top of page

Should the FOMC Pause Rate Hikes After July?

The real message to the FOMC is this: hike another 75bp in July and then let the Fed funds target sit for a few meetings...

-

Jul 21, 20225 min read

Interest Rates & Bank Earnings

The good news for BAC and other banks is that there is a discernable lift underway on the yield of bank balance sheets

-

Jul 19, 20226 min read

Dollar Remains World Reserve Currency

Once again the US is coming out of a global crisis as the cleanest dirty shirt in the laundry.

-

Jul 18, 20223 min read

Update: Ally Financial (ALLY)

The 5-year CDS spreads for ALLY were trading 280bp over the swaps curve compared with 120bp for Citigroup (C) & 150bp for CapitalOne

-

Jul 13, 20224 min read

Elon Musk, China & Twitter (TWTR)

Why did Elon Musk ever pretend that he was able to acquire TWTR, a transaction the US government would never allow.

-

Jul 11, 20225 min read

Top Five US Banks by Market Performance

In times of market volatility and suddenly ended delusions of easy money, the prudent path is to fly to quality.

-

Jul 7, 20225 min read

Hard Landings & Systemic Crypto

Putting dollar leverage under crypto tokens – that is to say, under nothing – makes for infinite dollar risk.

-

Jul 4, 20226 min read

Bank Earnings Setup: JPM, USB, WFC, BAC & Citi

Most of the banks in our surveillance group are down between 10% and 30% so far this year, but none of these are particularly cheap as yet

-

Jun 29, 20228 min read

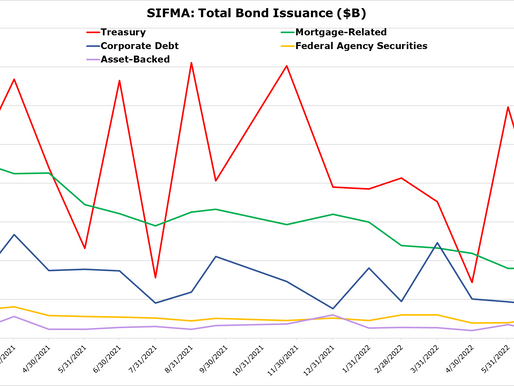

Bank Liquidity & Quantitative Tightening (QT)

A "normal" level for US bank deposits would be closer to $15 trillion than $19.9 trillion today.

-

Jun 27, 20223 min read

New Residential Pivots, Gets "Rithm"

NRZ must pay $400 million to Fortress to end the relationship with the external manager, a final act of squeezing NRZ shareholders

-

Jun 22, 20225 min read

The Fed and Housing

Issuing CMOs via the GSEs could help the FOMC out of its trading mess, but represents a monumental irony.

-

Jun 20, 20228 min read

Update: US Banks Post-QE

Even as the FOMC raises interest rates, we caution our readers to be prepared for disappointment from banks near term

-

Jun 15, 20225 min read

QE = Supranormal Credit Risk

Given the demand for safe assets, the true risk free rate today is probably less than zero. Ponder that Chairman Powell

-

Jun 12, 20227 min read

Interest Rates and Residential Mortgage REITs

We see an at least equal chance that margins will get squeezed for agency and MSR investors before they expand via higher interest rates

-

Jun 9, 20228 min read

Memo to Gary Gensler: Beware the “Non-Controlling Interest”

As a result of the adoption of "artificial intelligence," the 21st Century investor is mostly a victim in waiting.

-

Jun 6, 20226 min read

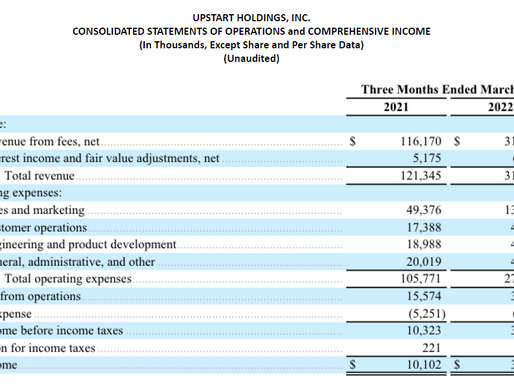

Update: Upstart Holdings & Cross River Bank

If investors and partner banks don’t want to buy UPST loans at current market rates, then the game is over in an originate to sell model

-

Jun 2, 20227 min read

Labor Day Fishing at Leen's Lodge

By the end of August, the bugs are gone but the fish are still biting, making for a perfect way to end the summer.

-

Jun 1, 20223 min read

QT Means Short Credit Risk

Market risk realized today becomes credit risk tomorrow...

-

May 31, 20226 min read

The IRA Bank Book | Outlook Q2 2022

The sharp rise in bank stocks in 2021 coincided with a surge in operating income due to COVID. Now we reverse that trend in 2022...

-

May 29, 20222 min read

FOMC vs TGA; PennyMac Financial & United Wholesale Mortgage

Net, net, the dynamics in the market are actually forcing interest rates down

-

May 25, 20229 min read

bottom of page

.png)