top of page

LendingClub Corporation: Impressive Growth and Risk Leverage

LC is clearly succeeding where the larger banks are not in terms of both loan originations and loan sales, which are shown in the chart below. If LC can continue to create assets and also sell loans to investors, that is an indication of a healthy business. But the big question for us is how much of the consumer lending opportunity can LC capture and retain? The table below shows the gross loan yield, net loss rate and net income vs average assets for LC and its bank competi

-

Jan 49 min read

What Consumer Recession? Trading Points: Gold and Silver Surge

With the FOMC cutting the target for fed funds one quarter point last week, we expect to see funding costs for banks continue to fall, part of the larger narrative that has seen bank loan demand and share repurchases leaving a great deal of dry powder. Deposits are growing 2x loans, meaning that the balance must go into securities. One of the reasons that lenders of all sorts have been pushing down loan yields is to capture assets in a market that is short quality duration.

-

Sep 22, 20258 min read

Banks Blow Past Coins on Rate Cuts; Who is the Worst Consumer Lender?

If we told you that large cap financials are outperforming both the S&P 500 and bitcoin over the past month, what would you say?

-

Jul 2, 20256 min read

How Will Consumer Lenders Fare in a Serious Recession?

Many voices in the media and elsewhere have been predicting an economic slump since 2023. Didn’t happen, but 2025 is very different.

-

Mar 28, 202511 min read

Banks Slide as Asset Sales Accelerate

If we told you that the Trump White House was planning to end the issuance of all agency MBS, how do you think this will impact financials?

-

Mar 11, 20255 min read

Logan Riffs on SOMA; XYZ and SYF Say No Recession Yet

Like 2023 and 2024, the year 2025 may end up being relatively stable, yet investors remain worried about stealth externalities.

-

Feb 25, 20258 min read

Taxing Crypto? And Just Where Is That Consumer Recession?

Yes, net loss rates in percentage terms post default are back up to 2010 levels, but the dollar volume of net charge-offs remains very low.

-

Jan 5, 20258 min read

Update: Our Top Five Ideas

How will the sudden shift in Fed policy impact financials? Are we headed for a recession?

-

Sep 24, 20246 min read

WGA Bank Top 100+ | Large Banks Retreat, Small Banks Rise

The big story nobody is discussing is the fact that large banks led by JPM, BAC and TFC continue to sell off briskly

-

Sep 11, 20245 min read

Recession? Consumer Lenders: AX, AXP, ALLY, Barclays, COF, SOFI, SYF

Axos continues to rebound after the bear raid by Hindenburg Research. AX ranked 18th in the WGA Bank Top Index in Q3 2024 vs 98th for SOFI

-

Sep 2, 202412 min read

Earnings Setup: Consumer Lenders | ALLY AXP AX BCS COF SOFI SYF

The first comment to make is that consumer defaults are rising across the board. The only question we need to consider is the rate of change

-

Jul 11, 20245 min read

Goldman Sachs Fails Fed Stress Test

Notice that the Fed stress test is silent on trillions of dollars in mark-to-market losses facing US banks from COVID-era securities

-

Jul 7, 202410 min read

GSE Release? Really? Update: Ally Financial

You take the GSEs out of conservatorship, the big banks led by JPMorgan and U.S. Bancorp will own the conventional loan market

-

Apr 11, 202410 min read

Interview: Bill Kennedy of RiskBridge Advisors

Volatility remains perhaps the biggest risk factor today, mostly because of a lack of visibility on unexpected risks.

-

Jan 24, 20249 min read

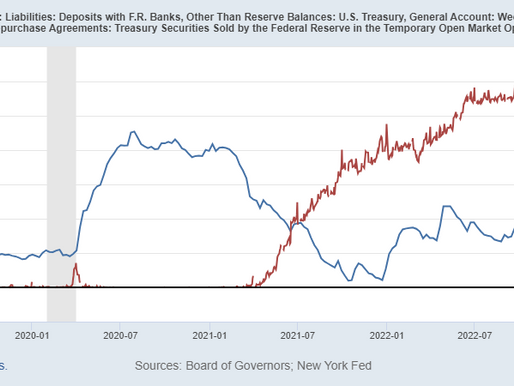

Stocks, Interest Rates and Reverse RPs

Simply stated, with T-bills trading significantly above the yield on RRPs, there is no reason for MMFs to leave cash at the Fed

-

Dec 8, 20234 min read

Profile: Comerica Inc.

If the FOMC raises the target rate for fed funds further, then banks like CMA are likely to come under renewed selling pressure.

-

Jun 28, 20237 min read

Profile: Synchrony Financial

What can SYF tell us about the bleeding edge of unsecured consumer credit?

-

Jun 9, 20236 min read

PacWest Bancorp & Fed Hawks

To survive long-term, both WAL and PACW need to get that beta back down below 2 and closer to 1, but the hawks on the FOMC may not cooperate

-

May 23, 20237 min read

Banks, Interest Rates & Fed Chairs

Imagine how President Joe Biden will react if Chair Powell needs to announce formal limits on access to US bank deposits.

-

May 4, 20234 min read

Why the FT is Wrong About Ally Financial

Ally is still more finance company than bank and really has no core deposit base worthy of the name.

-

Jan 30, 20237 min read

bottom of page

.png)