top of page

End of Fintech? Biden GSE Release?

Is AFRM maturing from a hot new fintech entrant to a familiar face headed for a bank license?? Yikes.

-

Dec 31, 20237 min read

Higher Home Prices & Inflation in 2024

This morning, banks are buying funding from the BTFP below 4.85% and selling Fed funds at 5.5%.

-

Dec 26, 20235 min read

Update: Citigroup Fights for Credibility

Citigroup picked up almost 10 points of book value since the end of Q3 2023.

-

Dec 21, 20237 min read

Another Progressive New Year?

Many participants in the equity markets are chewing on ski tips this holiday season after boldly predicting lower interest rates in 2024

-

Dec 19, 20236 min read

Rates Rally Financials, But Credit Fears Remain

The key term for risk managers and investors in 2024 remains unchanged from this year: Volatility.

-

Dec 15, 20237 min read

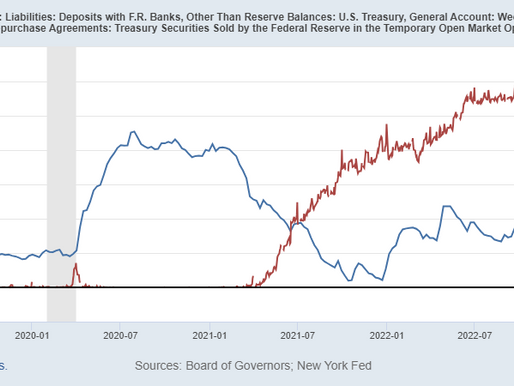

Stocks, Interest Rates and Reverse RPs

Simply stated, with T-bills trading significantly above the yield on RRPs, there is no reason for MMFs to leave cash at the Fed

-

Dec 8, 20234 min read

Update: Flying Fintechs & Zombie Banks

COIN has been helped by a groundswell of positive comment about crypto in 2023...

-

Nov 29, 20236 min read

Yield Curve Normalization Good for Banks?

We think that doing nothing is a fool’s trade, to be blunt, because the next Treasury refunding could pull market yields sharply higher.

-

Nov 20, 20236 min read

Update: Bank of America

If you conduct a fire sale analysis of BAC's balance sheet as of Q3 2023, the result more than wipes out the bank's tangible equity

-

Nov 8, 20235 min read

ACH: The Bank Deposit Ain't in the Mail

Was the breakdown of the normally stable and, indeed, routine workings of the Clearinghouse the result of bad actors?

-

Nov 6, 20234 min read

Charles Schwab Unwinds the QE Trade

Rising interest rates are not good for bank earnings or bank equity valuations.

-

Oct 17, 20234 min read

Bank Earnings Takeaways -- JPM, WFC and Citi

Bank earnings can be best described as cautiously mediocre, but as usual the Street proclaimed that three banks "beat the estimates"

-

Oct 15, 20237 min read

Jerome Powell's Silent Crisis

The Powell Fed needs to drop short-term interest rates back down to 4% and leave them there indefinitely.

-

Oct 11, 20236 min read

Texas Capital Bank v Ginnie Mae

The legal dispute between Ginnie Mae and Texas Capital Bank makes additional defaults by HECM lenders more likely...

-

Oct 9, 20237 min read

Credit Suisse\UBS to Apollo: Bye, Bye

UBS ultimately seems intent upon running off the remaining US mortgage assets, including a few billion in Ginnie Mae MSR financings

-

Oct 2, 20236 min read

SoftBank as Systemic Event; Update: Charles Schwab & Co

The public behavior and decision-making processes of SoftBank suggest that the organization is in trouble.

-

Sep 27, 20239 min read

FSOC Frets About Nonbank Risk; Goldman Sachs Stepping Back?

GS has the weakest position in terms of funding of the top-ten banks and no real narrative for the business post-Marcus.

-

Sep 21, 20236 min read

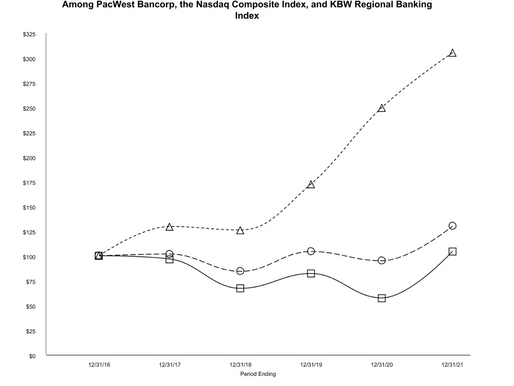

Does PacWest + Banc of California + Warburg Pincus = Value?

The Q2 2023 disclosure for PACW suggests an institution that is bleeding cash and operating in extremis...

-

Sep 18, 20237 min read

Bank Industry Review & Survey Q3 2023

The US banking industry has seen now two consecutive down quarters for net income caused by the Fed’s massive open market operations

-

Sep 11, 20233 min read

Markets Affirm the Unbearable Lightness of Fintech

When you are in a big crowd, nothing else matters.

-

Sep 7, 20235 min read

bottom of page

.png)