top of page

Bank Earnings Setup Q4 2023

Look for falling rates sooner rather than later as the Fed and other agencies prepare to resolve more bank failures in 2024.

-

Jan 11, 20245 min read

Update: Citigroup Fights for Credibility

Citigroup picked up almost 10 points of book value since the end of Q3 2023.

-

Dec 21, 20237 min read

What Does PNC Financial Say About Commercial Real Estate?

What does PNC tell us now about commercial loan exposures in 2024?

-

Dec 12, 20236 min read

Update: Bank of America

If you conduct a fire sale analysis of BAC's balance sheet as of Q3 2023, the result more than wipes out the bank's tangible equity

-

Nov 8, 20235 min read

ACH: The Bank Deposit Ain't in the Mail

Was the breakdown of the normally stable and, indeed, routine workings of the Clearinghouse the result of bad actors?

-

Nov 6, 20234 min read

Charles Schwab Unwinds the QE Trade

Rising interest rates are not good for bank earnings or bank equity valuations.

-

Oct 17, 20234 min read

Update: U.S. Bancorp & Goldman Sachs

We expect to see USB trading at a discount to JPM and Peer Group 1 until the bank improves its operating leverage to pre-COVID levels.

-

Jul 20, 20235 min read

Bank Earnings: JPM, WFC & Citi

JPM has an impressive lead in earnings and growth over WFC and C, neither one of which is positioned to catch up with Jamie Dimon in 2023.

-

Jul 15, 20235 min read

Profile: Comerica Inc.

If the FOMC raises the target rate for fed funds further, then banks like CMA are likely to come under renewed selling pressure.

-

Jun 28, 20237 min read

Update: Banks & Fintechs

With inflation fears moderating, look for Buy Side managers to buy bank stocks – even if earnings remain constrained...

-

Jun 14, 20235 min read

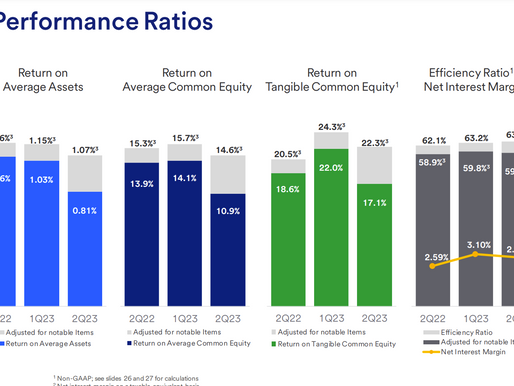

Q1 2023 Bank Earnings: Lower for Longer | JPM USB C WFC BAC

Given that the US Treasury is paying 4% for 90-day T-bills, you can see how far banks have to go to become competitive on rates

-

Apr 12, 20238 min read

Powell's Duration Trap, Banks and the US Treasury

The Fed by definition cannot make a profit and is always an expense to the Treasury, thus operating losses are a expense to the taxpayer

-

Apr 9, 202312 min read

Update: Charles Schwab (SCHW); Sagent Presentation

Most major banks grew larger during quantitative easing. Now many of these banks will shrink in terms of assets and also earnings in Q1 2023

-

Apr 3, 20236 min read

Update: Bank of America

We hear in the channel that regulators are making their views of future loss probabilities very clear in guidance to the top banks

-

Jan 23, 20236 min read

Update: JPMorganChase & Wells Fargo

But nothing lasts forever in mortgage land or in financials. Stay tuned and pay attention to LT rates and spreads...

-

Jan 13, 20236 min read

Update: Truist, Charles Schwab, U.S. Bancorp & PNC Financial

The largest banks continue to serve as a haven for refugees from crypto fraud schemes and the fintech swoon, but are not cheap

-

Jan 4, 20237 min read

Update: U.S. Bank vs. Bank OZK; Q3 2022 Earnings Setup

How will this above-peer performer from Little Rock do in a Fed-induced recession that rivals 2008 in terms of market losses?

-

Oct 12, 20227 min read

Nonbank Lenders: The Dead Pool

With the Fed doubling down on rate increases, the pressure on all manner of nonbank finance companies and fintech platforms is growing.

-

Oct 6, 20226 min read

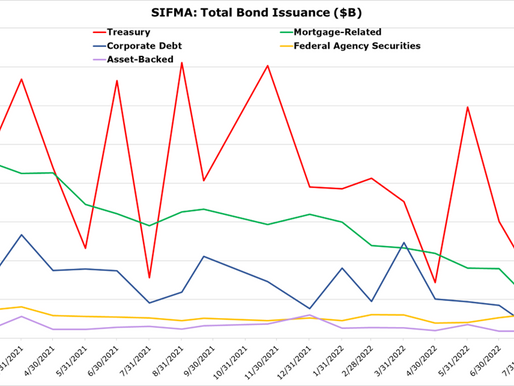

Large Banks: QT Winners & Losers

A number of readers have asked us to talk about the winners and losers among large banks in the current interest rate environment.

-

Oct 2, 202210 min read

Update: The Bull Case for US Financials

Investors who were buying large caps at 2x book value a year ago are now running away from bank stocks just as fundamentals improve...

-

Sep 8, 20225 min read

bottom of page

.png)