Blockchain, Crypto & Falling Liquidity

- Dec 9, 2022

- 5 min read

December 9, 2022 | As we watch the world of crypto tokens slide into the recycle bin of history, it is more than a little amusing to see Goldman Sachs (GS) CEO David Solomon and former UK PM Boris Johnson both out shilling for blockchain, a technology with no discernable value save wasting billions of dollars in investor cash. At least with crypto tokens, what JPMorgan (JPM) CEO Jamie Dimon likens to pet rocks, you had the possibility of speculative gain.

GS is said to be among the largest investors in blockchain, the supposed enabler technology for bitcoin. The list of banks wasting billions on a technology meant to disintermediate banks is long and storied. And all of these "investments" could be a complete loss. Just as the notion that we need “independent” currencies was a bogus enabler for crypto fraud, the tripe that said we need “independent” verification of transactions was likewise the grease for billions in lost investments in blockchain.

The true use case for bitcoin, keep in mind, is money laundering and funding criminal enterprises. Legitimate users were purely decorative. Leaving aside the criminality, blockchain as used in bitcoin is a retrograde ledger technology that consumes stupid amounts of energy. "Trusted ledgers" really only make sense in offline applications that are not transaction intensive. A ledger that stores every turn of a loan underwriting model, for example, is relevant.

Even in those use cases that have some utility, what we are talking about as “blockchain” is unremarkable. Blockchain is basically a write-only Excel spreadsheet with layers of permissions on top. The bitcoin variant of blockchain has been hacked so many times that it seems almost silly to discuss security in the context of “immutable blocks.” Remember, there is no file that cannot be altered.

The only people who get real value from blockchain are the consultants and media that promote it for their own personal gain. Same goes for ESG. The blockchain/ESG crowd are a perfect example of the “conflicted agents” that our colleague Alex Pollock loves to describe in his writings. When Blackrock (BLK) decides to vote the shares of clients in support of acts of idiocy like ESG, for example, that is a conflict. He wrote in the Financial Times:

“BlackRock represents a giant and profound principal-agent conflict. It should not be voting any shares at all without instructions from the real owners, whose money is really at risk… The real owners whose own money is at risk are the owners of the mutual fund and exchange-traded fund shares and the beneficiaries of pension funds, not their hired agents.”

For risk professionals, the fact of crowd-funded, consultant-driven manic phenomenon like crypto currencies, ESG and blockchain underscores the danger that policy makers are going to get something very big very wrong in 2023. Our prime candidate for the big risk is liquidity.

The lesson of the bankruptcy of Reverse Mortgage Funding (RMF), which we profiled last week (“RMF Bankruptcy Signals Systemic Risk in GNMA Market”), is that liquidity is fleeing from the ABS markets, even for FHA-guaranteed loans. That is a hint. In a rising interest rate environment, falling asset prices inevitably lead to lenders stepping away from markets – even markets with explicit US government credit support. Thus, when RMF could no longer sell the FHA-guaranteed notes from reverse mortgages, the choice was bankruptcy.

The process of price discovery or not is going on all around the financial markets, with residential and commercial mortgage exposures. The fact of so much worthless crypto detritus littering the floor of the financial markets only makes finding the bottom that much more difficult. Look, for example, of the prices for Manhattan apartments since the end of COVID and now a couple of months into the crypto bust.

Source: Miller Samuel/Douglas Elliman

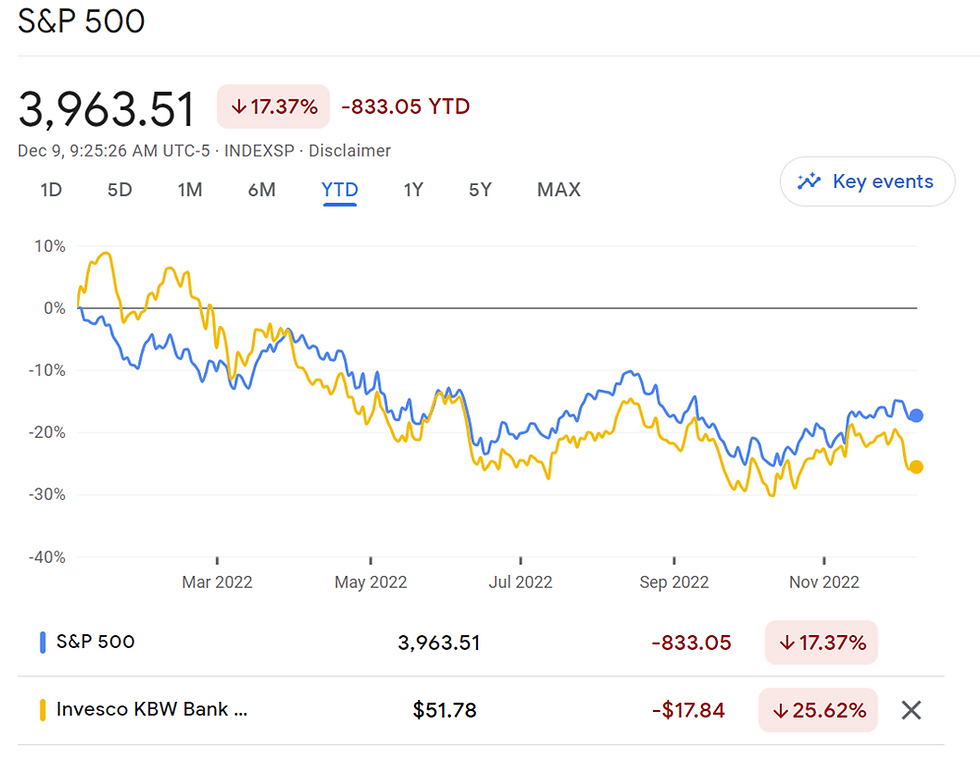

Our friend Kurt Kasun asks in a recent missive: “What if October was not the bottom for stocks?” No, October was a pause, a bit of a short-covering rally both for stocks and housing. Notice however that financials are underperforming the broader market.

Source: Google Finance

The false narrative on Wall Street says that rising interest rates are good for financials, but the recent market carnage caused by the FOMC suggests otherwise. Rising funding costs and falling asset valuations are bad for bank stock and bondholders. Dick Bove reflected on this challenging question of whether higher interest rates are good for banks last week:

“When I started covering bank stocks, it was generally believed that interest rate increases were not good for banks. That theory was driven by the view that when rates went up real book values went down and, therefore, the value of the enterprise was less. Valuation was based on book values which represented the base of a bank’s earnings power.”

Rising interest rates are also bad for housing finance. The primary-secondary spread had reached over 2.25% a couple of weeks back, but the intense desire of lenders to make loans pushed rates down for a while. Remember, lenders set loan coupons, markets set bond yields. Loans being bought via correspondent channels last month actually made a profit, but November and December are short months in terms of actual business days.

During the supposed rally from the October lows, financials did show some signs of life, but only a little. The same individuals that find value in crypto currencies or blockchain are not especially picky about the asset class of the moment. They are simply looking for the next shiny object to chase. And again, we warn our readers to ponder whether that book value on the Bloomberg screen won’t be 10 or 20% lower in a year’s time.

Sad to say, whether we are talking about corporate credit exposures or housing, the short trade may be the place to be over the next year. Once the Fed declares victory over inflation, then a short but intense rally will ensue, followed by an equally intense but much larger down correction in home prices around 2026 or so. In that sense, the larger scenario is unaffected by what the FOMC does or does not do in the next year. Have a great weekend.

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments