top of page

The Trumpian Wave & Systemic Risk

The common penny stocks of these two appendages of the state, Fannie Mae and Freddie Mac, are up over 600% in the past year, generating huge gains for the likes of Bill Ackman and John Paulson. Bitcoin is up a paltry 50% LTM. Indeed, much like old fintech stocks such as PayPal (PYPL) and Block Inc (XTZ), bitcoin seems to be losing the special novelty that always seems to drive these manic stories. Is bitcoin now just another boring Wall Street ETF?

-

May 25, 20256 min read

FHFA Director Bill Pulte at the MBA Secondary Conference

“The boards of the GSEs don’t have a fiduciary duty to the Enterprises,” Pulte noted. “They have a fiduciary duty to the conservatorship.”

-

May 21, 20254 min read

Coinbase Global vs Robinhood Markets?

So yes, we think that every major bank is going to be integrating crypto at some point. Like I said, we think it’s a technology to update the financial system. And we’ve had conversations with a number of them.

-

May 19, 20255 min read

The First Crypto Currency: The Dollar

When you buy a crypto currency, you buy an option on finding a greater fool, but nothing more, a transaction that would have provoked contempt in Lincoln’s day.

-

May 18, 20258 min read

The Single Fed Mandate & Bank Stocks

The Fed's actions in 2008 and again in March 2020 were largely driven by the sole mandate of the central bank -- to keep the Treasury market opening and functioning.

-

May 14, 20259 min read

Post-Trumpian Fintech Bounce: How High? How Long?

At one point last year, HOOD was up several hundred percent, but has given back much of those gains. Yet the leaders of our finance group have outperformed the broad market.

-

May 12, 20256 min read

Housing Finance in the Age of Volatility: GHLD, UWMC, RKT, COOP, JPM

While GHLD provides a lot of good information about their business, the investor disclosure provided by UWMC is a bad joke, especially when you remember that UWMC is the largest nonbank lender in the US. The Q1 2025 press release is just 9 pages in length and lacks some of the most basic financial information available from UWMC’s peers.

-

May 9, 202510 min read

Interview: Henry Smyth on the Return of Gold as Global Reserve Asset

Central banks have changed their posture from net sellers of gold to net buyers. Central banks are not price sensitive regarding gold, they are sensitive to volume and tonnage of available gold.

-

May 7, 202510 min read

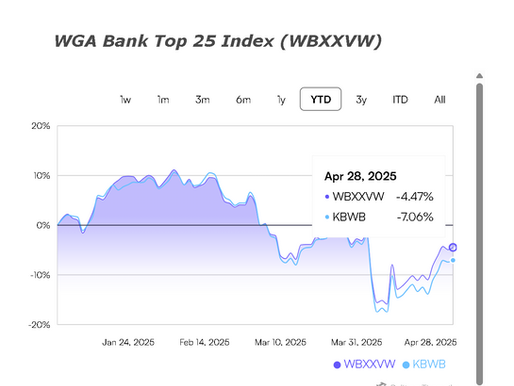

Bank Stocks Down | WGA Bank Top 100 Index: Q2 2025

TD was up about 6% over the past three months, the only name in our test group with a positive three-month market return, of note.

-

May 4, 20256 min read

Update: SOFI Technology & Credit Risk

The overall loss rate for the SOFI credit book is very low and the overall net loss rate reported in the Form Y-9 is also low, as shown in the chart above. But the levels of net loss on the bank's unsecured consumer loan book are eye-opening. As and when credit costs actually start to rise among US banks, the unsecured consumer book of SOFI may become a larger concern.

-

Apr 29, 20254 min read

Should Treasury Accept Debt for Tax Payments? Bank OZK Update

When President Donald Trump says the Fed should cut interest rates, he is probably right – at least speaking from the perspective of the real estate markets.

-

Apr 28, 20257 min read

Budget Reconciliation, Fiscal Credibility & GSE Release

The Trump budget package is priority number one on Capitol Hill, but odds of the big tax bill passing are falling every day. The White House still needs 25 votes in the House and May is upon us.

-

Apr 24, 20257 min read

Trump to Fire Jay Powell? No. Bank Earnings? Nada. Bayview for Sale?

President Trump will not try to fire Chairman Powell. Why not? First, because Powell cannot be removed save for malfeasance. Second, because firing Powell would seriously piss off Senate Republicans, killing Trump's hopes for tax legislation this year.

-

Apr 22, 20256 min read

Elizabeth Warren Opposed CapitalOne + Discover? Really?

When Elizabeth Warren and Maxine Waters spoke publicly against the CapitalOne-Discover transaction, they were actually supporting the monopoly position of JPMorgan and other large banks. By opposing CapitalOne-Discover and, indirectly, supporting JPM, Warren, Waters and other progressives are actually hurting low income consumers.

-

Apr 20, 20256 min read

Trading Points: Banks, Interest Rates & MSRs

Some of the smaller holders of MSRs may ask themselves if selling right now is not the best strategy over a 36-48 month horizon.

-

Apr 16, 20258 min read

Trump Volatility: Go to Cash? Or Go Shopping?

The paper money economy created by President Franklin Delano Roosevelt in 1933 trapped Americans and the world into using fiat dollars.

-

Apr 13, 20257 min read

Trade, Taxes & GSE Release

Who are the two most powerful people in the Trump White House?

-

Apr 9, 20254 min read

Fear & Loathing on Wall Street: GS, MS, AMP, SCHW, RJF, SF

Some of the largest banks by assets have dropped from the top quartile into the bottom half of the distribution for the top 100 banks

-

Apr 8, 20258 min read

Trump, Tariffs, Silver and the American Dream

US history over the past century was largely written by liberal Democrats, who at least rhetorically opposed tariffs and embraced inflation

-

Apr 6, 20258 min read

AIG Reflux: Private Equity Collapse Threatens US Insurers

Is the flow of toxic waste pouring from busted private equity portfolios into credit trades a threat to insurance companies? Yup.

-

Apr 3, 20256 min read

bottom of page

.png)