top of page

Update: Bank of America

We hear in the channel that regulators are making their views of future loss probabilities very clear in guidance to the top banks

-

Jan 23, 20236 min read

Goldman Drops Restatement; Jamie Dimon Drops the Ball on "Frank"

The Fed’s de facto embrace of inflation encourages misallocation of economic resources on a grand scale....

-

Jan 16, 20237 min read

Update: JPMorganChase & Wells Fargo

But nothing lasts forever in mortgage land or in financials. Stay tuned and pay attention to LT rates and spreads...

-

Jan 13, 20236 min read

Predictions for the New Year 2023

Will Fannie Mae and Freddie Mac require another federal rescue in 2023 or beyond?

-

Dec 30, 20229 min read

Outliers: CapitalOne, Goldman Sachs & Citigroup

Like most nonbanks (and Goldman Sachs is predominantly a nonbank), volumes are falling and funding costs are rising.

-

Dec 20, 20225 min read

Blockchain, Crypto & Falling Liquidity

Whether we are talking about corporate credit exposures or housing, the short trade may be the place to be over the next year.

-

Dec 9, 20225 min read

Bank M2M Losses Surge in Q3 to $347 Billion

Rapidly rising interest rates in Q3 2022 pushed down the tangible capital for the US banking industry to negative $1.9 trillion

-

Dec 6, 20221 min read

Is JPMorgan Chase Insolvent?

The US banking industry has been rendered insolvent by the Federal Open Market Committee

-

Nov 28, 20226 min read

Extension Risk Threatens US Banks

There are literally dozens of banks in the US made insolvent by the policy moves of the FOMC over the past year.

-

Nov 17, 20227 min read

AOCI: The Winter of Quantitative Easing

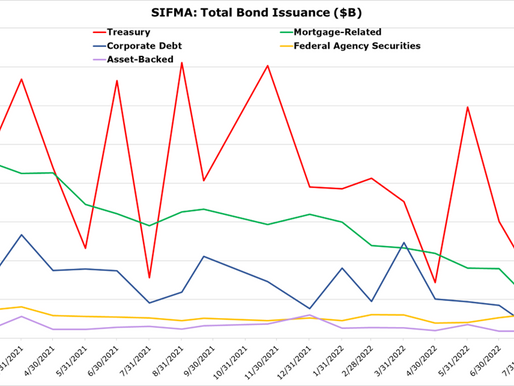

Little attention is being paid to the collateral damage being done by the FOMC to the debt capital markets

-

Oct 24, 20223 min read

Will the FOMC Break the Financials?

Will the market risk created by quantitative tightening (QT) tip over a large bank or nonbank financial firm?

-

Oct 17, 20227 min read

Large Banks: QT Winners & Losers

A number of readers have asked us to talk about the winners and losers among large banks in the current interest rate environment.

-

Oct 2, 202210 min read

The Bear Case for Ginnie Mae Issuers

The nightmare scenario in the government loan market is that FHA loan delinquency rises to the point where issuers become insolvent

-

Sep 22, 20228 min read

IRA Bank Book Q3 2022

We expect to see reasonably strong earnings for commercial lenders in Q3 2022 as loan yields slowly rise...

-

Sep 13, 20222 min read

Update: The Bull Case for US Financials

Investors who were buying large caps at 2x book value a year ago are now running away from bank stocks just as fundamentals improve...

-

Sep 8, 20225 min read

Interview: Scott Olson of Community Home Lenders of America

The banks have left the government market. Now Ginnie Mae seems bound and determined to drive the IMBs out of government lending as well

-

Aug 24, 20226 min read

Interest Rates, FinTechs & MSRs

Interest rates are starting to be very positive, and bank deposit rates are barely moving, so pretense of fintech as bank killer is over

-

Aug 21, 20227 min read

No End to Conservatorship for Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac will likely sit in conservatorship indefinitely unless and until Congress acts first.

-

Aug 17, 20226 min read

Universal Banks | Morgan Stanley, Goldman Sachs, Charles Schwab, Raymond James & Stifel

Total noncore funding at GS was over $700 billion at the end of Q1 2022 vs $321 billion for MS.

-

Aug 15, 20229 min read

The FOMC Embraces Debt Deflation

The deflation of 2023 is about marking down all types of real assets to the price level that equates with a non-QE world.

-

Aug 10, 20225 min read

bottom of page

.png)