How Will Consumer Lenders Fare in a Serious Recession?

- Mar 28, 2025

- 11 min read

March 31, 2025 | Premium Service | In the this issue of The Institutional Risk Analyst, we ponder the world of consumer credit two months into the Trump Administration. Readers may recall that we were cautious in 2024 about calling a consumer recession despite the many voices in the media and elsewhere who have been predicting an economic slump since 2023. Didn’t happen, but 2025 is already very different.

First and foremost, 2025 remains about deteriorating credit in the commercial real estate and multifamily channels, as illustrated by the shellacking that Bank OZK (OZK) is taking in Chicago in two stalled commercial development deals. As we discussed with Dan Proft & Amy Jacobsen earlier this week, what is uber banker George Gleason, CEO of OZK, doing lending on new development in suburban Chicago?? IOHO, Illinois in the hands of progressive Democrats is uninvestable. And New York State is right behind.

Second, the US economy is slowing and inflation is going up in the most recent release from the BLS. During the past four years of COVID and aggressive fiscal policy by the Biden Administration, the economy benefited from vast excess cash flows. These monetary and fiscal flows tended to overstate the true level of economic growth and employment, while suppressing the visible cost of credit. Now these factors are being reversed as the Trump Administration seeks to shrink the public sector even as the Fed is backing away from any interest rate cuts in 2025.

Below we look at our consumer lenders surveillance group – including Ally Financial (ALLY), American Express (AXP), Axos Financial (AX), the US unit of Barclays Bank (BCS), CapitalOne (COF), SoFi Technologies (SOFI) and Synchrony Financial (SYF) – as we prepare for the release of Q1 2025 earnings. Readers may recall that back in Q3 2024, the market was expecting a couple of cuts in the target for short-term interest rates by the FOMC. The financials saw a big uptick in lending volumes, and better revenue and earnings as well, largely because the bond market rallied. Since that time, however, a number of names have retreated as concerns about credit and the economy have come back into focus.

Meanwhile in Washington, the Trump Administration is rolling back many of the policies of President Joe Biden, policies that masked a significant amount of consumer pain. Reductions in the availability of credit from HUD, and Fannie Mae and Freddie Mac, may accelerate the deterioration of consumer credit already visible in credit cards and autos. Well-intentioned cuts in multifamily lending by the Trump White House may cause an already rancid sector to roll over entirely. Multifamily loans supported by HUD and the GSEs are the new subprime. We expect losses in this sector to increase significantly this year.

