top of page

The Martyrdom of Jerome Powell

As we told Bloomberg TV last week, not only has the President's attacks not forced Powell out, but he has made this decidedly mediocre Fed chief a progressive martyr. As a result of Trump’s ill-considered attacks, Powell will likely remain as a Governor through 2028, depriving the President of an opportunity to appoint another governor for a 14-year term. How does this mess serve the agenda of President Trump?

-

Jan 267 min read

The Wrap: Rate Cuts, FSOC Fantasy and CRE Deflation

The Trump FSOC document reads like a Marvel comic book and is entirely laudatory towards crypto fraud, but uses the same idiotic language as former Treasury Secretary Janet Yellen in describing the grave systemic risks posed by residential mortgage servicers. The report states incredibly: "The continued use of U.S. dollar-denominated stablecoins is expected to support the role of the U.S. dollar in the international financial system..."

-

Dec 11, 20256 min read

The Single Fed Mandate & Bank Stocks

The Fed's actions in 2008 and again in March 2020 were largely driven by the sole mandate of the central bank -- to keep the Treasury market opening and functioning.

-

May 14, 20259 min read

Trading Points: Banks, Interest Rates & MSRs

Some of the smaller holders of MSRs may ask themselves if selling right now is not the best strategy over a 36-48 month horizon.

-

Apr 16, 20258 min read

Silicon Valley and the Large Bank Dead Pool

When you see a bank with more than 10% of total assets in MBS, that's a big red flag in our book.

-

Mar 9, 20257 min read

Is Trump Bullish for Interest Rates? Pump & Dump for GSE and Fintech Stocks

You can tell lies and damn lies about the idea of releasing Fannie and Freddie, but the SEC and FINRA cannot and will not say a word.

-

Oct 30, 20246 min read

The Powell Hedge Fund Drives Private Market Instability

In 2019, the FOMC essentially nationalized the US money markets, eliminating private price discovery for a representation of a market.

-

Aug 12, 20247 min read

Market Volatility and Loan Defaults

The market tantrum which began on Friday was largely over by the market close on the following Tuesday.

-

Aug 8, 20246 min read

Yellen's FSOC: Housing Policy Dreams vs Mortgage Market Reality

Yellen's proposal for a backstop is merely a canard to help Treasury avoid another fiasco next time a Ginnie Mae issuer fails

-

Jul 30, 20246 min read

Interview: Robert Brusca on the Federal Open Market Committee

Powell won’t hit the two percent target, but he won’t change the target either.

-

Jun 10, 20249 min read

Home Mortgage Rates Falling? Really?

If President Trump starts talking about fixing the federal budget deficit and redeveloping moribund urban real estate, he’d win in November

-

Feb 18, 20246 min read

Bank Reserves & Treasury Auctions

As the public debt of the US grows, after all, the implicit claim of the Treasury on all private US assets also grows.

-

Jan 8, 20248 min read

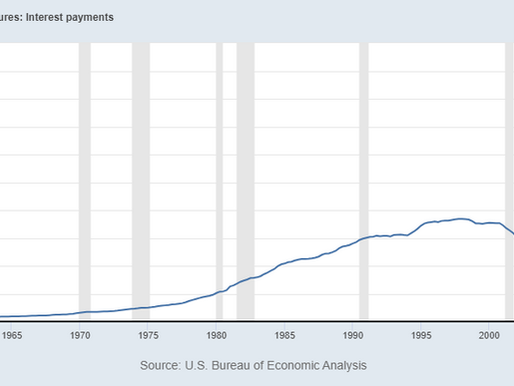

Big What? Rising Debt Service & Falling Liquidity

As with the Volcker Rule for banks, the move to centralized clearing of Treasuries and T-1 settlement seems destined to reduce liquidity

-

Nov 13, 20238 min read

Biden Administration Staggers Toward a Debt Default

Whether we have Donald Trump or Joe Biden in the White House next Christmas, the US seems to be on a trajectory to a financial crisis...

-

Aug 7, 20236 min read

Washington Trip Notes; Mr. Cooper & PennyMac Financial

The last Treasury Secretary that tried to extend the maturities of US government debt was Jack Lew (2013-2017). Yellen missed an opportunity

-

Jul 28, 20235 min read

The False Narrative on First Republic Bank

Until Chairman Powell comes clean with the Congress and the American people, more banks will inevitably fail.

-

May 1, 20236 min read

Who Killed First Republic Bank?

The Treasury and Fed cannot admit fault for fear of bringing the whole house of cards crashing down.

-

Apr 26, 20236 min read

Extension Risk Threatens US Banks

There are literally dozens of banks in the US made insolvent by the policy moves of the FOMC over the past year.

-

Nov 17, 20227 min read

Terminal Rates & Conflicted Economists

The cult of ever falling interest rates goes back 50 years and spans the terms of Fed chairs back to Alan Greenspan and Paul Volcker...

-

Nov 2, 20226 min read

Inflation, Politics & Fed Chairmen

As the scale of Fed open market operations grew since 2008, volatility has increased, rendering the adjustment from QE to QT problematic

-

Sep 18, 20229 min read

bottom of page

.png)