top of page

The Wrap: Hezbollah in Caracas? AI Flameout? Trump Buys MBS? Really?

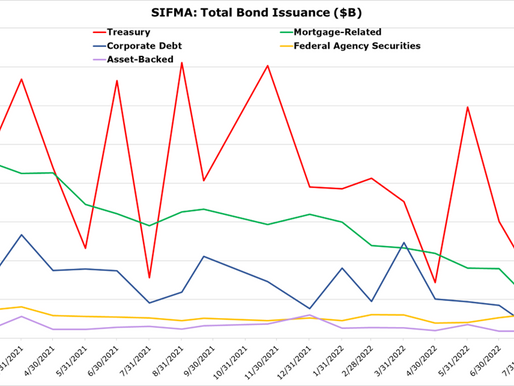

Only the Fed under Janet Yellen was dumb enough to buy $3 trillion in MBS, costing the taxpayer hundreds of billions in losses without really affecting mortgage rates. A mere $200 billion from Donald Trump is a rounding error, pure populist political pulp -- another progressive political display that will have zero impact on LT interest rates. In fact, the childish suggestions coming from the White House on housing may continue to push LT interest rates up.

-

Jan 810 min read

Should the Federal Reserve Pay Interest on Bank Reserves?

Paying interest on reserves has nothing to do with whether banks lend and everything to do with enabling the Fed to manage the Treasury market. If you don’t want the Treasury market to remain open, then take away the Fed’s power to pay interest on reserves.

-

Jul 17, 20258 min read

Q: Which Top Seven Bank is Most Vulnerable in a Recession?

If we consider the larger picture, we already have years of pent-up credit expenses awaiting realization, but add to the sauce Donald Trump.

-

Mar 23, 202514 min read

WGA Releases Bank Quarterly Q2 2024

The unrealized losses on COVID era securities remain a huge problem for banks large and small, especially if long-term interest rates rise

-

Jun 2, 20242 min read

MBA Aftermath; Profile: Merchants Bancorp (MBIN)

When NYC is forced to recognize reality, it will already be too late to avoid another fiscal crisis.

-

May 22, 20247 min read

WGA Releases Top 50 Bank Index | What's in Your ETF?

Not all banks or companies are the same and not all follow the herd.

-

Feb 25, 20245 min read

Bank Industry Review & Survey Q3 2023

The US banking industry has seen now two consecutive down quarters for net income caused by the Fed’s massive open market operations

-

Sep 11, 20233 min read

Update: Banks & Fintechs

With inflation fears moderating, look for Buy Side managers to buy bank stocks – even if earnings remain constrained...

-

Jun 14, 20235 min read

The IRA Bank Book | Q2 2023 Industry Outlook

How much of book value do banks lose

as the Fed adjusts interest rates to fight inflation?

-

Jun 5, 20232 min read

First Take on FDIC Bank Data

If we assume that asset returns will continue to rise, but that bank funding costs will rise 5x asset returns, then US banks have a problem

-

Jun 1, 20234 min read

Update: JPMorganChase & Wells Fargo

But nothing lasts forever in mortgage land or in financials. Stay tuned and pay attention to LT rates and spreads...

-

Jan 13, 20236 min read

Outliers: CapitalOne, Goldman Sachs & Citigroup

Like most nonbanks (and Goldman Sachs is predominantly a nonbank), volumes are falling and funding costs are rising.

-

Dec 20, 20225 min read

Update: Crypto Fraud Crumbles as Bank Stocks Surge

Crypto has gone from a sort-of juiced up equity strategy to a distressed credit story in just hours.

-

Nov 10, 20225 min read

IRA Bank Book Q3 2022

We expect to see reasonably strong earnings for commercial lenders in Q3 2022 as loan yields slowly rise...

-

Sep 13, 20222 min read

Update: The Bull Case for US Financials

Investors who were buying large caps at 2x book value a year ago are now running away from bank stocks just as fundamentals improve...

-

Sep 8, 20225 min read

The FOMC Embraces Debt Deflation

The deflation of 2023 is about marking down all types of real assets to the price level that equates with a non-QE world.

-

Aug 10, 20225 min read

Ukraine & the Return of Credit Risk

Just imagine how global markets will react when Putin deploys tactical nuclear weapons in Eastern Ukraine to avoid a military defeat

-

Apr 20, 20225 min read

Profile: Morgan Stanley vs Goldman Sachs

Simply stated, Morgan Stanley has a much more diverse and sustainable business model than Goldman Sachs...

-

Apr 17, 20226 min read

Weak Bank Earnings & Surging Interest Rates = Lower Valuations

Will Fed Chairman Jay Powell fold in terms of further rate hikes if the S&P 500 falls 1,000 points in a day?

-

Apr 11, 20225 min read

The Next Trade: Banks, Nonbanks and Mortgage Servicing Rights

Many of the startups, investment flows and SPAC transactions that proliferated in 2020-2021 are likely to be casualties in the next several

-

Apr 6, 20224 min read

bottom of page

.png)