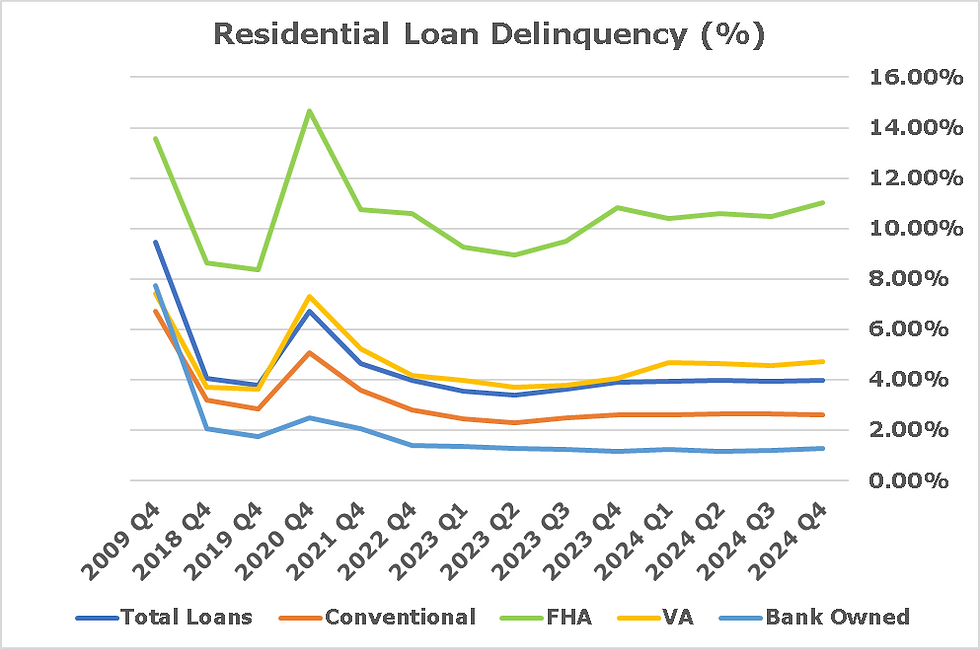

As we’ve noted previously, average credit delinquency rates for consumers are still moderate, but the bottom quartile of consumers are suffering. As Seton Motley noted in his blog recently, a lot of Americans cannot afford to shop at Walmart (WMT). That’s why President Donald Trump won the last election. The real delinquency rate for the quarter of all US mortgage holders represented in the data from the MBA for FHA mortgage loans is in the mid-teens. As credit conditions worsen, the Trump Administration will be forced to resolve these delinquencies, especially as home prices weaken.

Source: MBA, FDIC

More broadly, federal layoffs and other changes in the federal footprint may accelerate credit problems for both consumers and commercial borrowers. “The stock market faces an uphill struggle as the US government reduces the size of the state,” notes Simon White of Bloomberg. “The fiscal impulse – the annual change in the deficit as a percentage of GDP – is already falling. Equities react to changes rather than levels, leaving the market in a more precarious place.”

During our trip to Tampa this week for the mortgage conference sponsored by Fay Servicing, we had several conversations with bankers, investors and other professionals who do restructuring in delinquent consumer credit. All report that default rates and loss severity are rising rapidly in autos and cards. Is that a recession on the horizon? Our view is yes. Of note, Marina Walsh of the Mortgage Bankers Association reports that consumers seem to be prioritizing mortgage payments in this cycle, unlike in 2008, but high home prices continue to mask the overall level of delinquency.

Ally Financial

During its Q3 2024 conference call, ALLY noted that the current “dynamic operating environment,” including high interest rates, volatility and “cumulative inflationary pressure,” has strained consumers. The stock fell 25% in a day from the low $40s down to the low $30s, but is now down single digits for the year compared to the rest of the consumer group.

Ally also announced an exit from residential mortgage lending last year and an intention to refocus on autos and credit cards. While net income fell in 10% between Q2 and Q3, results for Q4 were significantly lower due to a $140 million “repositioning” charge.

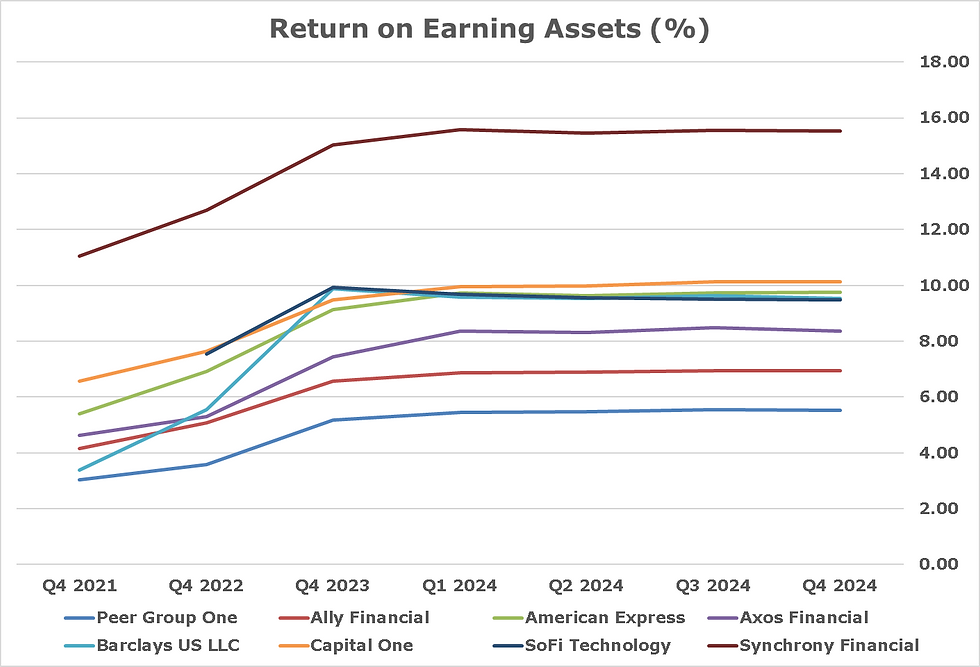

As you can see in the chart below, ALLY is in the bottom of the group in terms of asset returns, but credit expenses for the whole group were down last quarter. This follows the trend already visible across the industry in Q4, but we expect loan loss provisions and net losses to be elevated in Q1 2025 earnings for the group. At a minimum, changes in expectations for the US economy will force all banks to boost forward estimates for credit expenses for the rest of this year.

