top of page

The Moral Hazard of Jerome Powell

Instead of seeking authority from Congress, Chairman Bernanke and other members of the FOMC merely turned on the public spigot.

-

Nov 27, 20236 min read

Yield Curve Normalization Good for Banks?

We think that doing nothing is a fool’s trade, to be blunt, because the next Treasury refunding could pull market yields sharply higher.

-

Nov 20, 20236 min read

Recessions Signs in Texas & China

The mood in the Dallas mortgage community is subdued, much like the atmosphere after an especially good party.

-

Nov 17, 20236 min read

Housing Finance Outlook Q4 2023

Baring some emergency, the Fed seems on track to keep interest rates at current levels indefintely.

-

Nov 14, 20233 min read

Big What? Rising Debt Service & Falling Liquidity

As with the Volcker Rule for banks, the move to centralized clearing of Treasuries and T-1 settlement seems destined to reduce liquidity

-

Nov 13, 20238 min read

Update: Bank of America

If you conduct a fire sale analysis of BAC's balance sheet as of Q3 2023, the result more than wipes out the bank's tangible equity

-

Nov 8, 20235 min read

ACH: The Bank Deposit Ain't in the Mail

Was the breakdown of the normally stable and, indeed, routine workings of the Clearinghouse the result of bad actors?

-

Nov 6, 20234 min read

Update: PennyMac Financial Services

If we are marking balance sheet assets to actual market in the age of deflation, what of the heavily modeled world of servicing assets?

-

Nov 1, 20236 min read

Rate Peak Emerges, Deflation Looms

One of the effects of QE has been making many banks and real estate investors insolvent, a precursor to debt defaults.

-

Oct 30, 20234 min read

Interest Rates, Fintech & MSRs

Regulatory skepticism about mortgage assets could effect financing rates for lenders, which means higher mortgage rates for consumers.

-

Oct 26, 20239 min read

QE Means Higher for Longer, But No Recession

We look for modest rate cuts in 2025, followed by an equally modest boom in mortgage lending

-

Oct 24, 20235 min read

Are Bank Stocks Undervalued? Which Ones & Why

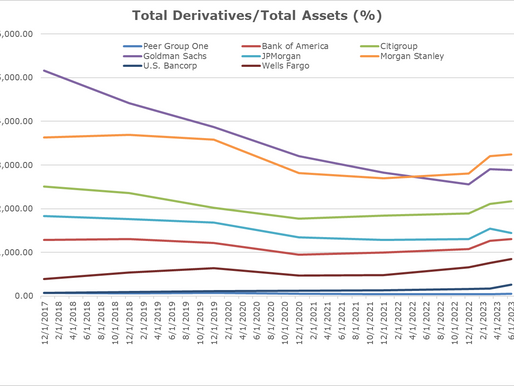

Large universal banks that ply the capital markets and use essentially infinite leverage in the derivatives markets face challenges

-

Oct 19, 20236 min read

Charles Schwab Unwinds the QE Trade

Rising interest rates are not good for bank earnings or bank equity valuations.

-

Oct 17, 20234 min read

Bank Earnings Takeaways -- JPM, WFC and Citi

Bank earnings can be best described as cautiously mediocre, but as usual the Street proclaimed that three banks "beat the estimates"

-

Oct 15, 20237 min read

Jerome Powell's Silent Crisis

The Powell Fed needs to drop short-term interest rates back down to 4% and leave them there indefinitely.

-

Oct 11, 20236 min read

Texas Capital Bank v Ginnie Mae

The legal dispute between Ginnie Mae and Texas Capital Bank makes additional defaults by HECM lenders more likely...

-

Oct 9, 20237 min read

Top Five Bank Earnings Setup | Q3 2023

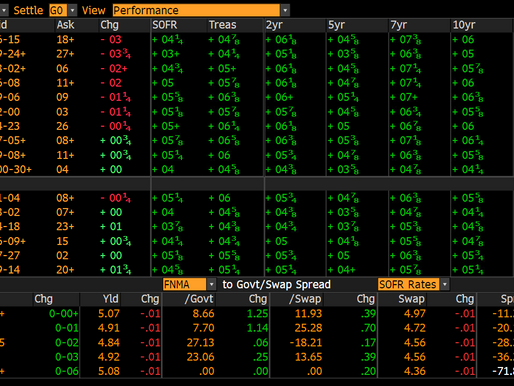

Did we mention margin calls on Treasury and mortgage-backed securities (MBS) and rising mark-to-market losses on securities...

-

Oct 3, 20236 min read

Credit Suisse\UBS to Apollo: Bye, Bye

UBS ultimately seems intent upon running off the remaining US mortgage assets, including a few billion in Ginnie Mae MSR financings

-

Oct 2, 20236 min read

SoftBank as Systemic Event; Update: Charles Schwab & Co

The public behavior and decision-making processes of SoftBank suggest that the organization is in trouble.

-

Sep 27, 20239 min read

Will Fannie Mae & Freddie Mac Raise Guarantee Fees?

With a 75bp average total gfee, would the market for private label MBS return? Or would conventional lending volumes simply crater?

-

Sep 25, 20236 min read

bottom of page

.png)