top of page

Nonbank Lenders: The Dead Pool

With the Fed doubling down on rate increases, the pressure on all manner of nonbank finance companies and fintech platforms is growing.

-

Oct 6, 20226 min read

Large Banks: QT Winners & Losers

A number of readers have asked us to talk about the winners and losers among large banks in the current interest rate environment.

-

Oct 2, 202210 min read

Update: Switch Inc.

SWCH is performing above the rate of total returns for the data center REITs, according to Nareit

-

Sep 29, 20224 min read

Short QE, Long Volatility

Until the FOMC raises interest rates to more “normal” levels, we don’t expect actual volatility to decline.

-

Sep 27, 20223 min read

The Bear Case for Ginnie Mae Issuers

The nightmare scenario in the government loan market is that FHA loan delinquency rises to the point where issuers become insolvent

-

Sep 22, 20228 min read

Inflation, Politics & Fed Chairmen

As the scale of Fed open market operations grew since 2008, volatility has increased, rendering the adjustment from QE to QT problematic

-

Sep 18, 20229 min read

IRA Bank Book Q3 2022

We expect to see reasonably strong earnings for commercial lenders in Q3 2022 as loan yields slowly rise...

-

Sep 13, 20222 min read

Interview: David Stevens on GNMA Capital Rule & ICE + BKI

The entire mortgage industry will have a single point of failure with the ICE/BKI combination

-

Sep 11, 20228 min read

Update: The Bull Case for US Financials

Investors who were buying large caps at 2x book value a year ago are now running away from bank stocks just as fundamentals improve...

-

Sep 8, 20225 min read

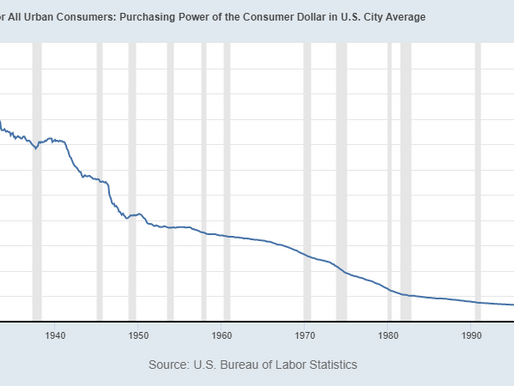

Pink Floyd: Inflation & Asset Prices

The assumption of price volatility on the part of consumers and business managers is at the heart of inflation expectations

-

Sep 6, 20225 min read

Update: Blend Labs & loanDepot Inc.

If the merger of Black Knight and Intercontinental Exchange goes through, the expanded ICE monopoly will simply give POS tools away for free

-

Aug 25, 20226 min read

Interview: Scott Olson of Community Home Lenders of America

The banks have left the government market. Now Ginnie Mae seems bound and determined to drive the IMBs out of government lending as well

-

Aug 24, 20226 min read

Interest Rates, FinTechs & MSRs

Interest rates are starting to be very positive, and bank deposit rates are barely moving, so pretense of fintech as bank killer is over

-

Aug 21, 20227 min read

No End to Conservatorship for Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac will likely sit in conservatorship indefinitely unless and until Congress acts first.

-

Aug 17, 20226 min read

Universal Banks | Morgan Stanley, Goldman Sachs, Charles Schwab, Raymond James & Stifel

Total noncore funding at GS was over $700 billion at the end of Q1 2022 vs $321 billion for MS.

-

Aug 15, 20229 min read

The FOMC Embraces Debt Deflation

The deflation of 2023 is about marking down all types of real assets to the price level that equates with a non-QE world.

-

Aug 10, 20225 min read

Update: Guild Mortgage & Block Inc.

Since Block has not yet changed its ticker symbol, perhaps Mr. Dorsey will eventually change the company's name back to Square...

-

Aug 7, 20227 min read

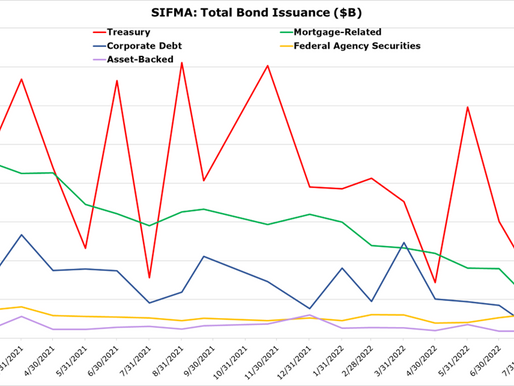

Short Collateral & Long Tantrums

Demand for risk-free collateral and liquidity is largely a function of how JPMorgan (JPM) CEO Jamie Dimon feels about risk on any given day

-

Jul 31, 20228 min read

Update: Mr. Cooper Group

We agree with the assessment by Leon Cooperman of COOP management that this firm is one of the best positioned IMBs in the industry...

-

Jul 27, 20225 min read

Questions for Chairman Powell

QE has created a gigantic interest rate mismatch across markets for banks, non-banks and other financial intermediaries including the GSEs

-

Jul 24, 20226 min read

bottom of page

.png)