Source: FFIEC

We expect to see credit costs for the banking industry and especially consumer lenders higher in Q1 2025. Given flat to down revenues and also compression of spreads over funding, higher credit costs imply lower earnings. The equity market is already anticipating this change, but many of the managers who piled into financials in 2H 2024 are loathe to sell. Of all of the banks in this group, ALLY has the weakest asset and equity returns, and earnings have fallen by a third since 2023. Notice that SOFI, on the other hand, continues to make progress in terms of profitability.

American Express

AXP saw net income rise in 2024 vs the prior year. As the chart above illustrates, the $270 billion asset bank is in the 99the percentile of Peer Group 1 in terms of profitability. After peaking on January 23rd up 45% over the past twelve months, however, AXP has given ground and is now even with the Invesco KBW Bank ETF (KBWB) up 21% LTM. The chart below shows net loss to average assets for the group. Only SYF and COF saw higher credit costs in Q4, but that reduction in net losses may have been a head fake before a period of sustained increases in credit costs.

Source: FFIEC

In terms of fundamentals, there is no particular reason for AXP to move lower. At 6.3x book the bank is still very pricey, yet lower than the 7x book at the end of 2024. If Q1 2025 earnings are a “surprise” to equity managers, then AXP could move lower because of concerns about credit in a recession. The premier US consumer bank was trading at 5x book at the end of 2023, thus the adventurous may take further declines as an opportunity to get into the stock. Our only caution is that in a consumer recession, all of the consumer names could sell off significantly from current levels.

Axos Financial

Axos is one of our favorite names. When Hindenburg Research came out with an attack piece on AX last year, we laughed. Now Hindenburg has exited the advisory business and AX remains one of the few bad calls by the noted research shop. A year later, AX still has one of the lowest default rates in the group, but has sold off along with the rest of the consumer lenders.

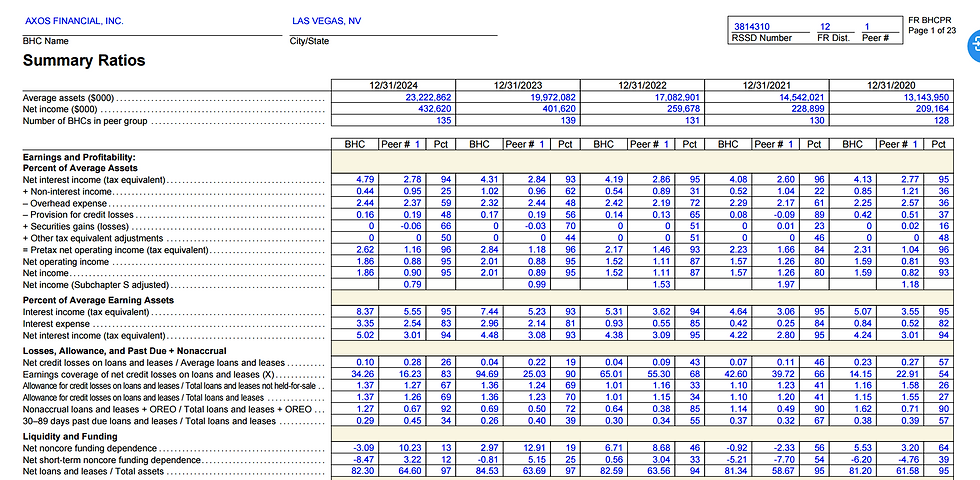

In November last year, the bank’s stock was up 65% LTM, but since that time has dropped to +24% LTM, just above the KBWB. The $20 billion asset bank has seen credit losses double in the last year, yet its loss rate is still less than half of the broad average for Peer Group 1. The table below shows the income statement for AX going back five years from the FFIEC.

Source: FFIEC

Why does AX perform so well, even at such a small size? Efficiency is one big positive. The bank’s overhead expenses are in the bottom quartile of the top 100 US banks. But the other big driver of value is growth, assets, equity and loans all averaging 3x Peer Group 1 growth rates. But like the rest of the industry, AX was actually shrinking non-core funding along with assets in Q4, consistent with our earlier comments about weak demand for credit by JPMorgan (JPM) CEO Jamie Dimon.

