top of page

The Top Seven Banks: JPM, BAC, C, WFC, USB, PNC & TFC

Banks lose money every single day by holding onto a below market security from the 2019-2021 period.

-

Aug 18, 20249 min read

Bank of Nova Scotia + KeyCorp = ??

If you were really, REALLY going to do mortgage warehouse lending in today's market, KEY would be the better platform, not BNS.

-

Aug 13, 20246 min read

Market Volatility and Loan Defaults

The market tantrum which began on Friday was largely over by the market close on the following Tuesday.

-

Aug 8, 20246 min read

Update: Pinnacle Financial & Synthetic Credit Risk Transfer

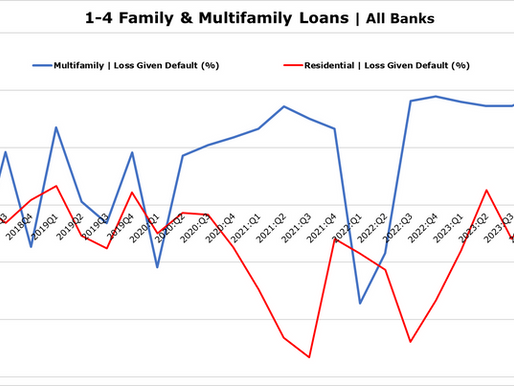

We hear in the channel that banks with festering multifamily exposures are paying north of 10% for similar CRT transactions.

-

Jul 18, 20246 min read

Bank Earnings: JPM, BAC, AX, GS & SCHW

GS saw loss provisions fall slightly in Q2 2024 to $282 million but the number was still $600 million in the first half of the year...

-

Jul 17, 20245 min read

Goldman Sachs Fails Fed Stress Test

Notice that the Fed stress test is silent on trillions of dollars in mark-to-market losses facing US banks from COVID-era securities

-

Jul 7, 202410 min read

Who Leads the Asset Gatherers? | SCHW, MS, GS, AMP, RJF & SF

The larger banks led the way in January and February, but today the top 25 names in terms of total return include many smaller banks.

-

Jul 3, 20247 min read

USSC Kills Chevron | Zombie Banks Pass Stress Tests?

The Fed bank stress tests are another sign of magical thinking in Washington.

-

Jul 1, 20248 min read

Q2 2024 Earnings Setup: JPM, BAC, WFC, C, USB, PNC, TFC

Citigroup leads the pack with a net loss rate of 133 basis points (bp) that is almost five times the average for Peer Group 1 at 27 bp.

-

Jun 23, 20249 min read

Interview: Robert Brusca on the Federal Open Market Committee

Powell won’t hit the two percent target, but he won’t change the target either.

-

Jun 10, 20249 min read

Inside the Private Credit Trade

Direct lenders are the pawnbrokers of the 21st Century for subprime commercial borrowers, usually firms financed via leveraged buyouts.

-

Jun 4, 20246 min read

Interest Rates, Deficits & Inflation

We think it is reasonable to push expectations of a cut in the target for Fed funds into Q1 2025.

-

May 24, 20246 min read

Joe Biden Goes Subprime; Should Citi Buy NYCB/Flagstar?

Citi is a subprime lender. They should be directly involved in government lending.

-

May 20, 20246 min read

The Bull Case for Large Banks

Big banks have big CRE exposures, too. So what drives this marvelous progression up the wall of worry?

-

May 15, 20247 min read

WGA Bank Top 100 Index | Q2 2024

Our Bank Top 10 and Top 25 indices continue to outperform the industry benchmarks, but the broader samples show growing financial stress

-

Apr 29, 20243 min read

The Death of Leverage; What's the WAC of Bank America?

The yield on BAC's $320 billion commercial and industrial (C&I) book was just 5.4% or more than 150bp below peer at year-end 2023.

-

Apr 24, 20247 min read

TCBI v Ginnie Mae Goes to Trial | Outlook for Commercial & Residential Mortgage Finance

McCargo's actions and the fact that the case has not been dismissed in its entirety is very unhelpful given current market conditions.

-

Apr 21, 20247 min read

Update: Bank of America & Charles Schwab

BAC is in big trouble, not due to credit but because of sub-par asset returns. BAC’s return on assets has fallen to just 0.8% in Q1 2024

-

Apr 17, 20246 min read

Zombie Banks & Budget Deficits

The fixation with the idea of resolving large zombie banks without public expense is evidence of our collective delusion.

-

Apr 15, 20249 min read

GSE Release? Really? Update: Ally Financial

You take the GSEs out of conservatorship, the big banks led by JPMorgan and U.S. Bancorp will own the conventional loan market

-

Apr 11, 202410 min read

bottom of page

.png)