top of page

The Wrap: Gold Surged, Bank Stocks Sagged & FOMC Did Nothing

US banks and nonbanks are entering a period of increased uncertainty in terms of earnings and rising credit costs, yet another reason why financial stocks are retreating. We published a comment on the risks to banks from loans to private equity funds (“Does Private Credit Hurt Bank Stocks?”). Bank credit costs have been so low for so long that they have nowhere to go but up.

-

Jan 305 min read

All About AI?: Goldman vs Citigroup

GS had a remarkable year in 2025, as shown in the table below. It is good to see the firm back on track after the disastrous experiment in retail banking and credit cards. This is really one of the few pages in the GS public disclosure that has any useful information, which is a major reason that the Fed's Y-9C is must reading for analysts of Goldman Sachs.

-

Jan 188 min read

The Wrap: No GSE Release? Will the Fed Buy MBS Too? Gold vs Silver

President Donald Trump, Bill Pulte and Commerce Secretary Howard Lutnick have apparently met a couple of times in recent weeks to consider policy initiatives for spurring housing. Meanwhile, the GSEs have begun to buy and/or retain mortgage assets in an effort to push down mortgage rates, an effort that is unlikely to have much effect.

-

Jan 165 min read

Fed Cancels Raymond James? Universal Bank Q4 Earnings Setup

If SCHW could but find a competent team to manage the bank's assets they could vault to the top of this group in terms of financial and equity market performance. In the meantime, we hope that the folks at the Fed figure out how to publish the Y-9C and related documents for Raymond James.

-

Jan 127 min read

The Wrap: Hezbollah in Caracas? AI Flameout? Trump Buys MBS? Really?

Only the Fed under Janet Yellen was dumb enough to buy $3 trillion in MBS, costing the taxpayer hundreds of billions in losses without really affecting mortgage rates. A mere $200 billion from Donald Trump is a rounding error, pure populist political pulp -- another progressive political display that will have zero impact on LT interest rates. In fact, the childish suggestions coming from the White House on housing may continue to push LT interest rates up.

-

Jan 810 min read

Is Capital One the Leader Among Consumer Lenders?

Half of COF assets are allocated to consumer loans, with single digits in real estate and C&I exposures. The bank was in the 94th percentile of Peer Group 1 on nonaccrual real estate loans in Q3, the 97th percentile in 90+ day past due C&I loans and the 94th percentile in 90+ day past due for other loans and leases, which includes loans to nonbanks. We expect COF to have high levels of delinquency in its consumer book, but these other credit metrics are a little troubling.

-

Dec 26, 202510 min read

The IRA Bank Book Q4 2025: Credit Defaults Fall, Market Risk Grows

We have published the latest edition of The IRA Bank Book for Q4 2025. Entitled "Defaults Fall, Market Risk Grows," the report details how indicators of consumer credit risk are falling even as risk to financial markets from institutional and commercial credit, crypto tokens and market exposures grow. Bank income has reached record levels in Q3 2025, but what happens in Q4 2025 and 2026?

-

Nov 29, 20253 min read

Wharf Rats: Rising Credit Concerns & Fraud Hurt Financial Stocks

As we note in a recent article published by The Daily Reckoning, “The Bezzel: Is it 1925 All Over Again?,” that tales of woe regarding the Fed-fueled credit boom in commercial real estate and private credit will continue to grow in number in 2026. When it comes to fraud, cockroaches are an inconvenience, but wharf rats carry the plague and are an existential threat.

-

Nov 2, 20255 min read

Trading Points: Banks Stocks, Gold and Crypto Assets Diverge

The first obvious point from the Q3 2025 earnings and commentary so far is that the larger banks in the US and Europe are starting to back away from private credit markets. When you hear Goldman Sachs (GS) CEO David Solomon and JPMorgan CEO Jamie Dimon making cautionary statements about private credit and recent disasters like First Brands and Tricolor, that tells you that they are trying to mitigate potential shareholder lawsuits down the road.

-

Oct 17, 20254 min read

Goldman Sachs Sees a Difficult AI Harvest

Below we set up Goldman, Morgan Stanley and the other asset gatherers as we go into Q3 2025 earning this week. As you might expect, GS is ahead of where it was a year ago in terms of non-interest income, earnings overall and equity market value.

-

Oct 7, 20258 min read

Market Risk Threatens US Banks

The largest bank loan portfolio increases reported by the FDIC were in loans to non-depository financial institutions and broker-dealer loans to purchase or carry securities, including margin loans. This situation is inherently unstable.

-

Aug 31, 20253 min read

Zohran Mamdani's NYC Bank Dead Pool

The prospect of Zohran Mamdani becoming Mayor of NYC and the rise of other socialist elements in the Democratic Party means that owners of New York real estate are facing effective expropriation of their property. And the real losers are New York consumers.

-

Aug 19, 20258 min read

Is Goldman's Run Over? Or Do Financials Surge Ever Higher?

We all were more than a little amused to learn that in the most recent bank stress tests the Federal Reserve Board decided to ignore the massive financial and reputation risk in private equity and private credit. With cash bids for private assets plummeting, and sponsors in full flight due to prospective litigation by jilted clients, how do the Fed and other bank regulators retain any credibility? Our friend Nom de Plumber had an appropriate observation...

-

Jul 9, 20258 min read

Time to Short the AI Bubble?

Researchers at Apple just released a paper that throws cold water on the "reasoning" capabilities of the latest, most powerful large language AI models. In the paper, a team of machine learning experts makes the case that the AI industry is grossly overstating the ability of its top AI models, including OpenAI's o3, Anthropic's Claude 3.7, and Google's Gemini.

-

Jun 11, 20256 min read

Bank Stocks Down | WGA Bank Top 100 Index: Q2 2025

TD was up about 6% over the past three months, the only name in our test group with a positive three-month market return, of note.

-

May 4, 20256 min read

Trading Points: Banks, Interest Rates & MSRs

Some of the smaller holders of MSRs may ask themselves if selling right now is not the best strategy over a 36-48 month horizon.

-

Apr 16, 20258 min read

Fear & Loathing on Wall Street: GS, MS, AMP, SCHW, RJF, SF

Some of the largest banks by assets have dropped from the top quartile into the bottom half of the distribution for the top 100 banks

-

Apr 8, 20258 min read

HOOD: Is the Bloom off the Rose?

And just why do financial firms like HOOD, SoFi Technologies (SOFI) and Block (XYZ) talk about EBITDA in their investor materials?

-

Feb 13, 20254 min read

Is Ameriprise Overvalued? Is PennyMac Cheap vs the REITs?

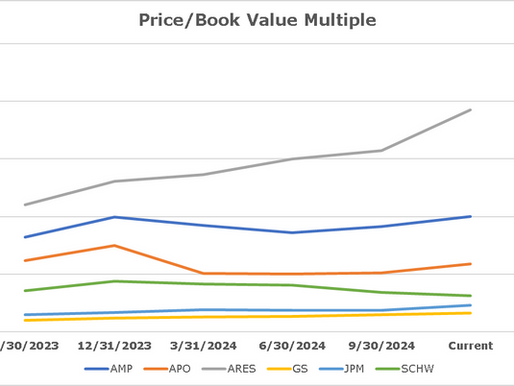

We think it is notable that AMP has underperformed the other members of the group other than SCHW over the past year.

-

Feb 3, 20257 min read

WGA Bank Top 100 Index | Q1 2025

GS had not appeared in the top 25 since we began the indices a year ago, while MS had made it three times.

-

Jan 29, 20254 min read

bottom of page

.png)