Barclays USA

When we walked into the American Airlines (AA) Admirals Club this week, the Barclays Mastercard signage was long gone and there were piles of Citibank Visa applications with a come-on of 70,000 free miles. Barclays lost the card sponsor relationship with AA to Citi at the end of 2024.

Citi will acquire Barclays' suite of AAdvantage cards, becoming the exclusive issuer for American Airlines and aims to move existing Barclays cardholders over to Citi products sometime in 2026. Of note, the Admirals Club at LaGuardia Airport in NYC was pretty empty on a Monday morning in March, normally a very busy time. Travel demand is down significantly in Q1 due to President Donald Trump's broad tariffs and a crackdown on government spending. Airlines led by AA have cut earnings estimates accordingly.

The US unit of BCS saw credit expenses rise in 2024 to 2.75% of average assets for the full year, yet after peaking in Q1 net losses fell during 2024. Operating income for the $191 billion bank was up 11% in 2024, but the loss of the relationship with AA is going to present some challenges for BCS in 2025.

CapitalOne

COF was one of two banks in our consumer lender group that saw net losses rise in 2024. Net income for COF was down year-over-year, in part due to expenses related to the termination of the relationship with WMT and the prospective integration with Discover Financial (DFS). Several states led by New York are trying to derail the merger, which is now expected to close in May 2025.

While DFS has long been one of our favorite banks, COF on the other hand is big and has higher operating costs. COF has an efficiency ratio of 55% vs 39% for DFS. The bank spends lots of money on advertising to acquire new customers, but then fritters away potential earnings by not managing credit, expenses or the balance sheet particularly well. As the chart below illustrates, COF’s yield on its securities portfolio is dead on the average for Peer Group 1 at 3%, while the rest of the group is significantly higher. Compare COF to AXP in most areas and the smaller card issuer is clearly a better run organization measured by profitability and asset returns.

Source: FFIEC

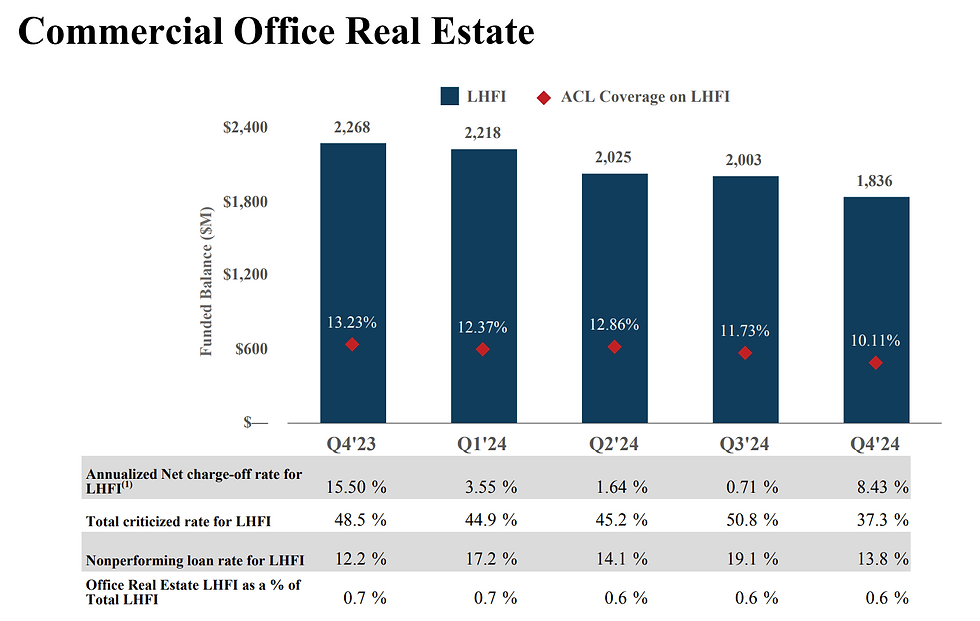

Once the acquisition of DFS is closed, COF will be close to $700 billion in assets and will, finally, have its own payments platform. But the integration of DFS is not going to result in a change in the culture of COF, which features a disturbing tendency to wander away from the core business of issuing credit cards. COF’s commercial real estate book, for example, is a source of credit expenses that is not contributing to the CapitalOne franchise. Thankfully the numbers for the COF office portfolio are small relative to the whole bank, but the loss rates are an embarrassment, as shown below.

