top of page

NYCB Cleans House Badly, NAIC Gives Insurers Pass on Realized Losses

Sad to say, the business at NYCB is doing better than you'd think reading the bank's absurd disclosure.

-

Feb 1, 20247 min read

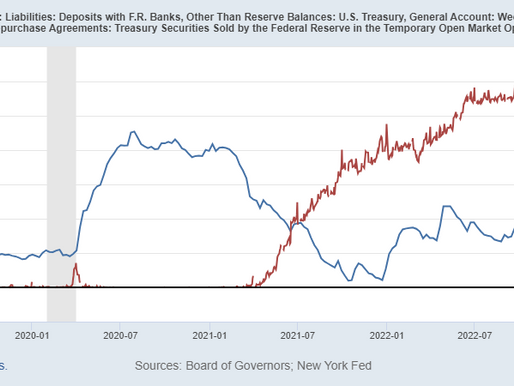

Stocks, Interest Rates and Reverse RPs

Simply stated, with T-bills trading significantly above the yield on RRPs, there is no reason for MMFs to leave cash at the Fed

-

Dec 8, 20234 min read

Interest Rates, Fintech & MSRs

Regulatory skepticism about mortgage assets could effect financing rates for lenders, which means higher mortgage rates for consumers.

-

Oct 26, 20239 min read

Winter is Coming in Bank Credit

If a bank has 6% debt to assets, what is the equity of the parent BHC worth?

-

Sep 1, 20236 min read

Update: New York Community Bank

We liked the NYCB + Flagstar story prior to the transaction with the FDIC for the assets and deposits of Signature Bank.

-

Mar 26, 202310 min read

Winners & Losers in the New Gilded Age

Mark Twain called Washington ''the grand old benevolent National Asylum for the Helpless'' in his classic "The Gilded Age."

-

Mar 21, 20235 min read

RKT Sinks, UWMC Wobbles, RITM Treads Water & Goldman Doubles Down

GS is a securities dealer first and foremost and has no comparative advantage as a bank.

-

Mar 2, 20236 min read

Mortgage Wrap; PennyMac Financial, Rithm Capital & MSRs

We suspect that the IMBs will be sellers of conventional assets to defend their Ginnie Mae MSRs. Banks may be buyers of conventional assets

-

Feb 9, 20237 min read

Two Inflation Narratives; Credit Suisse & Ginnie Mae MSRs

The big take away from Q4 2022 earnings is that credit expenses are headed higher and at a brisk pace

-

Feb 3, 20239 min read

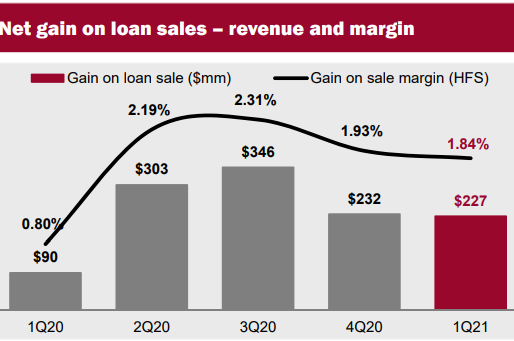

Profile: NYCB + Flagstar Bancorp

The combination of New York Community Bank and Flagstar creates an $85 billion bank with a national mortgage business

-

May 4, 20216 min read

bottom of page

.png)