top of page

All About AI?: Goldman vs Citigroup

GS had a remarkable year in 2025, as shown in the table below. It is good to see the firm back on track after the disastrous experiment in retail banking and credit cards. This is really one of the few pages in the GS public disclosure that has any useful information, which is a major reason that the Fed's Y-9C is must reading for analysts of Goldman Sachs.

-

1 day ago8 min read

Does Private Credit Hurt Bank Stocks?

But more to the point, the comingled worlds of private equity and credit may be the biggest scandal to hit Wall Street in a century. Most bank loans to PE sponsors "secured" by private company assets are actually non-recourse, so there is no recovery for the bank in the event of default. We think these factors are just some of the reasons that exposures to private equity and credit may be the most risky part of bank loan portfolios.

-

5 days ago7 min read

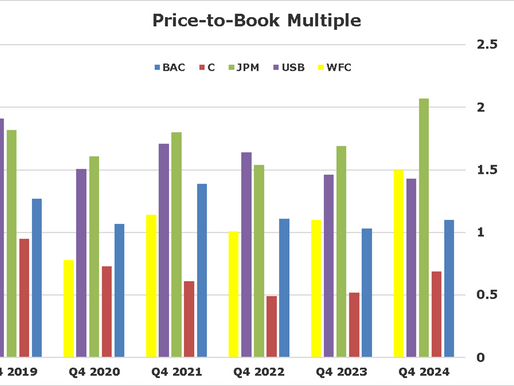

Q4 Bank Earnings Setup: BAC, C, JPM, TFC, PNC, USB, WFC

Of note, JPM's CFO Barnum said in response to a question that “I haven't heard anything to suggest that the private [credit] deals are performing differently from the public deals. It probably is true at the margin that some of the new direct lending initiatives involve underwriting at slightly higher expected losses, and that's significant because, as we've been discussing here, the wholesale charge-off rate has been very, very low for a long time."

-

Dec 18, 20257 min read

Bank of America: Warren Buffett Sells, Brian Moynihan Waffles

“Moynihan is trying to demonstrate that the business can grow and hedge funds different investors in stock want price appreciation not just dividend. The decision to host the investor day was made long ago - JPM does it every year. Jamie Dimon has taken away the excuses of big banks that they can’t grow.”

-

Nov 6, 20256 min read

Wharf Rats: Rising Credit Concerns & Fraud Hurt Financial Stocks

As we note in a recent article published by The Daily Reckoning, “The Bezzel: Is it 1925 All Over Again?,” that tales of woe regarding the Fed-fueled credit boom in commercial real estate and private credit will continue to grow in number in 2026. When it comes to fraud, cockroaches are an inconvenience, but wharf rats carry the plague and are an existential threat.

-

Nov 2, 20255 min read

Goldman Sachs Sees a Difficult AI Harvest

Below we set up Goldman, Morgan Stanley and the other asset gatherers as we go into Q3 2025 earning this week. As you might expect, GS is ahead of where it was a year ago in terms of non-interest income, earnings overall and equity market value.

-

Oct 7, 20258 min read

France Downgraded Below JPMorgan

In this edition of The Institutional Risk Analyst, we ponder the world of credit and investing as sovereign nations see their debt ratings sinking below that of global corporations. Meanwhile, the price of gold is reaching new highs. Then we set up the Q3 earnings of the top-seven US depositories for subscribers to our Premium Service as we surge into quarter end with equity markets at all-time highs and global central banks turning the money spigots wide open.

-

Sep 15, 20257 min read

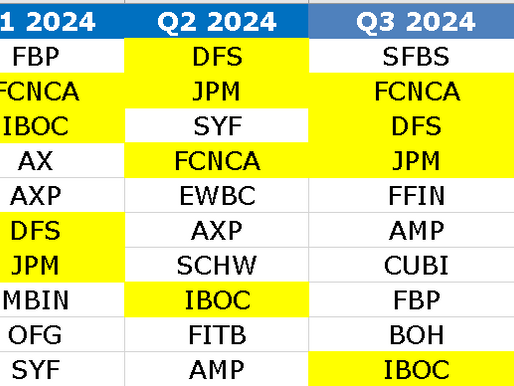

Q2 Earnings Setup: JPM, BAC, C, PNC, TFC, USB, WFC

We noted in the most recent IRA Bank Book that the Q1 2025 banking industry data from the FDIC was showing improvement in certain commercial line items, particularly non-owner occupied real estate. But is this another head fake by desperate banks trying to conceal rancid commercial real estate exposures?

-

Jun 22, 20257 min read

Trading Points: Banks, Interest Rates & MSRs

Some of the smaller holders of MSRs may ask themselves if selling right now is not the best strategy over a 36-48 month horizon.

-

Apr 16, 20258 min read

Q: Which Top Seven Bank is Most Vulnerable in a Recession?

If we consider the larger picture, we already have years of pent-up credit expenses awaiting realization, but add to the sauce Donald Trump.

-

Mar 23, 202514 min read

Trading Points: Trump, Housing & Private Credit

President Trump is using the threat of tariffs to change the behavior of some of our trading partners, particularly Canada and Mexico.

-

Mar 5, 20257 min read

WGA Releases Q1 2025 Bank Industry Survey | Higher for Longer May Throttle Deposit Growth

Industry results in 2024 were reasonably good, but the banking industry is still 200 bp below 2019 levels of asset and equity returns

-

Feb 28, 20252 min read

QT + Lower Federal Outlays = ?

Banks continue to show a strong preference for late vintage loans over securities, a fact which may cause loan yields to continue falling

-

Feb 11, 20255 min read

Update: Has Jane Fraser Redeemed Citigroup? Nope.

Citi seems to be tracking the group now, whereas pre-COVID the stock significantly underperformed in terms of market beta. But performance?

-

Dec 18, 20247 min read

Fed Duration Trap Threatens Banks, SOMA

It’s time for the Fed to get smart on duration risk before circumstances create another money market crisis.

-

Nov 1, 20248 min read

Should TD Bank Rethink US Retail?

WFC is not even out of dodge yet, but TD has cut off the fingers of one hand in yakuza style and is now headed for years of misery

-

Oct 16, 20246 min read

Will Rohit Chopra Kill Basel III? Shrinking NIM at JPM and WFC

In opposing Basel III, Chopra is doing the bidding of Senator Elizabeth Warren (D-MA) but big banks are very happy to have no rule at all.

-

Oct 14, 20245 min read

Citigroup + (Cenlar - Black Knight) = ?

The Citi decision to exit mortgage servicing perhaps made sense in 2017, but today not so much.

-

Oct 9, 20247 min read

New & Old Names in Nonbank Finance

In dollar terms, the moves in 2023 were tiny vs the post March rally in 2020.

-

Aug 21, 20247 min read

The Top Seven Banks: JPM, BAC, C, WFC, USB, PNC & TFC

Banks lose money every single day by holding onto a below market security from the 2019-2021 period.

-

Aug 18, 20249 min read

bottom of page

.png)