top of page

Is Capital One the Leader Among Consumer Lenders?

Half of COF assets are allocated to consumer loans, with single digits in real estate and C&I exposures. The bank was in the 94th percentile of Peer Group 1 on nonaccrual real estate loans in Q3, the 97th percentile in 90+ day past due C&I loans and the 94th percentile in 90+ day past due for other loans and leases, which includes loans to nonbanks. We expect COF to have high levels of delinquency in its consumer book, but these other credit metrics are a little troubling.

-

Dec 26, 202510 min read

The IRA Bank Book Q4 2025: Credit Defaults Fall, Market Risk Grows

We have published the latest edition of The IRA Bank Book for Q4 2025. Entitled "Defaults Fall, Market Risk Grows," the report details how indicators of consumer credit risk are falling even as risk to financial markets from institutional and commercial credit, crypto tokens and market exposures grow. Bank income has reached record levels in Q3 2025, but what happens in Q4 2025 and 2026?

-

Nov 29, 20253 min read

Wharf Rats: Rising Credit Concerns & Fraud Hurt Financial Stocks

As we note in a recent article published by The Daily Reckoning, “The Bezzel: Is it 1925 All Over Again?,” that tales of woe regarding the Fed-fueled credit boom in commercial real estate and private credit will continue to grow in number in 2026. When it comes to fraud, cockroaches are an inconvenience, but wharf rats carry the plague and are an existential threat.

-

Nov 2, 20255 min read

Goldman Sachs Sees a Difficult AI Harvest

Below we set up Goldman, Morgan Stanley and the other asset gatherers as we go into Q3 2025 earning this week. As you might expect, GS is ahead of where it was a year ago in terms of non-interest income, earnings overall and equity market value.

-

Oct 7, 20258 min read

Market Risk Threatens US Banks

The largest bank loan portfolio increases reported by the FDIC were in loans to non-depository financial institutions and broker-dealer loans to purchase or carry securities, including margin loans. This situation is inherently unstable.

-

Aug 31, 20253 min read

Zohran Mamdani's NYC Bank Dead Pool

The prospect of Zohran Mamdani becoming Mayor of NYC and the rise of other socialist elements in the Democratic Party means that owners of New York real estate are facing effective expropriation of their property. And the real losers are New York consumers.

-

Aug 19, 20258 min read

Fear & Loathing on Wall Street: GS, MS, AMP, SCHW, RJF, SF

Some of the largest banks by assets have dropped from the top quartile into the bottom half of the distribution for the top 100 banks

-

Apr 8, 20258 min read

WGA Bank Top 100 Index | Q1 2025

GS had not appeared in the top 25 since we began the indices a year ago, while MS had made it three times.

-

Jan 29, 20254 min read

Update: Top Bank Asset Managers

As and when GS can exit the loss leading credit card relationship with AAPL, the performance of the business should improve significantly.

-

Dec 30, 20248 min read

Citigroup + (Cenlar - Black Knight) = ?

The Citi decision to exit mortgage servicing perhaps made sense in 2017, but today not so much.

-

Oct 9, 20247 min read

Universal Banks: Should TD Buy Schwab & Sell Its US Operation?

SCHW needs to take advantage of their strong operating leverage and repair some needless damage done during COVID by inept bank management.

-

Aug 25, 20247 min read

Bank of Nova Scotia + KeyCorp = ??

If you were really, REALLY going to do mortgage warehouse lending in today's market, KEY would be the better platform, not BNS.

-

Aug 13, 20246 min read

Goldman Sachs Fails Fed Stress Test

Notice that the Fed stress test is silent on trillions of dollars in mark-to-market losses facing US banks from COVID-era securities

-

Jul 7, 202410 min read

Who Leads the Asset Gatherers? | SCHW, MS, GS, AMP, RJF & SF

The larger banks led the way in January and February, but today the top 25 names in terms of total return include many smaller banks.

-

Jul 3, 20247 min read

Rate Peak Emerges, Deflation Looms

One of the effects of QE has been making many banks and real estate investors insolvent, a precursor to debt defaults.

-

Oct 30, 20234 min read

Are Bank Stocks Undervalued? Which Ones & Why

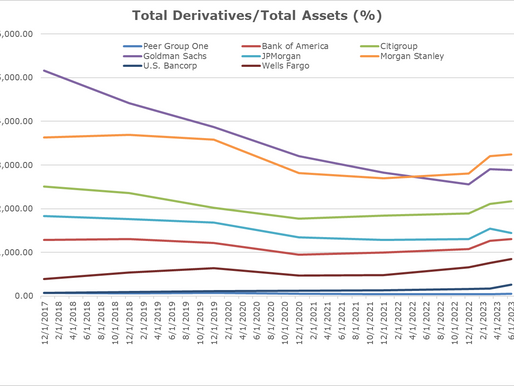

Large universal banks that ply the capital markets and use essentially infinite leverage in the derivatives markets face challenges

-

Oct 19, 20236 min read

Bank Earnings Takeaways -- JPM, WFC and Citi

Bank earnings can be best described as cautiously mediocre, but as usual the Street proclaimed that three banks "beat the estimates"

-

Oct 15, 20237 min read

SoftBank as Systemic Event; Update: Charles Schwab & Co

The public behavior and decision-making processes of SoftBank suggest that the organization is in trouble.

-

Sep 27, 20239 min read

FSOC Frets About Nonbank Risk; Goldman Sachs Stepping Back?

GS has the weakest position in terms of funding of the top-ten banks and no real narrative for the business post-Marcus.

-

Sep 21, 20236 min read

Bank Industry Review & Survey Q3 2023

The US banking industry has seen now two consecutive down quarters for net income caused by the Fed’s massive open market operations

-

Sep 11, 20233 min read

bottom of page

.png)