top of page

Bank Industry Review & Survey Q3 2023

The US banking industry has seen now two consecutive down quarters for net income caused by the Fed’s massive open market operations

-

Sep 11, 20233 min read

Consumer Credit Collapsing? Not Yet...

Sadly for the bears in the audience, nothing would make the banks happier than if consumers would use more credit....

-

Sep 5, 20236 min read

Mortgage Lenders Face Return of a Purchase Market

The “winners” in the mortgage sector will be those larger players with equally large servicing books that can access bank funding

-

Jul 8, 20237 min read

Profile: Synchrony Financial

What can SYF tell us about the bleeding edge of unsecured consumer credit?

-

Jun 9, 20236 min read

Ginnie Mae - Credit Suisse = ? A Biden MSR Tax? Does BKI + ICE = < 2?

Our view is that the BKI purchase is a horrible deal for ICE shareholders, a value killer of epic proportions

-

Feb 13, 20238 min read

Mortgage Wrap; PennyMac Financial, Rithm Capital & MSRs

We suspect that the IMBs will be sellers of conventional assets to defend their Ginnie Mae MSRs. Banks may be buyers of conventional assets

-

Feb 9, 20237 min read

Update: Bank of America

We hear in the channel that regulators are making their views of future loss probabilities very clear in guidance to the top banks

-

Jan 23, 20236 min read

GNMA, FNMA Seize Assets from Reverse Mortgage Funding Estate

The US government now owns the largest reverse lender in the country.

-

Dec 22, 20226 min read

Rising Interest Rates? Really?

Since 2008, dollar swap spreads have traded below Treasury yields, suggesting a persistent demand for dollars coming from offshore.

-

Dec 12, 20224 min read

Bank M2M Losses Surge in Q3 to $347 Billion

Rapidly rising interest rates in Q3 2022 pushed down the tangible capital for the US banking industry to negative $1.9 trillion

-

Dec 6, 20221 min read

Record Losses for Mortgage Banks Presage Tough Year Ahead

Is 2023 the year of the Return of the Distressed Loan Trade?

-

Nov 19, 20221 min read

Brief: The Return of Home Equity Loans

Every residential mortgage loan made in 2020-2021 is likely to be underwater by the end of 2023

-

Nov 7, 20227 min read

Update: U.S. Bank vs. Bank OZK; Q3 2022 Earnings Setup

How will this above-peer performer from Little Rock do in a Fed-induced recession that rivals 2008 in terms of market losses?

-

Oct 12, 20227 min read

Interest Rates, FinTechs & MSRs

Interest rates are starting to be very positive, and bank deposit rates are barely moving, so pretense of fintech as bank killer is over

-

Aug 21, 20227 min read

Hard Landings & Systemic Crypto

Putting dollar leverage under crypto tokens – that is to say, under nothing – makes for infinite dollar risk.

-

Jul 4, 20226 min read

Bank Earnings Setup: JPM, USB, WFC, BAC & Citi

Most of the banks in our surveillance group are down between 10% and 30% so far this year, but none of these are particularly cheap as yet

-

Jun 29, 20228 min read

The Fed and Housing

Issuing CMOs via the GSEs could help the FOMC out of its trading mess, but represents a monumental irony.

-

Jun 20, 20228 min read

QE = Supranormal Credit Risk

Given the demand for safe assets, the true risk free rate today is probably less than zero. Ponder that Chairman Powell

-

Jun 12, 20227 min read

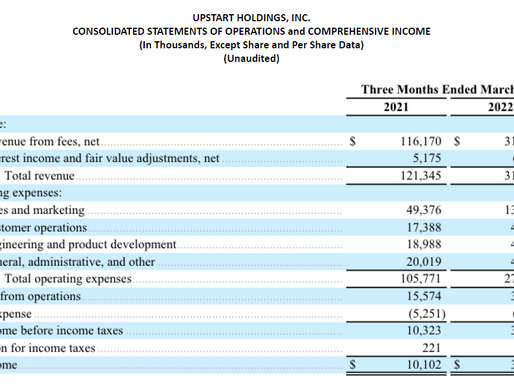

Update: Upstart Holdings & Cross River Bank

If investors and partner banks don’t want to buy UPST loans at current market rates, then the game is over in an originate to sell model

-

Jun 2, 20227 min read

Equity Market Valuations & Quantitative Tightening

The reduction in the Fed's balance sheet is the largest ever margin call on equity exposures of all descriptions.

-

May 23, 20227 min read

bottom of page

.png)