The Death of Leverage; What's the WAC of Bank America?

- Apr 24, 2024

- 7 min read

Updated: Apr 26, 2024

April 24, 2024 | Premium Service | In a recent comment in MacroScope, Simon White of Bloomberg News stated what seems like the obvious: “It’s Time to Pay Attention to Funding Risks Again.” Yes it is. But we must pay attention to not just the cost of credit, but how having a real cost to credit changes investor behavior. If investors cannot finance aspirational assets at zero carry, what does that say about the assets?

Join WGA Chairman Christopher Whalen for

the 31st Annual Levy Institute Event!

As we prepare to rebalance the WGA Top Bank Index for Q2 2024, it’s interesting to note that the top performers in our group are up double digits over the past three months. Below are the top-10 banks in the surveillance group sorted only by 3-month total returns.

Who are some of the top performing bank stocks in the WGA Top Bank 100? The group includes some perennial over-performers as well as some large-cap turkeys that were pulled higher by the flight to quality in Q1 2024. But with the Treasury yield curve moving up half a point as this week’s Treasury auction began, all eyes should be on funding costs and asset returns. “Profitable growth” is again in vogue, both for banks and their customers.

The big change that is sweeping across the financial world is the flight to liquidity that is visible all over the global markets. Chinese speculators are madly buying gold, the world’s most liquid asset. But much of the world remains entombed by low-yielding assets that cannot be sold. Pensions and sovereign wealth funds, for example, are buried in private equity investments that made sense when interest rates were near zero but now are almost worthless.

The requirement that new ventures actually have a prospect for profitability is a new wrinkle. New PE funds, such as the SKKY vehicle sponsored by Kim Kardashian and Carlyle Group veteran Jay Sammons have encountered tough markets, Bloomberg reports. But there is hope. SKKY managed to raise $80 million for a new maker of truffle-infused hot sauces. Post money valuation is said to be only $250 million. Surely some truffle oil in the cholula is a compelling proposition?

A number of players in the world of private equity have turned to leverage to offset the illiquidity of PE holdings, a decidedly bad choice in a rising interest rate market. The assumption, of course, is that the Fed eventually will drop short-term rates if the financial markets encounter problems, but that does not mean that the long end of the curve will follow suit. There’s always tomorrow, but the next day may not be like yesterday.

Indeed, as we discuss below for the enjoyment of our Premium Service subscribers, short-term funding is now above the average asset returns of many banks. Funds, dealers and other nonbank players are points underwater on funding vs existing assets. PE assets that were acquired or financed during the 2019-2022 period are likewise upside down in terms of today’s cost of leverage.

If everything you trade today has a 4 or 5 handle in terms of coupon, then paying ~ SOFR +2 for funding or over 7% really does not work. Just as bonds and CRE assets are getting killed by rising funding costs and cap rates, PE investments are likewise way out of the money in so many different ways. Consider that ARK funds, once an aggressive investor in nouvelle tech, is now labeled as the biggest wealth destroyer of the previous decade. Ark has lost investors a collective $14.3 billion, according to Morningstar.

When we tell you that CRE and mortgage servicing assets are trading around the same cap rate, should we all laugh or cry? Think of the cap rate a prospective investor in a private PE will demand today. Say 8x NOI?? This is why we published a little cap rate tutorial in our last comment (“TCBI v Ginnie Mae Goes to Trial | Outlook for Commercial & Residential Mortgage Finance”).

The brutal math of cap rates makes you appreciate why the FOMC says that “price stability” = 2%. For the American commercial real estate market to work, it needs at least 2% inflation annually or the whole heavily leveraged pile of bollocks collapses. But the same can be said of leveraged PE investments, especially the aspirational stories that assume an easy exit via IPO.

“When the IPO market will not offer sufficient pricing and liquidity to unwind the portfolio companies from a past-SELL-BY-DATE private equity fund,” notes Nom de Plumber from his perch in the risk management trench. You may have seen Nom de Plumber in the latest John Wick film.

“Managers can try to buy more time (plus asset management fees) by borrowing (more) against these (already-overleveraged) companies,” he complains. “In other words, if you cannot sell something which you had bought with debt via an IPO, you try to hock it---with debt encumbrance---at the pawn shop.”

The prospect of heavily leveraged PE portfolio companies eventually defaulting on debt raises fond memories of fraudulent conveyance claims years ago in a certain federal receivership in Houston, TX. The political backlash against PE firms raping private companies and then leaving the creditors for dead in bankruptcy is building. More of such behavior suggests may tip over the proverbial dung wagon in favor of federal legislation to discourage leveraged PE transactions.

