top of page

Trading Points: ALLY, CRCL, COIN, HOOD, SCHW & SOFI

Smaller issuers of stable coins will soon be competing with Verizon (VZN) and JPMorgan (JPM), while platforms offering turnkey coin solutions will multiply like Lantern Flies.

-

Jul 20, 20255 min read

Should the Federal Reserve Pay Interest on Bank Reserves?

Paying interest on reserves has nothing to do with whether banks lend and everything to do with enabling the Fed to manage the Treasury market. If you don’t want the Treasury market to remain open, then take away the Fed’s power to pay interest on reserves.

-

Jul 17, 20258 min read

Silver Surges? Waller Wants Lower Reserves & Tighter Policy

The leading candidate to be the next Fed Chairman believes the balance sheet could safely shrink to around $5.8 trillion, with bank reserves potentially decreasing to $2.7 trillion. Waller argues that a shift towards more short-term Treasury bills would make the balance sheet safer and more flexible, and he is absolutely right.

-

Jul 14, 20255 min read

Is Goldman's Run Over? Or Do Financials Surge Ever Higher?

We all were more than a little amused to learn that in the most recent bank stress tests the Federal Reserve Board decided to ignore the massive financial and reputation risk in private equity and private credit. With cash bids for private assets plummeting, and sponsors in full flight due to prospective litigation by jilted clients, how do the Fed and other bank regulators retain any credibility? Our friend Nom de Plumber had an appropriate observation...

-

Jul 9, 20258 min read

Soaring Fiscal Deficits, Military Parades and Irrelevant Bank Stress Tests

Imagine if the Fed had to tell the public that federal deficits were bad for bank safety and soundness? We haven't had a Fed chairman since Arthur Burns who would speak publicly about the inflationary aspect of federal deficits.

-

Jul 5, 20256 min read

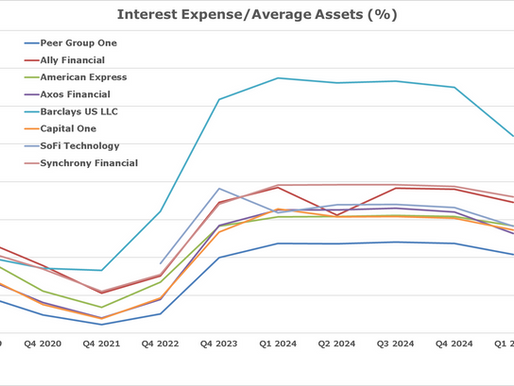

Banks Blow Past Coins on Rate Cuts; Who is the Worst Consumer Lender?

If we told you that large cap financials are outperforming both the S&P 500 and bitcoin over the past month, what would you say?

-

Jul 2, 20256 min read

Regulators Retreat on Bank Capital; Trump Wants Fed Funds at 1%. Really?

The Treasury market/bank industry PR lobbyist angle on the Fed's eSLR proposal is a little fake-out for the financial media. This not about buying more Treasury debt but instead buying back more bank stocks. Sabe?

-

Jun 30, 20257 min read

Asset Allocation: Financials Blow Past the Broad Market

We have little conviction behind our long positions in AXP and the SPX, thus the defensive recommendation in terms of sell orders.

-

Jun 27, 20254 min read

Flagstar Financial and the New York City Multifamily Meltdown

In simple terms, FLG is not making money and does not seem to have any immediate prospects to pull itself out of a slow downward spiral of balance sheet shrinkage and operating losses. Whereas before 2024, FLG was a peer performer in most respects, today the bank’s financial performance is significantly below-peer, bottom quartile in many cases.

-

Jun 24, 20258 min read

Q2 Earnings Setup: JPM, BAC, C, PNC, TFC, USB, WFC

We noted in the most recent IRA Bank Book that the Q1 2025 banking industry data from the FDIC was showing improvement in certain commercial line items, particularly non-owner occupied real estate. But is this another head fake by desperate banks trying to conceal rancid commercial real estate exposures?

-

Jun 22, 20257 min read

Bayview Acquires Guild Mortgage

Truth is, it’s hard to see the leadership of either RITM or UWMC combining with another entity, but the cost pressures in the industry today are driving radical change.

-

Jun 19, 20254 min read

Will Banks Buy More Treasury Bonds?

The connection between expanding the balance sheet via open market purchases of Treasury debt and bank reserves is one of the starkest illustrations of how federal budget deficits translate directly into inflation.

-

Jun 18, 20253 min read

Do Stablecoins Help or Hurt Crypto?

The intriguing thing about private coin empires is that they are obviously not a positive for existing payment systems, yet neither are they dependent upon crypto. Larger sponsors may be able to create exclusive coin ecosystems without actually touching crypto assets at all. Fiat to AMZN coin, “ZON,” is really all that the sponsor needs.

-

Jun 15, 20258 min read

Time to Short the AI Bubble?

Researchers at Apple just released a paper that throws cold water on the "reasoning" capabilities of the latest, most powerful large language AI models. In the paper, a team of machine learning experts makes the case that the AI industry is grossly overstating the ability of its top AI models, including OpenAI's o3, Anthropic's Claude 3.7, and Google's Gemini.

-

Jun 11, 20256 min read

Circle Internet Soars; BNPL FinTechs Rally as Recession Fades

The proliferation of low- or no-cost coin systems is ultimately negative for established players in nonbank finance and payments, including the major card issuers, as we discuss below. Still worried about interchange fees?

-

Jun 8, 20257 min read

Ray Dalio is Wrong About the Treasury Bond Market

When Ray Dalio says to be afraid of the bond market, he is asking a question that belongs in the mid-1970s, when the dollar still competed with other currencies and US interest rates were actually affected by interest rates in other nations. But today, with many of the other industrial nations led by Japan, China and the EU literally drowning in public debt, the US is still the leader of the parade.

-

Jun 5, 20256 min read

Profile: The Bank of New York

As of yesterday's close, BK was right behind SoFi Technology (SOFI) leading the bank surveillance group higher. BK closed yesterday at 14x forward earnings and 1.6x book value, roughly the same PE multiple as JPM but at a lower book value multiple.

-

Jun 3, 20255 min read

The IRA Bank Book Industry Survey | Q2 2025

“Our operative assumption is that the strong economy and continued high inflation expectations will mitigate against any interest rate cuts in 2025,” Whalen notes. “We expect to see the FOMC end the shrinkage of the central bank’s balance sheet, which should help to increase the very low growth rates for bank deposits.”

-

Jun 1, 20253 min read

Annuities Migrate Offshore? Silicon Valley Syndrome and Bank of America

Even a small decrease in prepayments due to higher LT interest rates could significantly impact the fair value of the Bank of America mortgage portfolio, forcing unrealized losses higher. If LT rates continue to rise, one veteran banker told The IRA yesterday, then BAC and several other large banks are going to start to literally shake apart from unrealized losses on COVID era assets.

-

May 29, 20257 min read

Housing Finance Outlook | Q3 2025

We expect to see continued consolidation in the world of residential mortgage finance in coming months. The sad fact is that many less competitive businesses in mortgage finance have been waiting for the FOMC to ride to the rescue with lower interest rates. If rate cuts do not materialize in 2025, however, then many of these businesses may not survive.

-

May 27, 20259 min read

bottom of page

.png)