top of page

Inflation & the Passion of Jerome Powell

Perhaps Chairman Powell will be kind enough to fall on his sword on way out the door to make things easier for a future Chairman Waller...

-

Mar 28, 20245 min read

Top-Five Banks: Q1 '24 Earnings Setup

We see higher credit costs, narrowing NIM and still rising funding costs squeezing the banking industry in Q1 2024...

-

Mar 19, 20247 min read

Should FOMC Members Avoid the Media? The WGA Top 100 Banks

More often than not, Fed Governors use media appearances to enhance their personal celebrity rather than doing their jobs.

-

Mar 4, 20246 min read

Update: UWMC & Rocket; Rate Cut Dreams Fade

Industry leaders believe that the FHFA wants the GSEs to offer issuers "repurchase insurance" to the tune of 25bps per loan.

-

Feb 29, 20247 min read

Interest Rates, Mortgage Lenders & MSRs

While there are a great number of people inside the Fed who ponder the appropriate level of reserves in the system, they don't really know

-

Feb 15, 20246 min read

Interview: Bill Kennedy of RiskBridge Advisors

Volatility remains perhaps the biggest risk factor today, mostly because of a lack of visibility on unexpected risks.

-

Jan 24, 20249 min read

With Commercial Property, the Equity Goes First

The key thing to remember with commercial real estate is the change in price volatility and direction that has occurred since COVID.

-

Jan 20, 20245 min read

Bank Reserves & Treasury Auctions

As the public debt of the US grows, after all, the implicit claim of the Treasury on all private US assets also grows.

-

Jan 8, 20248 min read

Rates Rally Financials, But Credit Fears Remain

The key term for risk managers and investors in 2024 remains unchanged from this year: Volatility.

-

Dec 15, 20237 min read

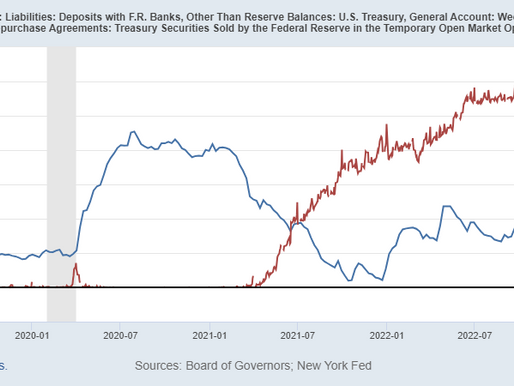

Stocks, Interest Rates and Reverse RPs

Simply stated, with T-bills trading significantly above the yield on RRPs, there is no reason for MMFs to leave cash at the Fed

-

Dec 8, 20234 min read

The Moral Hazard of Jerome Powell

Instead of seeking authority from Congress, Chairman Bernanke and other members of the FOMC merely turned on the public spigot.

-

Nov 27, 20236 min read

Rate Peak Emerges, Deflation Looms

One of the effects of QE has been making many banks and real estate investors insolvent, a precursor to debt defaults.

-

Oct 30, 20234 min read

Charles Schwab Unwinds the QE Trade

Rising interest rates are not good for bank earnings or bank equity valuations.

-

Oct 17, 20234 min read

Bank Earnings Takeaways -- JPM, WFC and Citi

Bank earnings can be best described as cautiously mediocre, but as usual the Street proclaimed that three banks "beat the estimates"

-

Oct 15, 20237 min read

Jerome Powell's Silent Crisis

The Powell Fed needs to drop short-term interest rates back down to 4% and leave them there indefinitely.

-

Oct 11, 20236 min read

SoftBank as Systemic Event; Update: Charles Schwab & Co

The public behavior and decision-making processes of SoftBank suggest that the organization is in trouble.

-

Sep 27, 20239 min read

Will Fannie Mae & Freddie Mac Raise Guarantee Fees?

With a 75bp average total gfee, would the market for private label MBS return? Or would conventional lending volumes simply crater?

-

Sep 25, 20236 min read

Biden Administration Staggers Toward a Debt Default

Whether we have Donald Trump or Joe Biden in the White House next Christmas, the US seems to be on a trajectory to a financial crisis...

-

Aug 7, 20236 min read

Fitch Downgrades US to AA+; Fintech Stocks Soar on Powell Inflation

S&P was the first to call out the growing lack of fiscal discipline in Washington, downgrading Uncle Sam in 2011

-

Aug 2, 20235 min read

Losses Mount Due to FOMC Policy "Tax"

Inflation is called a “hidden tax,” but lately the tax is not even barely concealed.

-

Jul 25, 20235 min read

bottom of page

.png)