Nom de Plumber notes that net asset values of PE portfolio companies, which are their reported fair values minus the original acquisition debts, could support these NAV loans. But if the IPO market cannot validate those privately reported fair values, how can NAV loan providers rely upon them? Good question.

What is the Weighted Average Maturity of BAC?

Moving right along, to illustrate the danger of higher interest rates for longer, below we return to Bank of America (BAC) using some of the powerful tools from Bill Moreland at BankRegData. Suffice to say that Bill adds some pretty gruesome color to the tactical situation facing the entire US banking sector as the 10-year Treasury notes rises toward 5%.

Readers of The IRA will recall that the last time LT interest rates were near 5%, the negative capital position of US banks was over $1 trillion. To make the picture crystal clear, the average yield reported by BAC suggests a mark-to-market haircut of 10% of total assets.

Although the duration profile of BAC is similar to that of other large banks, the average yield is more than a point below other large banks. The table below shows too-be-announced (TBA) prices for Fannie Mae MBS, coupon spreads across the table and Treasury benchmarks along the bottom. Notice that those FNMA 4s are trading at 90 cents on the dollar for delivery in May.

Source: Bloomberg (04/23/24)

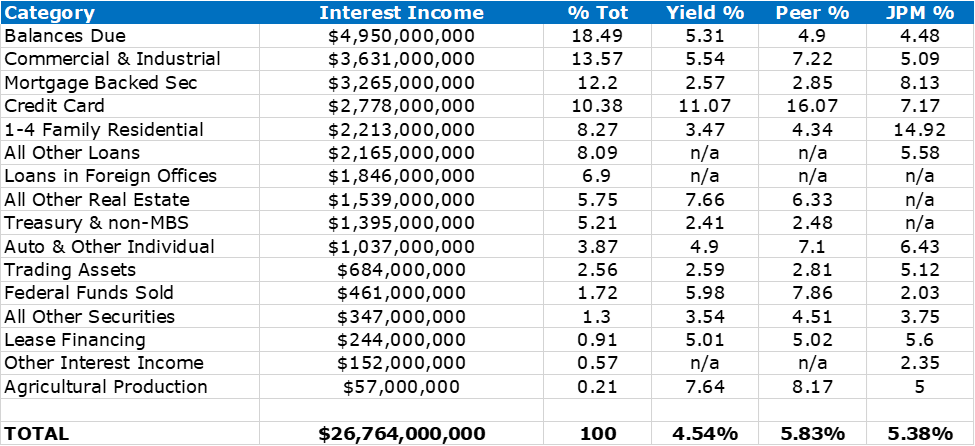

The first thing to notice about BAC’s lead unit is that the yield on assets is well-below the large bank average of 5.8%. Keep in mind that SOFR and fed funds are around 5.5% and prime is 8%, so 5.8% is no great shakes. As interest rates rise, the financial pain caused by these legacy exposures will grow. The table below shows the loan & securities returns for BAC, JPM and Peer Group 1.

BANK OF AMERICA

Source: FDIC/BankRegData (12/31/2023)

As we've noted in previous comments, the return on earning assets (ROEA) at JPM is below peer because CEO Jamie Dimon does not need to take duration risk. Half his revenue is non-interest fees. Just half of his assets are bank, the other half is investing and capital markets. Half. Thus the real comparison for BAC is against Peer Group 1.

BAC owns a lot of T-bills and a lot of mortgage-backed securities, in fact almost 10% more MBS than its peers. The yield on the half trillion dollars in MBS held by BAC is 2.5%. But if we look at some of the other asset classes, BAC is showing yields that are well-below peer. The yield on BAC's $320 billion commercial and industrial (C&I) book was just 5.4% or more than 150bp below peer at year-end 2023. In a rising interest rate environment, we expect to see increased market concern regarding unrealized losses on loans and securities held by banks. Of the top five commercial banks, BAC has arguably the weakest position when it comes to duration risk and asset returns.

Since the end of the COVID pandemic, interest rate in the US have risen to 25-year highs, reflecting the end of extraordinary ease by the Federal Reserve. But 2024 also marks the end of 40 years of steadily lower interest rates funded by the baby boomers. Returns on bank assets have steadily fallen since the 1990s, but now we enter the age of constraint in terms of fiscal resources and surplus savings. Higher real interest rates will benefit banks and real investments, while surreal investments that were encouraged by low or zero interest rates will be disadvantaged.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments