The IRA Bank Book | Q3 2021

- Sep 20, 2021

- 11 min read

September 20, 2021 | Federal Reserve Board Chairman Jerome Powell says under oath that asset purchases by the FOMC are not impacting home prices. But he is mistaken. The public data from the Federal Deposit Insurance Corp on bank loan loss rates says otherwise, Mr. Chairman. You see, when that rare foreclosure on a 1-4 family residential loan occurs, banks on average generate 2x the loan balance in sale proceeds from the home. Loss given default on 1-4s at the end of Q2 2021 was minus 115% percent. The LT average LGD for bank owned 1-4 family loans is 63%. Does that sound like no impact to readers of The Institutional Risk Analyst?

Source: FDIC/WGA LLC

Review & Outlook

In the Q3 2021 edition of The IRA Bank Book, we document the slow destruction of US bank asset and equity returns by the FOMC. In the age of Financial Repression and quantitative easing (QE), banks, money market (MM) funds, pensions, insurers, and really all savers are endangered species. For now, the negative impact on bank returns is masked by positive GAAP adjustments to income due to COVID. By year-end, however, the run rate incomes for the industry will be significantly below Q1 2021. Do most investors understand this impending change?

Source: FDIC/WGA LLC

The chart above shows returns on earning assets (ROEA) for US banks through Q2 2021. We’ve backed out the $10.8 billion in negative loan loss provisions from Q2 2021 net interest. On this basis, run rate net income was just $59.6 billion in Q2 2021, down from the adjusted $61 billion in Q1 2021, when the industry took $16 billion in loan loss provisions back into income. Look for run rate income for the industry –- excluding further reserve releases -- to be somewhere in ~ $60 billion range for Q3 2021 or $10 billion below Q2 2021.

Next we focus next on dividends, where the sharp drop in run rate income suggests that the elevated dividend rates seen in the first half of the year may be at risk. Dividends were $36 billion in Q2 2021 vs run rate income of $59 billion, thus depending on the view of regulators there may be an effective cap on dividends going forward. Again, if you eliminate the sharp downswing in income in 2020 due to fears of a COVID-driven credit crisis and also the spike in income in 1H 2021, the quarterly run rate for the industry is about $60 billion – perhaps lower.

Source: FDIC

The table below shows share repurchases by the top BHCs through Q2 2021. Notice that share repurchases by JPMorgan (JPM) are running at about 25% of 2020 levels. We look for these numbers to rise in Q3, in part because Buy Side managers expect buybacks to rise, but again forward income may not support higher rates of capital return.

Source: FFIEC, EDGAR

In the 2017-2019 period, banks saw a sharp drop in profits due to market volatility and the horribly tight credit spreads in 2018 and 2019. This difficult time was followed by a manic uptick in profits and secondary market spreads in 2020, led by 1-4 family mortgages. Run rate income for all lending is likely to remain muted for the balance of 2021, thus it seems appropriate to note that the last time bank net income was exceeded by dividends was 2009.

The reason why we raise the possibility of lower bank income going forward is that loan growth is essentially nil in the banking industry at the moment, while deposits have exploded, one reason why ROEA has been falling in the past several years going back to 2019. Some bank loan categories such as HELOCs, credit cards and 1-4 family first liens have actually been falling.

Source: FDIC

Source: FDIC

Given that the US has seen record debt issuance during the past several years, the poor performance of banks in terms of 1) making, 2) buying and/or 3) selling loans into the ABS market is striking. As the table below illustrates, progressives in Congress led by Senator Elizabeth Warren (D-MA) have essentially neutered the largest banks in terms of selling ABS or even 1-4 family mortgages. Warren, who recently suggested breaking up Wells Fargo (WFC) for its continued failure to clean up operational problems, has cost the US economy millions of jobs by essentially taking banks out of risk lending and related securities issuance.

Source: FDIC

Dick Bove at Odeon states the case succinctly:

“The key area of weakness is in commercial and industrial (C&I) lending. The hope for the future is in consumer lending. However, bottom line, the banks are being picked apart by competitors which means that the Bull case on banking must be adjusted to consider that loan growth will not be as robust as thought going forward.”

Although the US banking industry has managed to achieve a great deal of operating efficiency, the ability to create revenue has not kept pace as more nimble nonbank originators have stolen market share to Bove’s point. Notice the elevated efficiency ratios of WFC, suggesting that the bank is in serious crisis in terms of negative operating leverage. WFC needs to get into the 50s and stay there, implying future expenses reductions are in store.

Source: FFIEC

Banks are even starting to acquire nonbank lenders in an effort to address a significant competitive advantage for nonbanks in terms of lead acquisition, close rates and servicing. Fifth Third Bancorp (FITB), for example, in June announced a definitive agreement to acquire Provide, a digital platform for healthcare practices.

Behind every nonbank lender, there is generally a bank to underwrite and fund the loan, almost always prior to sale into the ABS market. In our profile, "Upstart Holdings: Victory for AI? Or Not...," we noted the connection with Cross River Bank in NJ. The nonbanks are earning the lion's share of the fees in these partnerships with legacy banks.

Of note, in March WFC agreed to sell its corporate trust services business to Computershare for $750 million. The deal is set to close in the second half of the year. Meanwhile, Bloomberg News reports that banking also ran Deutsche Bank (DB) sought unsuccessfully to acquire the WFC trust services business, but was rebuffed by the Federal Reserve Board because of the bank’s continuing problems with internal systems and controls.

DB is a key player in the world of custody for residential and commercial mortgage securities, but has recently been hobbled by serious operational problems in its custody business. Acquiring the WFC custody business would have been a boost for DB, but instead the trouble-plagued bank is more likely to sell its US banking business eventually. If DB cannot grow in the US, then selling Deutsche Bank Trust Company makes sense – as we have written in past comments.

As a general matter, the retreat of banks from the ABS markets continues unabated as does the parallel retreat from loan servicing. The chart below shows all bank MSRs and net servicing fees from the FDIC. Banks do not report individual business line results for servicing, but servicing government loans is generally a loss leader among commercial banks.

Source: FDIC

Only one significant depository, WFC, continues to purchase government servicing assets and then only to slow the decline of its total assets under management (AUM). Many other banks and IMBs have exited the government loan market or have become sub-servicers of MBS, as in the case of Flagstar Bancorp (FBC). The table below summarizes the major subsets for bank and nonbank servicing activity in 1-4s.

Source: FDIC, FRB St Louis

Our outlook for 2H 2021 is for income to essentially flatline around $60 billion per quarter, with credit costs remaining low and asset returns under continued pressure. The wild card in the mix is the fiscal deadlock in Washington, which could eventually lead to a US debt default – an event that could see a jump in volatility in interest rates and spreads.

Bottom line: Look for bank credit loss severities to remain below average for 2021 and into 2022, but revenue and earnings also are likely to remain under downward pressure until the FOMC ends QE.

Credit Charts

Total Loans

Looking at the top level view, total loans & leases continues to show a relatively normal pattern, albeit with defaults, noncurrent loans and LGDs falling sharply due to the Fed’s massive purchase of debt under QE and also the positive impact of federal spending in 1H 2021. Notice that loss given default for the $10.8 trillion in total bank loans is falling steadily in 2021.

Source: FFIEC

Source: FDIC

In different times this would be reckoned as a positive for bank earnings, but loan spreads remain muted at best in the same way as bond spreads. And yes, LGD for all $10 trillion in bank loans has fallen 20 points in the past year. The subsidy to debtors created by the actions of the FOMC and also the fiscal actions of Congress is captured in the FDIC bank credit metrics.

Source: FDIC/WGALLC

Total Real Estate Loans

Unlike with total loans and leases, the $5.1 trillion in bank owned real estate loans shows a relatively abnormal pattern in terms of defaults and LGD. The net loss rate had actually climbed to 60% at the end of 2020, but the surge in FOMC bond purchases in 2021 and subsidies and debt moratoria in response to COVID again pushed LGD down toward zero. We suspect that the actual economic loss rate is closer to 60% than to zero, thus when the FOMC begins to taper QE we look for LGD to revert to the 30-year mean of 66.7%

Source: FDIC

Source: FDIC/WGALLC

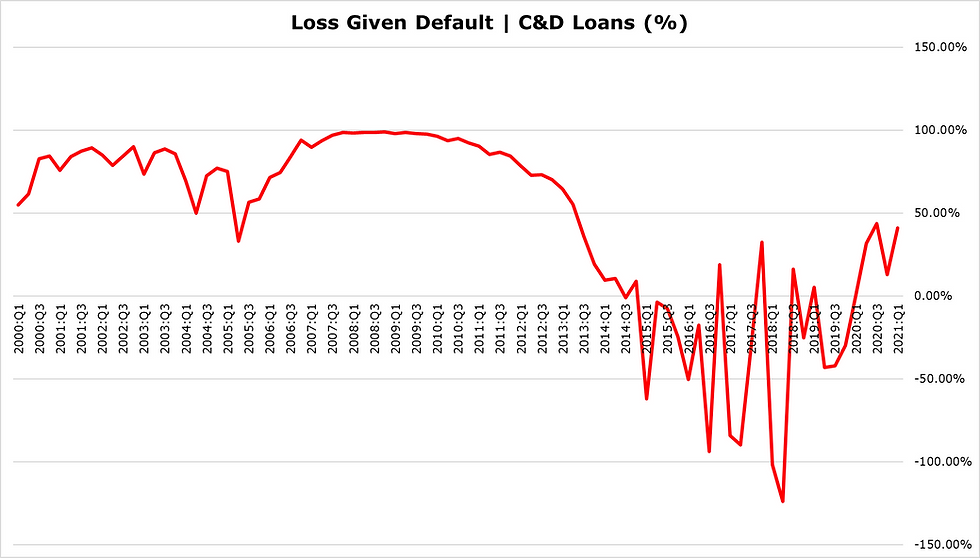

Construction & Development Loans

As with total real estate loans, construction & development loans display an abnormal pattern with considerable volatility, with LGDs near or below zero. The mad rush to acquire properties outside of urban areas has pushed asset prices to truly silly levels, but we are told by the folks on the FOMC that this asset price inflation is a transient phenomenon. With the bid for non-agency loans still significantly better than the execution in the agency market, this suggests to us that the bubble in real estate continues unabated.

Source: FDIC

Source: FDIC/WGALLC

Residential Construction Loans

Source: FDIC

Source: FDIC/WGALLC

1-4 Family Mortgage Loans

The skew visible in C&D loans is even more apparent in 1-4 family first lien mortgage notes, where charge-offs are essentially zero or negative, and LGD is likewise deeply negative, below 100% of the loan balance. In the rare event that a bank-owned 1-4 actually defaults, the result of the foreclosure generates proceeds 2x the loan balance. In view of this data, it is incredible for Chairman Powell to say that Fed policy is not impacting home prices.

In most cases, however, the struggling debtor will sell the house and pocket the net proceeds from the sale, one reason why the level of defaults is so low. Through Q2 2021, LGD on residential mortgages was negative 115% vs the long-term average of 63%, clear evidence that the FOMC’s policies are dramatically impacting the price of residential homes.

Source: FDIC

Source: FDIC/WGALLC

As the FDIC notes this quarter:

“Loans that were 90 days or more past due or in nonaccrual status (noncurrent loans) continued to decline (down $13.2 billion, or 10.8 percent) from first quarter 2021, supporting a 12-basis point reduction in the noncurrent rate to 1.01 percent. Noncurrent 1–4 family residential loans declined most among loan categories from the previous quarter (down $5.9 billion, or 10.9 percent), followed by noncurrent commercial and industrial (C&I) loans (down $3.1 billion, or 13.9 percent). Three-fifths of all banks reported a reduction in noncurrent loans compared with first quarter 2021.”

Home Equity Lines of Credit

The HELOC portfolio of US banks is now down to just $277 billion or a 14.4% decrease in unpaid principal balance over the past year alone. While some observers believe that HELOCs may eventually rebound as an asset class, as and when interest rates rise, we note that this has yet to occur. HELOC portfolios of US banks have been falling for a decade and could disappear entirely in the next two to three years.

Source: FDIC

HELOCs are a product designed for rising interest rate environments, but the growth in home equity suggests that the sheer weight of cash available may help to rescue this rapidly disappearing asset class. When do UPBs start to rise again? Ask Chairman Powell. Note that LGD for bank HELOCs was minus 150% in Q2 2021, the biggest downward skew of all 1-4 housing assets.

Source: FDIC/WGA LCC

GNMA Early Buyouts (EBOs)

As the rate of defaults and past due in bank real estate loans has fallen, the rate of bank purchase of delinquent loans is also receding. The bank exodus from the world of government lending is also contributing to this trend, but the high cure rates for loans under forbearance under the Cares Act or state moratoria is rapidly depleting the supply of EBOs held by banks.

Source: FDIC

Multifamily Loans

Unlike residential loans, multifamily assets have seen rising levels of delinquency, due in part to the fact that many of these properties are rentals. Federal and state rent payment moratoria have badly damaged many landlords and the data reflects a rising tide of credit loss severity.

Source: FDIC

Notice that LGD on the $490 billion in bank multifamily loans is rising quickly to 100% loss, well in excess of the 69% LT average. This move in loss rates for bank owned multifamily assets is a story that is largely under the radar of most investors and credit analysts.

Source: FDIC/WGALLC

Commercial & Industrial Loans

After residential mortgage loans, C&I loans have experienced the largest decline in non-current loans. The FDIC notes:

"Loans that were 90 days or more past due or in nonaccrual status (noncurrent loans) continued to decline (down $13.2 billion, or 10.8 percent) from first quarter 2021, supporting a 12 basis point reduction in the noncurrent rate to 1.01 percent. Noncurrent 1–4 family residential loans declined most among loan categories from the previous quarter (down $5.9 billion, or 10.9 percent), followed by noncurrent commercial and industrial (C&I) loans (down $3.1 billion, or 13.9 percent). Three-fifths of all banks reported a reduction in noncurrent loans compared with first quarter 2021."

Source: FDIC

Likewise, LGD for the $2.1 trillion in bank C&I loans shows the distortion due to the actions of the FOMC and also the COVID related fiscal action by Congress. This positive effect on bank credit loss severity is likely to be "transitory," however.

Source: FDIC/WGALLC

Bank Credit Card Loans

As we noted earlier in this report, bank credit card portfolios have been falling in terms of loan balances since 2019, suggesting that consumers are saving rather than spending. This is a problem for the FOMC since credit creation is a key goal of policy. In fact, with bank loans as a percentage of total assets at the lowest levels in decades, the entire framework for Fed monetary policy seems in question. Since WWII, the FOMC has used lower interest rates to pull tomorrow's sales into today. This no longer seems to be working.

Source: FDIC

Notice that, like other bank loan categories, noncurrent and net-defaults for credit cards have been falling for the past year. Also, LGD for bank credit cards was just 70% in Q2 2020, the lowest level in half a century and well-below the 83% average for that period.

Source: FDIC/WGALLC

Bank Auto Loans

Like most of the loan series discussed in this report, auto loans also evidence the distorting effects of QE, extraordinary spending by Congress and also the supply chain disruptions caused due to the shortage of semiconductors for new cars and trucks.

Source: FDIC

In the chart below, LGD for bank auto loans again shows the impact of QE, fiscal action by Congress and the strong demand for used cars due to supply constraints. Realized losses on bank auto loans are at the lowest levels observed since the FDIC began reporting data on this loan category. Again, this positive credit metric would normally be bullish for bank earnings, but we believe that the impact on bank credit losses is likely to be transitory.

Source: FDIC/WGALLC

The IRA Bank Book (ISBN 978-0-692-09756-4) is published by Whalen Global Advisors LLC and is provided for general informational purposes. By accepting this document, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The IRA Bank Book. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The IRA Bank Book are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The IRA Bank Book represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The IRA Bank Book is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The IRA Bank Book is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The IRA Bank Book. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments