WGA Bank Top 100 Index | Q2 2024

- Apr 29, 2024

- 3 min read

Updated: Jul 11, 2025

April 29, 2024 | Premium Service | On Friday after the market’s closed, the FDIC seized Republic First Bank (FRBK) in Philadelphia and sold the net assets and deposits to Fulton Financial Corp (FULT) of Lancaster, PA. The $5.8 billion Republic had a significant concentration in commercial real estate and a yield of 2% on its securities portfolio, BankRegData reports. Sound familiar? Watch Bill Moreland's video assessment of Republic.

Kroll Bond Ratings just published a research report on its large rated universe in the commercial mortgage backed securities (CMBS) market. “The delinquency rate among KBRA-rated U.S. commercial mortgage-backed securities (CMBS) in April increased moderately to 4.67%, up 17 basis points (bps) from March,” KBRA reports. “However, the total delinquent and specially serviced loan rate (distress rate) markedly increased 79 bps to 8.29%.”

KBRA notes that the jump in distress rate was largely driven by the multifamily sector, which saw two loans totaling over $1.5 billion transferring to the special servicer this reporting period, although retail (79 bps) and mixed-use (76 bps) also experienced some large increases.

We’ll be discussing the commercial real estate market and the banks at the 31st Annual Levy Economics Institute Conference on Thursday, May 2, 2024. Of note, Blackstone Mortgage Trust (BXMT) stock declined 4.6% after reporting a net loss in Q1 due to loan problems in the office category. "The market is concerned about the credit quality of the trust's office loan portfolio, reflected in the 29% discount to book value," notes Seeking Alpha.

As the month of April ended, the US banking sector was showing signs of rising stress, both from unrealized losses on legacy securities and credit losses on commercial exposures. Despite the rally at the end of Q1 2024, only 30% of the names in the WGA Bank Top 100 Index had positive equity returns for the first four months of the year. But there were some surprises among the top performers as once again it is proven that size matters.

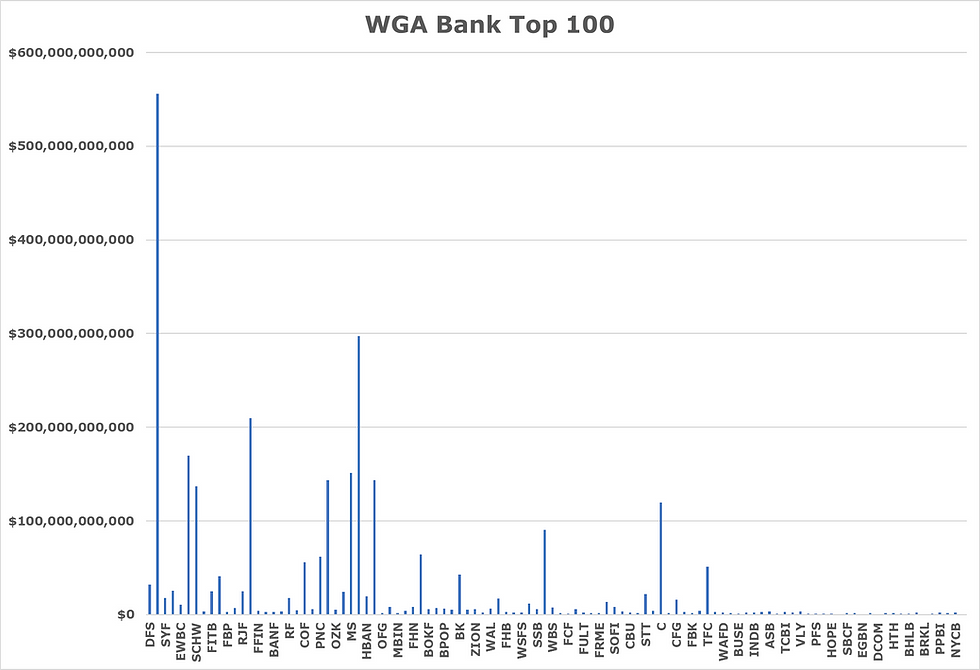

The chart below shows the distribution of the 106 banks in our index test group, with Discover Financial Services (DFS) in the lead at #1 from the far left. Charles Schwab (SCHW) came in at number 11 among the largest US banks and FifthThird (FITB) was number 9, riding higher on strong operating performance and a “5” handle on operating leverage. Subscribers to the Annual Plan of the Premium Service may download the latest WGA Top Bank 100 test group below. The big spike after DFS is JPMorgan (JPM).

Source: WGA LLC

Bank OZK (OZK) rose to number 25 and Bank of America (BAC) hit 28th on strong short-term market performance and the addition of a fifth size factor in the index model that boosts the weight of the bank's $300 billion market cap. Bank of Brian is up 33% LTM, following closely behind Citigroup (C) and JPMorgan (JPM) at +39% LTM. And New York Community Bank (NYCB) has fallen to 106 out of 100 in Q2 2024.

We’re pleased to report that our Bank Top 10 and Top 25 indices continue to outperform the industry benchmarks, but the broader samples show the growing financial stress on the industry. Subscribers to the Annual Plan of the Premium Service may download the latest WGA Top Bank 100 test group below.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments