top of page

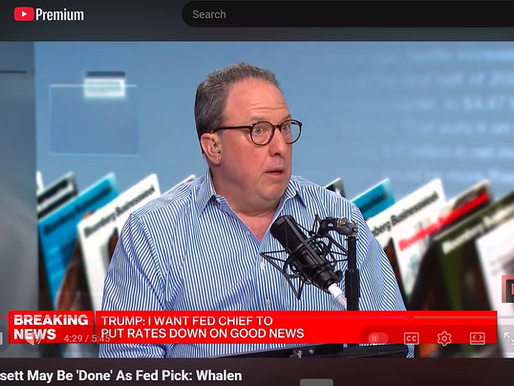

The Martyrdom of Jerome Powell

As we told Bloomberg TV last week, not only has the President's attacks not forced Powell out, but he has made this decidedly mediocre Fed chief a progressive martyr. As a result of Trump’s ill-considered attacks, Powell will likely remain as a Governor through 2028, depriving the President of an opportunity to appoint another governor for a 14-year term. How does this mess serve the agenda of President Trump?

-

Jan 267 min read

The Wrap | New Year 2026: Lower Interest Rates, Higher Defaults

When the Fed took net loan loss rates for banks down to ~ 50% of par in 2021 vs 95% after 2008, they enabled some very stupid and foolish behavior by investors and lenders. These behaviors are only partly described by the nominal level of interest rates because, of course, we must account for leverage in calculating the full scope of the prospectives losses. Lend More Upon Default (LMUD) has concealed the scope of the disaster and even pushed down reported loan default rates.

-

Dec 31, 202511 min read

The Wrap: Hassett or Warsh to Fed? Big Beautiful Housing Reform? Coin Crime?

Kevin Hassett's comments on Federal Reserve independence may have undercut his chances for the top Fed job. President Donald Trump has observed in recent days that there are “two Kevins,” Hassett and former Fed governor Kevin Warsh, who we personally support.

-

Dec 19, 20255 min read

Should the FOMC End Fed Funds Targeting? Issue CMOs?

As Chairman Powell said in the latest FOMC presser, the SOMA reinvestment plan is intended to get their duration down to that of the Treasury debt outstanding by allowing long duration MBS to be replaced by short-duration T-bills. Could the Fed have continued to shrink the SOMA further as Bowman and others have urged?

-

Nov 5, 20259 min read

What Consumer Recession? Trading Points: Gold and Silver Surge

With the FOMC cutting the target for fed funds one quarter point last week, we expect to see funding costs for banks continue to fall, part of the larger narrative that has seen bank loan demand and share repurchases leaving a great deal of dry powder. Deposits are growing 2x loans, meaning that the balance must go into securities. One of the reasons that lenders of all sorts have been pushing down loan yields is to capture assets in a market that is short quality duration.

-

Sep 22, 20258 min read

Trump, Deficits & Credit Default Swaps

As a practical matter, no Fed chairman or governor can function without the support of the White House and the US Treasury.

-

Nov 18, 20247 min read

Powell FOMC Folds on Inflation

As the federal debt rises, bank reserves must rise as well and with it inflation.

-

Sep 9, 20249 min read

The Powell Hedge Fund Drives Private Market Instability

In 2019, the FOMC essentially nationalized the US money markets, eliminating private price discovery for a representation of a market.

-

Aug 12, 20247 min read

Should FOMC Members Avoid the Media? The WGA Top 100 Banks

More often than not, Fed Governors use media appearances to enhance their personal celebrity rather than doing their jobs.

-

Mar 4, 20246 min read

With Commercial Property, the Equity Goes First

The key thing to remember with commercial real estate is the change in price volatility and direction that has occurred since COVID.

-

Jan 20, 20245 min read

Is the Fed Insolvent? Does it Matter?

The real question is not whether the FOMC can get inflation down to the 2% target but whether it can keep asset prices rising indefinitely

-

Dec 11, 20236 min read

Do Bank Reserves Boost Stocks? | IRA Bank Book for Q4 2023

In this issue of The Institutional Risk Analyst, we release the latest edition of The IRA Bank Book for Q4 2023

-

Dec 5, 20238 min read

Jerome Powell's Silent Crisis

The Powell Fed needs to drop short-term interest rates back down to 4% and leave them there indefinitely.

-

Oct 11, 20236 min read

Silvergate, Reverse RPs and the “Theology of Prosperity”

Crypto, of course, is not an asset as much as a bad idea that was given life by Quantitative Easing

-

Jan 25, 20238 min read

Short Collateral & Long Tantrums

Demand for risk-free collateral and liquidity is largely a function of how JPMorgan (JPM) CEO Jamie Dimon feels about risk on any given day

-

Jul 31, 20228 min read

Questions for Chairman Powell

QE has created a gigantic interest rate mismatch across markets for banks, non-banks and other financial intermediaries including the GSEs

-

Jul 24, 20226 min read

bottom of page

.png)