top of page

Interest Rates, Credit and MSRs

Even as Powell signals willingness to take interest rate targets higher, he has put off a decision on the Fed's balance sheet until June.

-

May 4, 20225 min read

Ukraine & the Return of Credit Risk

Just imagine how global markets will react when Putin deploys tactical nuclear weapons in Eastern Ukraine to avoid a military defeat

-

Apr 20, 20225 min read

Profile: Morgan Stanley vs Goldman Sachs

Simply stated, Morgan Stanley has a much more diverse and sustainable business model than Goldman Sachs...

-

Apr 17, 20226 min read

Top Five US Banks: USB, JPM, WFC, C & BAC

Valuations for the top five US banks are up slightly as Q1 2022 comes to an end

-

Mar 28, 20226 min read

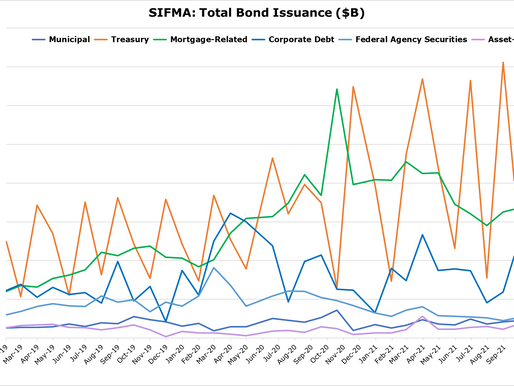

QE, Risk Premia and Option Adjusted Spreads

There a brisk debate ongoing in the fixed income markets over how much the Federal Open Market Committee will raise interest rates and when

-

Mar 15, 20225 min read

Powell, Yellen, Bernanke and Post-QE Deflation

The Powell FOMC has lost all credibility when it comes to financial markets or managing inflation and independence from the US Treasury

-

Jan 21, 20225 min read

Q4 Earnings | Big Banks & QE

In the short-run rising interest rates and spreads will help bank earnings. But where is the next credit hot spot?

-

Jan 12, 20228 min read

Interest Rates, Stocks & MSRs

We think the chart below from FRED is worth any amount of words on the impact of QE on equity market valuations.

-

Jan 6, 20225 min read

Mortgage Crises Yesterday and Today

As we move into Q4 2021 earnings, keep your eyes peeled for news of restructuring of urban commercial commercial and multifamily properties

-

Jan 4, 20226 min read

Update: Block Inc. & Upstart Holdings

Is SQ really, REALLY worth 25x book value? Our respectful answer to that question is no.

-

Dec 22, 20219 min read

A Bull Case for US Banks?

We ask whether bank fundamentals are starting to catch up to the very full equity market valuations , up 40% since the end of 2020

-

Dec 13, 202111 min read

Fed Tightens Months Late, Even as it Attacks Liquidity

any of the problems that the Fed now seeks to fix, starting with the unnecessary elimination of LIBOR, are a function of earlier policies...

-

Dec 7, 20217 min read

Update: Better.com, Wise PLC and United Wholesale Mortgage

Somehow the folks at UWMC did not take notice of the fact that secondary stock offerings for all issuers have basically disappeared

-

Dec 1, 20217 min read

As the Fed Ends QE, Stocks and Crypto Will Retreat

And in the meantime, we view the end of QE as a net negative for global stocks as well as crypto. Everything is correlated in a crowd.

-

Nov 15, 20214 min read

Update: Blend Labs, Guild Mortgage and United Wholesale Mortgage

To paraphrase our friend and fellow mortgage maven Rob Chrisman, ponder a 2022 lending market that’s 75% purchases and just 4.79 million uni

-

Nov 12, 20216 min read

Is New York City Coming Back?

Over the next several years, as the economic cost of COVID becomes full visible, New York City may face its second financial crisis

-

Nov 10, 20218 min read

Update: Rocket Companies, PennyMac Financial Services & Home Point

When issuers like RKT and PFSI are paying up for servicing assets, you know that the secondary loan market is getting tougher by the day.

-

Nov 8, 20216 min read

Update: New Residential Investment, Fortress & Softbank

The good news is that NRZ is growing and making strides in terms of asset creation and, especially, asset retention.

-

Nov 3, 20217 min read

Cenlar FSB, COOP, BLND and the Great MSR Migration

Risk to investors in the market for residential mortgages is rising and from multiple sources

-

Oct 28, 20214 min read

Three Questions for Chairman Powell

Look for the FOMC to act early and go big in terms of forward repurchase agreements at the first sign of liquidity stress.

-

Oct 25, 20216 min read

bottom of page

.png)