top of page

Is Goldman's Run Over? Or Do Financials Surge Ever Higher?

We all were more than a little amused to learn that in the most recent bank stress tests the Federal Reserve Board decided to ignore the massive financial and reputation risk in private equity and private credit. With cash bids for private assets plummeting, and sponsors in full flight due to prospective litigation by jilted clients, how do the Fed and other bank regulators retain any credibility? Our friend Nom de Plumber had an appropriate observation...

-

Jul 9, 20258 min read

HOOD: Is the Bloom off the Rose?

And just why do financial firms like HOOD, SoFi Technologies (SOFI) and Block (XYZ) talk about EBITDA in their investor materials?

-

Feb 13, 20254 min read

Is Ameriprise Overvalued? Is PennyMac Cheap vs the REITs?

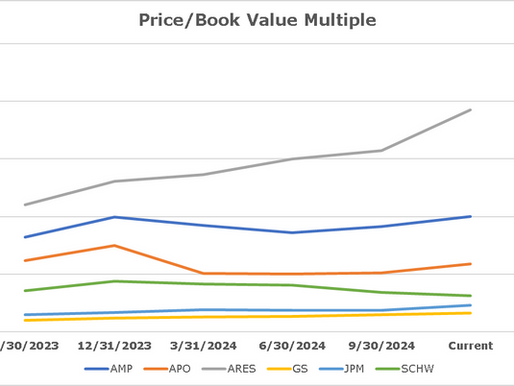

We think it is notable that AMP has underperformed the other members of the group other than SCHW over the past year.

-

Feb 3, 20257 min read

Update: Charles Schwab | SCHW

The SVB duration management from 2020 onward was recklessly negligent by any reasonable standard

-

Jan 22, 20255 min read

Update: Top Bank Asset Managers

As and when GS can exit the loss leading credit card relationship with AAPL, the performance of the business should improve significantly.

-

Dec 30, 20248 min read

WGA Bank Top 10 Index | Time to Short Financials?

When SCHW surpassed U.S. Bancorp in size in 2021, you knew that SCHW’s leadership had gotten lost.

-

Dec 9, 20249 min read

Q: Is JPMorgan Overinflated?

The banking industry has segmented into a handful of above-average performers and JPM is the largest leader of these "winners"

-

Nov 11, 20245 min read

Universal Banks: Should TD Buy Schwab & Sell Its US Operation?

SCHW needs to take advantage of their strong operating leverage and repair some needless damage done during COVID by inept bank management.

-

Aug 25, 20247 min read

The Bull Case for Large Banks

Big banks have big CRE exposures, too. So what drives this marvelous progression up the wall of worry?

-

May 15, 20247 min read

bottom of page

.png)