Source: CapitalOne

SoFi Technology

SOFI continues to make progress in terms of size and profitability, with assets over $32 billion at the end of 2024. Credit expenses remain very low, a validation of the SOFI business model which is predominantly loans to individuals. Yet the bank has an efficiency ratio of 90% vs the Peer Group 1 average of 63% and 30% for Synchrony Financial. The high efficiency ratio reflects the excessive overhead costs of SOFI, which fancies itself more a tech firm than a bank and pays its senior managers accordingly.

In the event that the US economy goes into recession and credit expenses rise, SOFI’s luster could be diminished very quickly. The chart below shows the gross yield on loans and leases for our group, with SOFI just below AXP but well-above ALLY, AX and Peer Group 1 at the bottom of the range.

Source: FFIEC

The basic risk profile of SOFI remains consumer lending, this despite the company’s statements about diversifying into residential mortgage, credit cards and even (gasp) business lending. Also, the bank persists in using financial presentation that is more appropriate for a commercial company than a bank. Terms such as earnings before interest, taxes, depreciation and amortization (EBITDA) are not appropriate for a bank. The graphic below shows the aspirations of SOFI, but consumer loans still make up 75% of total loans. In a recession, the bank could face some significant challenges that are not anticipated by many analysts and investors.

Source: SOFI

Synchrony Financial

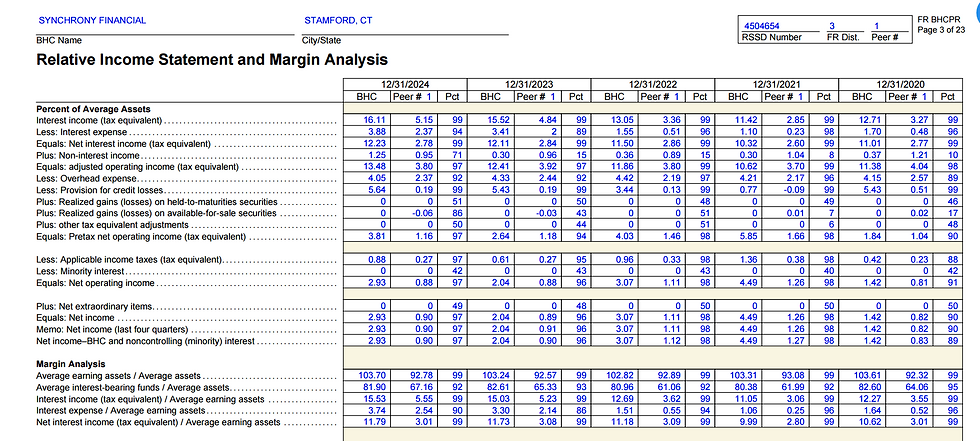

Last but not least, we look at Synchrony Financial, the most aggressive lender in our consumer group and a key bellwether for the consumer and the broader economy. Like COF, SYF saw credit expenses rising in 2024 including in Q4. But the bank’s very strong income at nearly 3% of average assets gives SYF a lot of firepower to deal with elevated levels of default. The table below from the FFIEC shows the summary income statement for SYF over the past five years.

One measure of this profitability is return on earning assets, which is over 15% for SYF vs 5% for Peer Group 1 and ~ 10% for AXP and COF. Notice in the chart below that ALLY has the lowest ROEA in the consumer group and is just above the average for the top 120 banks in Peer Group 1.

Source: FFIEC

Obviously in a severe recession, SYF will take some lumps on its white label consumer finance portfolio. Yet SFY has a considerable advantage over issuers such as ALLY because its cost of funds is relatively low, especially compared with the nose bleed levels paid by the US unit of Barclays. The chart below shows interest expense vs average assets for the consumer group.

Source: FFIEC

SYF was one of the best performers in our broad bank group, peaking at up 65% in January of this year. Since that time, SYF has given back a lot of those gains and is currently up “only” 25% LTM vs +17% for the KBWB ETF. If as we expect the US economy slips into recession, we’d expect SYF to underperform the group on the way down and could easily slip into negative territory before mid-year if credit expenses are elevated in Q1 2025 earnings.

The Institutional Risk Analyst (ISSN 2692-1812) is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments