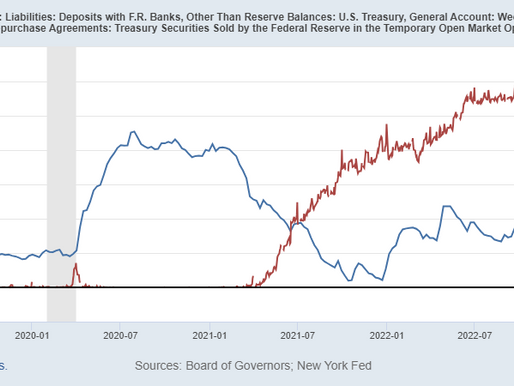

Stocks, Interest Rates and Reverse RPs

Simply stated, with T-bills trading significantly above the yield on RRPs, there is no reason for MMFs to leave cash at the Fed

-

Dec 8, 20234 min read

Update: PennyMac Financial Services

If we are marking balance sheet assets to actual market in the age of deflation, what of the heavily modeled world of servicing assets?

-

Nov 1, 20236 min read

Washington Trip Notes; Mr. Cooper & PennyMac Financial

The last Treasury Secretary that tried to extend the maturities of US government debt was Jack Lew (2013-2017). Yellen missed an opportunity

-

Jul 28, 20235 min read

Mortgage Lenders Face Return of a Purchase Market

The “winners” in the mortgage sector will be those larger players with equally large servicing books that can access bank funding

-

Jul 8, 20237 min read

Update: Mr. Cooper & PennyMac Financial

Both PFSI and COOP are navigating the current market well, but we have questions about where the former is headed.

-

Apr 30, 20236 min read

The Return of Credit Risk

Fact is, Dr. Brainard has primary culpability in the growing economic pain being felt around the country.

-

Feb 23, 20237 min read

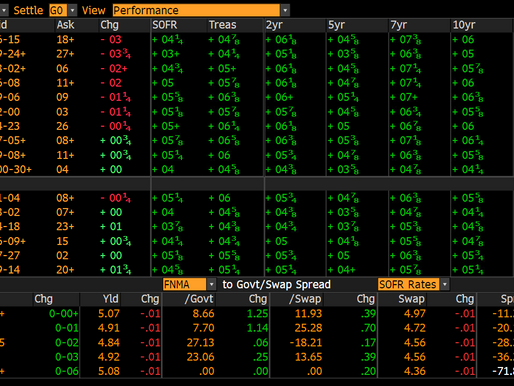

Mortgage Wrap; PennyMac Financial, Rithm Capital & MSRs

We suspect that the IMBs will be sellers of conventional assets to defend their Ginnie Mae MSRs. Banks may be buyers of conventional assets

-

Feb 9, 20237 min read

Update: Credit Suisse (CS) & PennyMac Financial (PFSI)

Like COOP, volumes are down dramatically from 2021 but MSR values and cash flows from servicing are rising

-

Oct 28, 20227 min read

Update: Mr. Cooper (COOP)

Despite the outlook for the industry, COOP continues to be one of the better performing names in our mortgage surveillance group.

-

Oct 26, 20224 min read

No End to Conservatorship for Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac will likely sit in conservatorship indefinitely unless and until Congress acts first.

-

Aug 17, 20226 min read

FOMC vs TGA; PennyMac Financial & United Wholesale Mortgage

Net, net, the dynamics in the market are actually forcing interest rates down

-

May 25, 20229 min read

bottom of page

.png)