Banks, Interest Rates & Fed Chairs

- May 4, 2023

- 4 min read

May 4, 2023 | Premium Service | The Federal Open Market Committee committed another significant error yesterday by raising interest rates a quarter point. The symbolism here is more important than the 25bp, since much of the US banking sector, as well as insurers and pension funds, are already insolvent on a mark-to-market basis. The concentration of risk caused by the FOMC’s massive open market bond purchases in 2020-2021 now threatens the US with a 1930s style financial collapse.

This situation is caused first and foremost by hubris and insensitivity by the US central bank as to how its actions impact markets and financial institutions. This AM we had a chance to speak with Hugh Hendry of Eclectica on Bloomberg Radio about what happens next. Hugh is a thoughtful guy who has seen this movie before. He suggested that US authorities may need to erect formal gates to prevent bank depositors from accessing their funds. We completely agree. Welcome to Brazil or Mexico circa 1970.

The idea that the Fed could let things get so bad that it must impose limits on bank deposit withdrawals shows how serious the situation in Washington is becoming. Idiotic discussions about suspending short-selling of bank stocks also illustrate where things are headed. Imagine how President Joe Biden will react if Chair Powell needs to announce formal limits on access to US bank deposits.

The Fed’s actions have undermined confidence in US banks as well as the government in general, but the only response from official Washington is to make things worse. The studied incompetence displayed by appointed officials at the Fed and other agencies stands in sharp contrast to the alarm and dismay expressed by career staff at the Treasury and Fed. Given recent developments, a couple of points for our readers:

Banks: With the short sellers attacking PacWest (PACW) and Western Alliance (WAL) this AM, we sold our WAL position and are reviewing our large bank preferred exposures. While we still have a position in New York Community Bank (NYCB), we’d tell our readers to avoid taking risk positions in banks until the FOMC relents and drops short-term interest rates. Until the Fed accepts that its policies are the problem, we see most smaller banks as targets for short-sellers and not suitable for any investor.

The only way that the Fed can end the run on banks is to offer to finance 2020-2021 vintage assets at par indefinitely. If not, then the run continues. Once the smaller banks are gone, then we’ll move up the list to larger outliers such as Ally Financial (ALLY) and Capital One (COF).

Remember, this situation is not about large banks vs small, but all banks vs the Fed and Treasury in the short-term funds market. The short sellers will continue to attack smaller banks, but then will turn to the larger depositories. We do not believe that the Fed Chairman can survive politically if more banks fail in coming weeks.

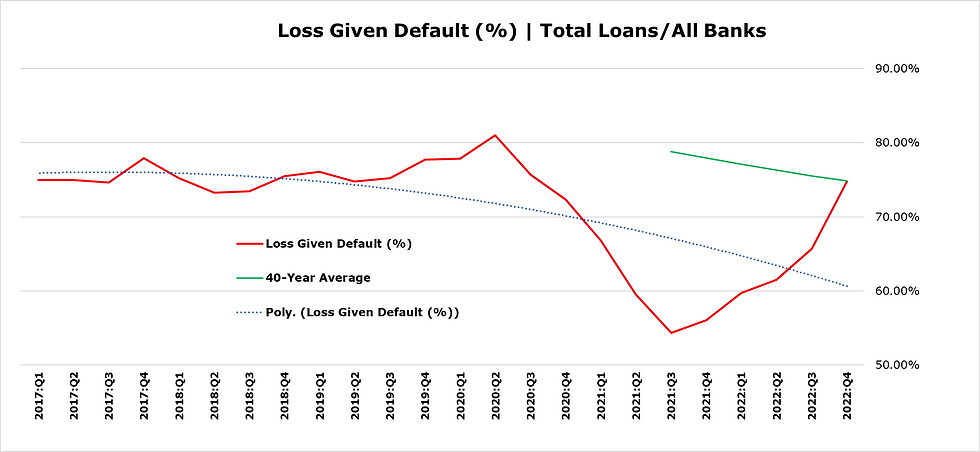

Economy: As banks and other market participants step back from lending in order to reduce risk exposures and/or raise cash, the impact on the economy will be to accelerate the normalization of credit and push loss mitigation costs sharply higher. We expect to see a sharp deceleration in economic growth over the next couple of months as credit tightens, with the rate of change mimicking the volatility seen in other quarters. Again, since the Fed itself is a major source of market volatility, any solution requires a change in Fed interest rate policy.

Source: FDIC/WGA LLC

Credibility & the Dollar: Perhaps the biggest issue we see created by the latest Fed interest rate move is about the credibility of the US. When Fed Chairman Jerome Powell gets up in front of the cameras and says that the banking crisis is over, but the markets continue to sell bank shares, he is eroding the credibility of the central bank and the entire US government. We don’t believe that the Fed will be able to maintain its interest rate policy for more than a few months, but that may be enough to badly damage the banking system, and the market position of the Treasury and the dollar.

As we’ve noted in The Institutional Risk Analyst, after 2008 the market for dollar interest rate swaps moved to a discount because of heavy demand for dollar assets. Today, that demand and the Fed’s massive bond market intervention have kept long-term interest rates artificially low. When the market for dollar interest rate swaps returns to a premium, then the special role of the dollar will be ebbing for the first time since 2008. Chairman Powell may be responsible for making that momentous change a harsh reality.

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments